Ebitda Template

Ebitda Template - Boost your financial analysis with our ebitda template! Calculate ebit/ebitda and keep track of your financial data automatically. The document provides an ebitda excel template and examples for calculating ebitda for three companies. Our free adjusted ebitda template and adjusted income statement example are designed to help you visualize and present your financial adjustments effectively. It defines ebitda as net income plus interest, taxes, and depreciation and. Ebitda stands for earnings before interest, taxes, depreciation, and amortization. Use our adjusted ebitda excel template to quickly and easily calculate a company's earnings before interest, taxes, depreciation, and amortization. Here is a screenshot of the template: View our free and editable ebitda templates for excel or google sheets. Download our ebitda template and assess a company’s operational profitability using the income statement and cash flow statement. These ebitda spreadsheet templates are easy to modify and you can customize the design, the header,. Learn how to use sheetgo's ebitda template in excel. Boost your financial analysis with our ebitda template! An ebitda bridge excel template is essential for financial analysts tracking and analyzing changes in ebitda over time. The ebitda multiple is a financial. The document provides an ebitda excel template and examples for calculating ebitda for three companies. Calculate ebit/ebitda and keep track of your financial data automatically. Download our ebitda template and assess a company’s operational profitability using the income statement and cash flow statement. It's a key metric for evaluating a company's operational performance, excluding certain expenses to. This professional template generator streamlines the creation. These ebitda spreadsheet templates are easy to modify and you can customize the design, the header,. Download our ebitda template and assess a company’s operational profitability using the income statement and cash flow statement. Presentation of ebitda indicators on an interactive dashboard. View our free and editable ebitda templates for excel or google sheets. The ebitda multiple is a financial. Use our adjusted ebitda excel template to quickly and easily calculate a company's earnings before interest, taxes, depreciation, and amortization. Download our ebitda template and assess a company’s operational profitability using the income statement and cash flow statement. Ebitda stands for earnings before interest, taxes, depreciation, and amortization. Presentation of ebitda indicators on an interactive dashboard. It's a key metric. Here is a screenshot of the template: Ebitda stands for earnings before interest, taxes, depreciation, and amortization. This professional template generator streamlines the creation. Download our ebitda template and assess a company’s operational profitability using the income statement and cash flow statement. The ebitda multiple is a financial. Boost your financial analysis with our ebitda template! Use our adjusted ebitda excel template to quickly and easily calculate a company's earnings before interest, taxes, depreciation, and amortization. Up to 3.2% cash back this ebitda multiple template helps you find out the ebitda multiple given the line items for determining the enterprise value. Here is a screenshot of the template:. The ebitda multiple is a financial. Up to 3.2% cash back this ebitda multiple template helps you find out the ebitda multiple given the line items for determining the enterprise value. Up to 3.2% cash back this ebitda template will show you how to calculate ebitda using the income statement and cash flow statement. Use our adjusted ebitda excel template. Up to 3.2% cash back this ebitda template will show you how to calculate ebitda using the income statement and cash flow statement. Boost your financial analysis with our ebitda template! Our free adjusted ebitda template and adjusted income statement example are designed to help you visualize and present your financial adjustments effectively. The ebitda multiple is a financial. This. These ebitda spreadsheet templates are easy to modify and you can customize the design, the header,. Ebitda stands for earnings before interest, taxes, depreciation, and amortization. Calculate ebit/ebitda and keep track of your financial data automatically. Learn how to use sheetgo's ebitda template in excel. View our free and editable ebitda templates for excel or google sheets. Calculate ebit/ebitda and keep track of your financial data automatically. Up to 3.2% cash back this ebitda multiple template helps you find out the ebitda multiple given the line items for determining the enterprise value. This professional template generator streamlines the creation. Download our ebitda template and assess a company’s operational profitability using the income statement and cash flow statement.. These ebitda spreadsheet templates are easy to modify and you can customize the design, the header,. It defines ebitda as net income plus interest, taxes, and depreciation and. Download our ebitda template and assess a company’s operational profitability using the income statement and cash flow statement. Up to 3.2% cash back this ebitda template will show you how to calculate. This professional template generator streamlines the creation. Ebitda stands for earnings before interest, taxes, depreciation, and amortization. These ebitda spreadsheet templates are easy to modify and you can customize the design, the header,. It's a key metric for evaluating a company's operational performance, excluding certain expenses to. Learn how to use sheetgo's ebitda template in excel. View our free and editable ebitda templates for excel or google sheets. Up to 3.2% cash back this ebitda multiple template helps you find out the ebitda multiple given the line items for determining the enterprise value. This professional template generator streamlines the creation. The ebitda multiple is a financial. Here is a screenshot of the template: Ebitda stands for earnings before interest, taxes, depreciation, and amortization. Use our adjusted ebitda excel template to quickly and easily calculate a company's earnings before interest, taxes, depreciation, and amortization. Learn how to use sheetgo's ebitda template in excel. Presentation of ebitda indicators on an interactive dashboard. Up to 3.2% cash back this ebitda template will show you how to calculate ebitda using the income statement and cash flow statement. Calculate ebit/ebitda and keep track of your financial data automatically. It's a key metric for evaluating a company's operational performance, excluding certain expenses to. These ebitda spreadsheet templates are easy to modify and you can customize the design, the header,. Boost your financial analysis with our ebitda template! Download our ebitda template and assess a company’s operational profitability using the income statement and cash flow statement.Ebitda Excel Template, (short Term Debt + Long Term.

EBITDA Excel Template Easily Calculate Business Value with EV Model

Free Ebitda Templates For Google Sheets And Microsoft Excel Slidesdocs

Full EBITDA Guide What is It & How Investors Use It (Formula)

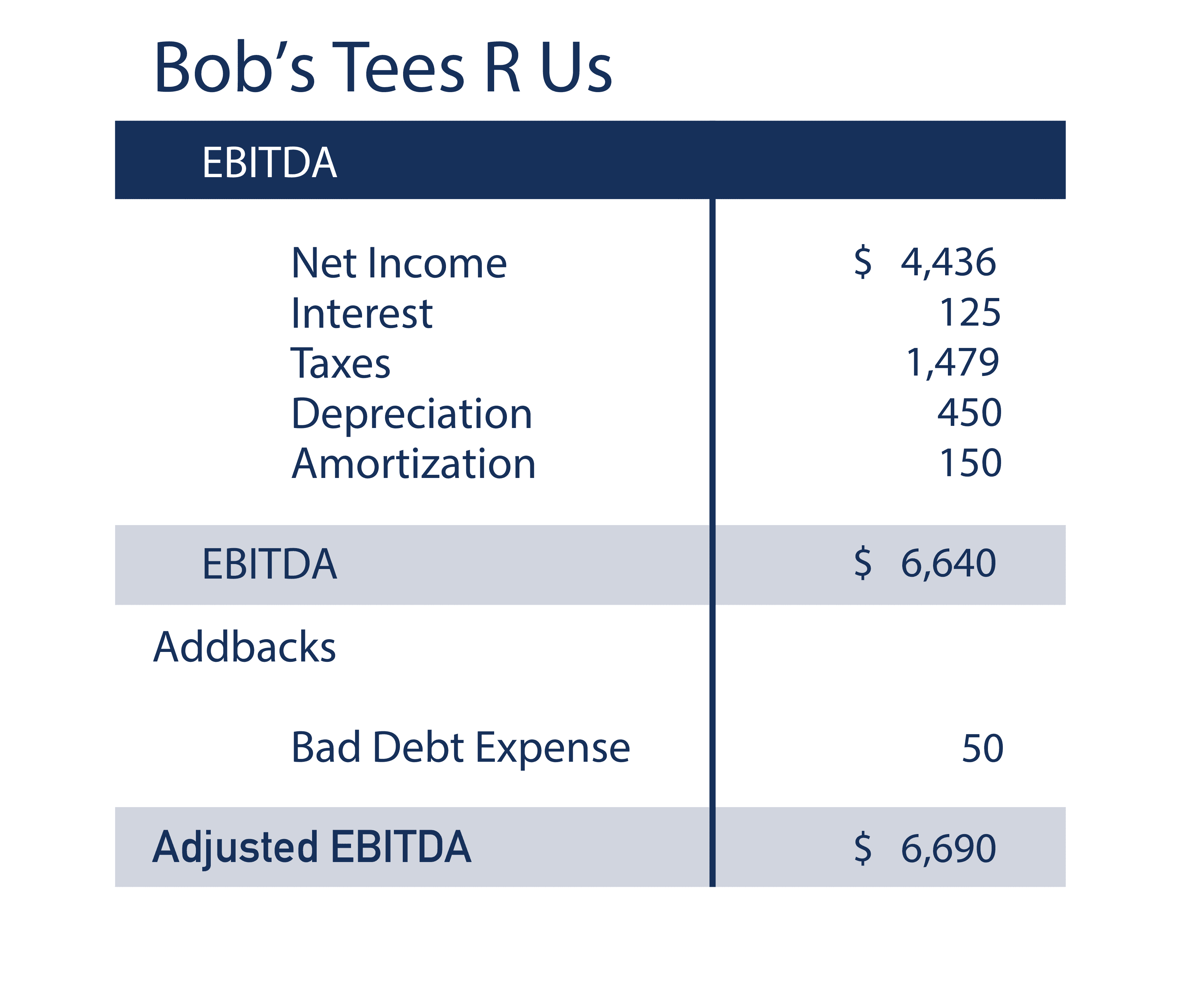

Free Adjusted EBITDA Excel Template Quickly Calculate Profits

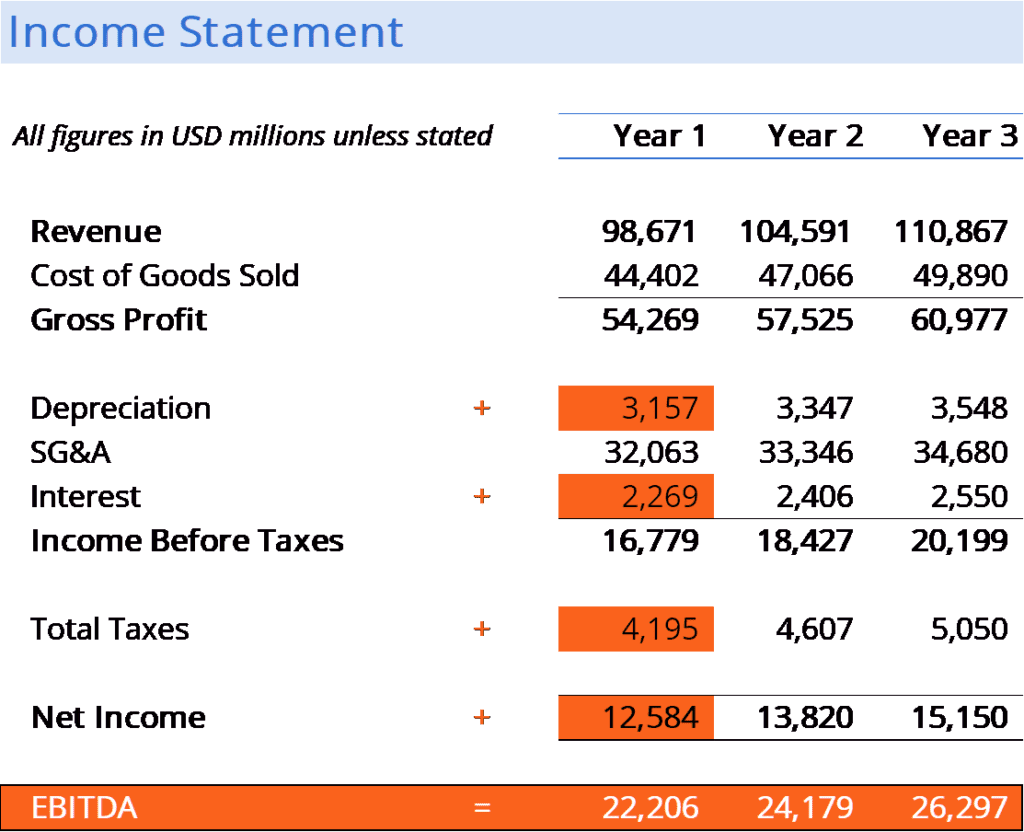

What is EBITDA Formula, Definition and Explanation

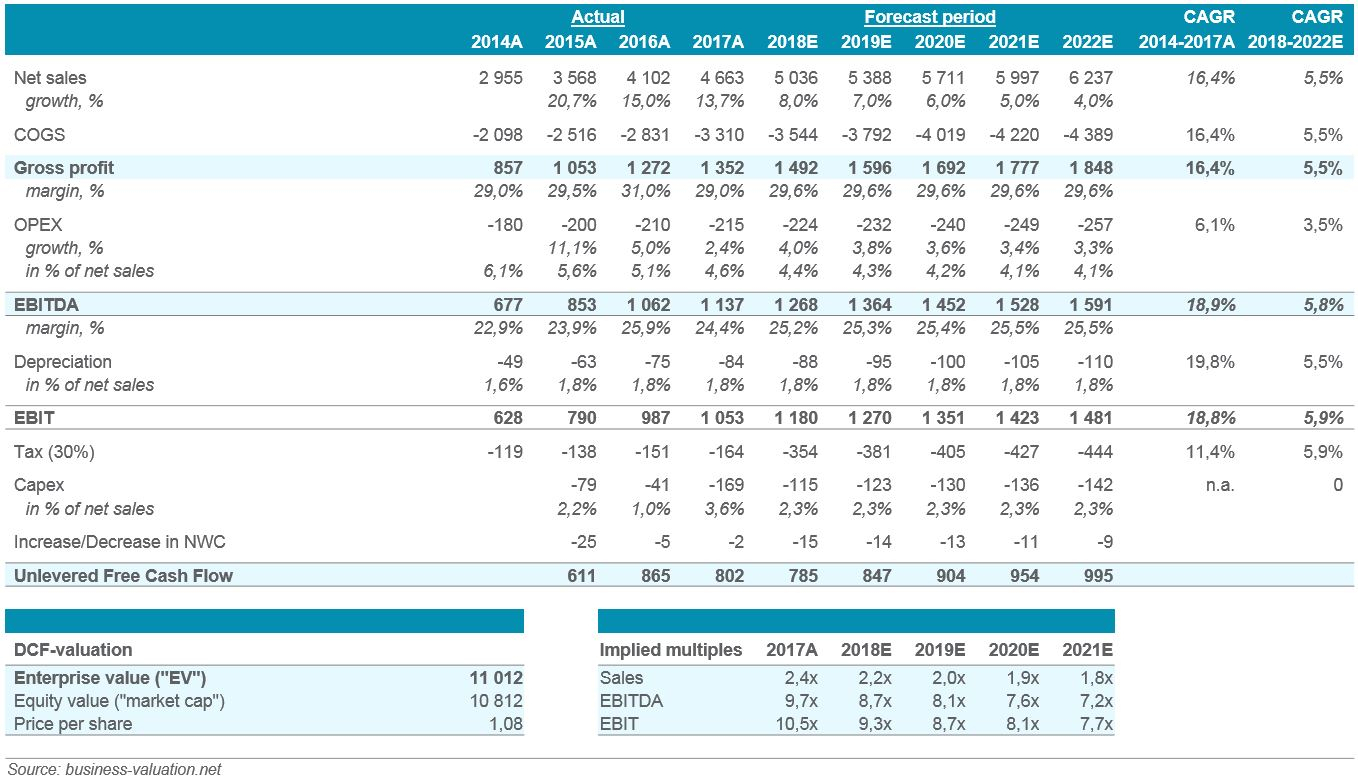

Ebitda Valuation Spreadsheet

Ebitda Excel Template prntbl.concejomunicipaldechinu.gov.co

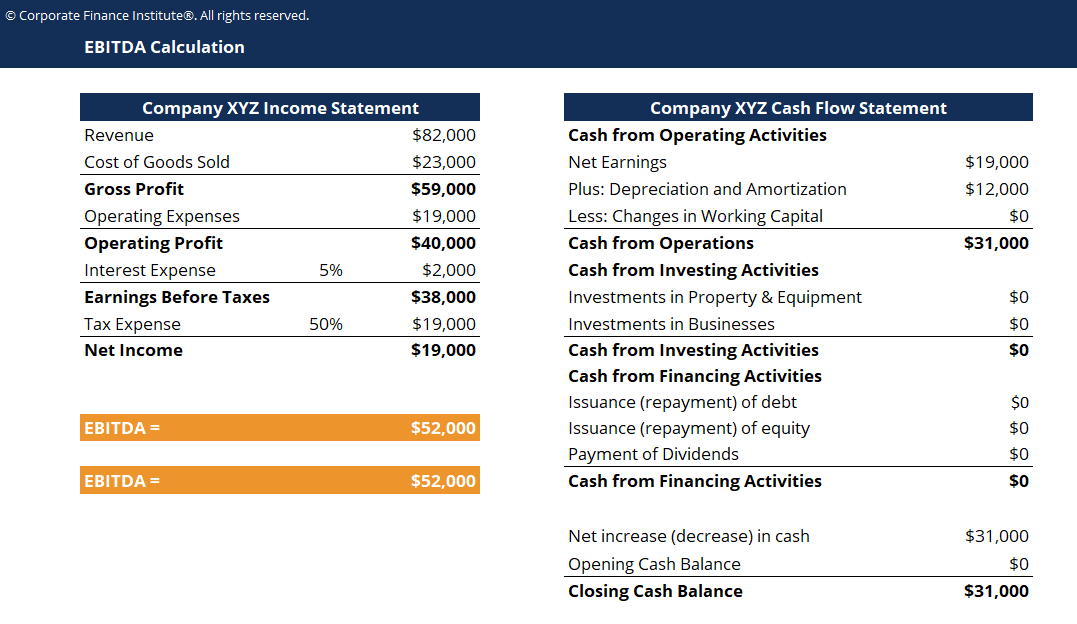

EBITDA Template Download Free Excel Template

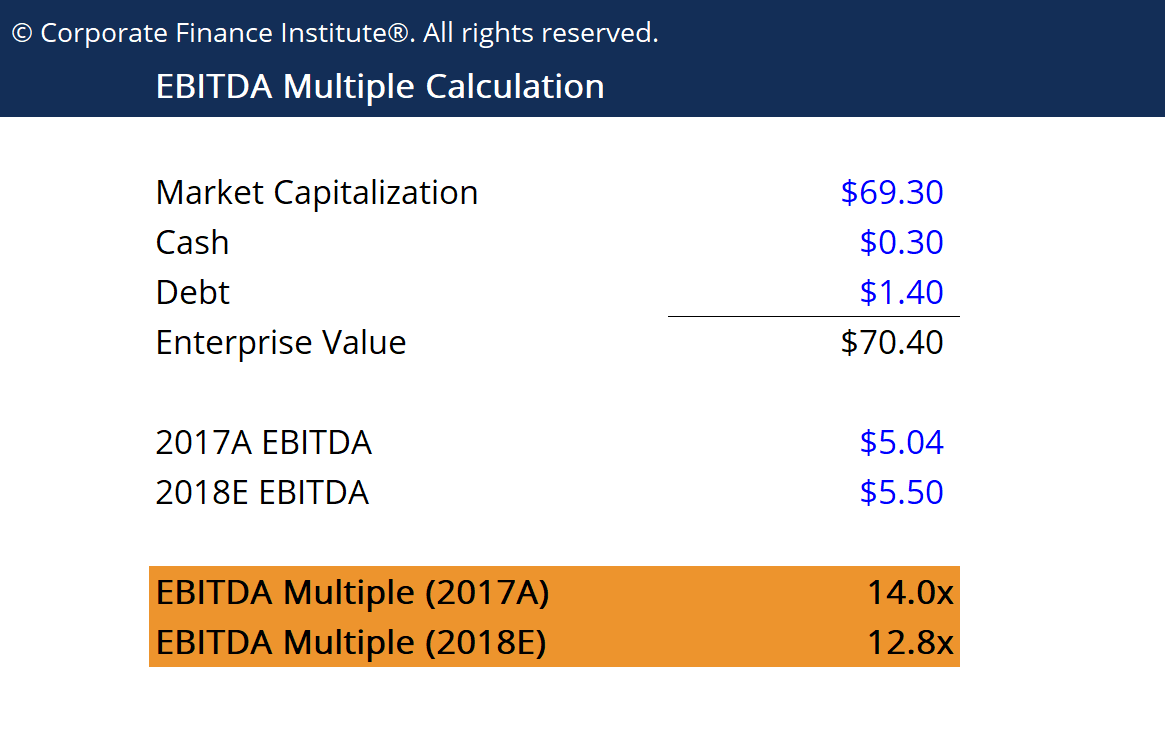

EBITDA Multiple Template Download Free Excel Template

Our Free Adjusted Ebitda Template And Adjusted Income Statement Example Are Designed To Help You Visualize And Present Your Financial Adjustments Effectively.

An Ebitda Bridge Excel Template Is Essential For Financial Analysts Tracking And Analyzing Changes In Ebitda Over Time.

It Defines Ebitda As Net Income Plus Interest, Taxes, And Depreciation And.

The Document Provides An Ebitda Excel Template And Examples For Calculating Ebitda For Three Companies.

Related Post: