First B Notice Template

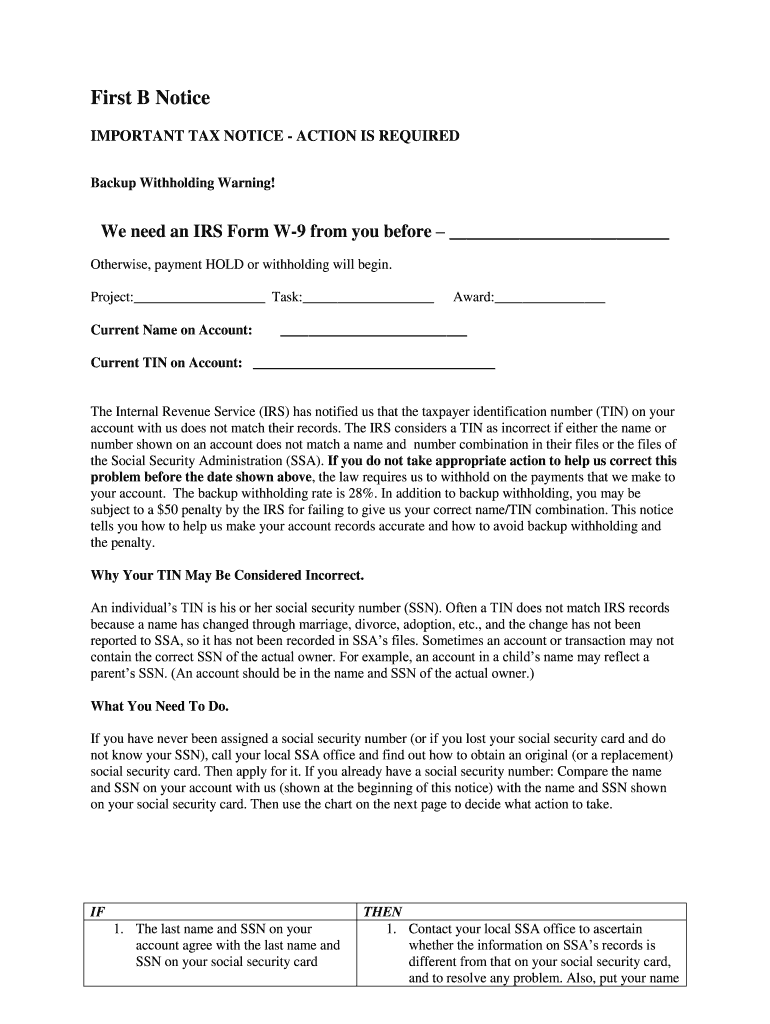

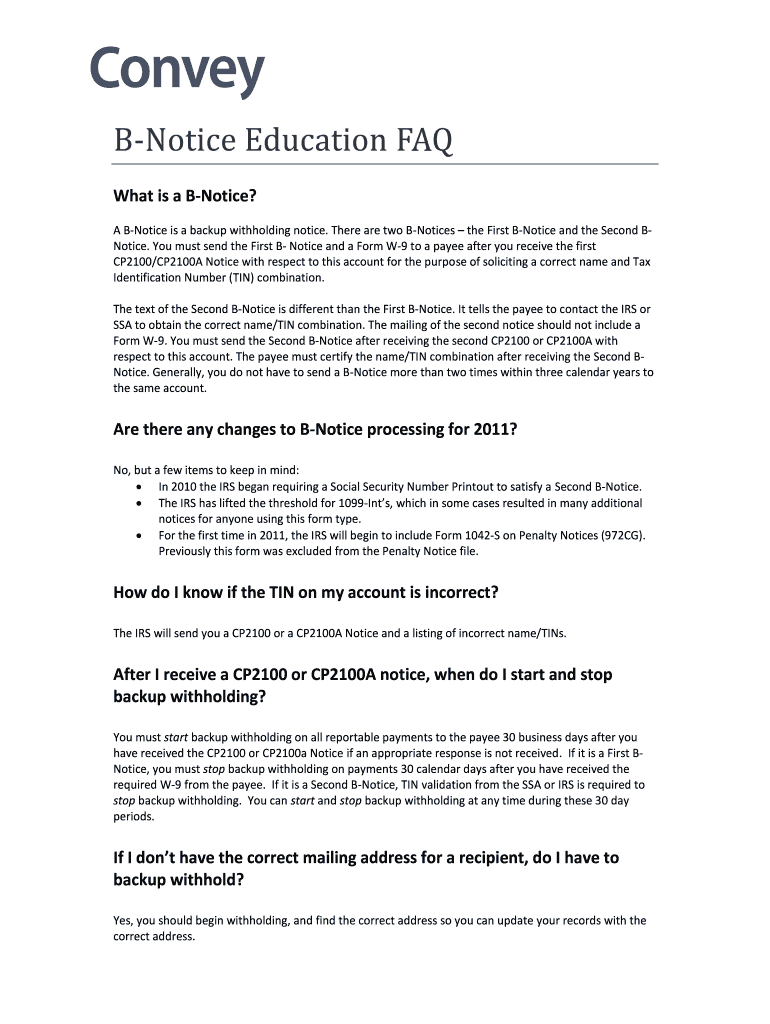

First B Notice Template - Before you go, you should call ssa so that they can explain what. The first b notice is a critical notification that alerts individuals and entities about discrepancies between their account information and the data held by the internal revenue service (irs) or. When you send the first b notice to a payee, you need to include: Up to $40 cash back a first b notice is defined as a name and tin combination that hasn't been identified in a b notice received within the last three calendar years. Up to 40% cash back the b notice creates potential backup withholding exposure, incorrect filing penalties, and potentially an irs form 1099 audit. Why your tin may be considered as incorrect?. Get first b notice form the first b notice is a critical document that the internal revenue service (irs) issues to inform individuals and entities that the taxpayer identification number. Irs publication 1281, backup withholding for missing and incorrect names/tin (s), contains detailed information with respect to backup withholding and the “b” notice. You can also download it, export it or print it out. This notice contains a list of 1099 forms that. B notices are sent to irs form 1099. Get first b notice form the first b notice is a critical document that the internal revenue service (irs) issues to inform individuals and entities that the taxpayer identification number. A b notice is a message from the irs, usually arriving in september or october, in the form of irs notice cp2100 or cp2100a. Before you go, you should call ssa so that they can explain what. Up to 40% cash back send irs first b notice form template free via email, link, or fax. When you send the first b notice to a payee, you need to include: Why your tin may be considered as. You are required to visit an ssa office, take this notice, your social security card, and any other related documents with you. Up to $40 cash back a first b notice is defined as a name and tin combination that hasn't been identified in a b notice received within the last three calendar years. Up to 40% cash back the b notice creates potential backup withholding exposure, incorrect filing penalties, and potentially an irs form 1099 audit. You can also download it, export it or print it out. Irs publication 1281, backup withholding for missing and incorrect names/tin (s), contains detailed information with respect to backup withholding and the “b” notice. This notice tells you how to help us make your account records accurate and how to avoid backup withholding and the penalty. Why your tin may. You are required to visit an ssa office, take this notice, your social security card, and any other related documents with you. Why your tin may be considered as incorrect?. Get first b notice form the first b notice is a critical document that the internal revenue service (irs) issues to inform individuals and entities that the taxpayer identification number.. This notice tells you how to help us make your account records accurate and how to avoid backup withholding and the penalty. Up to 40% cash back a first b notice is defined as a name and tin combination that hasn't been identified in a b notice received within the last three calendar years. B notices are sent to irs. This notice tells you how to help us make your account records accurate and how to avoid backup withholding and the penalty. Up to 40% cash back send irs first b notice form template free via email, link, or fax. Up to $40 cash back a first b notice is defined as a name and tin combination that hasn't been. Up to 40% cash back a first b notice is defined as a name and tin combination that hasn't been identified in a b notice received within the last three calendar years. Up to 40% cash back notice cp2100/cp2100a is known as the backup withholding notice and is sent when the irs identifies discrepancies between a payees name and tin. You can also download it, export it or print it out. B notices are sent to irs form 1099. Before you go, you should call ssa so that they can explain what. The first b notice, provided by the irs. Up to 40% cash back the b notice creates potential backup withholding exposure, incorrect filing penalties, and potentially an irs. Why your tin may be considered as. Irs publication 1281, backup withholding for missing and incorrect names/tin (s), contains detailed information with respect to backup withholding and the “b” notice. This notice contains a list of 1099 forms that. You can also download it, export it or print it out. Up to $40 cash back a first b notice is. You can also download it, export it or print it out. This notice contains a list of 1099 forms that. Irs publication 1281, backup withholding for missing and incorrect names/tin (s), contains detailed information with respect to backup withholding and the “b” notice. When you send the first b notice to a payee, you need to include: A b notice. A b notice is a message from the irs, usually arriving in september or october, in the form of irs notice cp2100 or cp2100a. Why your tin may be considered as incorrect?. You are required to visit an ssa office, take this notice, your social security card, and any other related documents with you. Up to 40% cash back a. Irs publication 1281, backup withholding for missing and incorrect names/tin (s), contains detailed information with respect to backup withholding and the “b” notice. This notice tells you how to help us make your account records accurate and how to avoid backup withholding and the penalty. Up to 40% cash back a first b notice is defined as a name and. Up to 40% cash back send irs first b notice form template free via email, link, or fax. Up to $40 cash back a first b notice is defined as a name and tin combination that hasn't been identified in a b notice received within the last three calendar years. This notice tells you how to help us make your account records accurate and how to avoid backup withholding and the penalty. Why your tin may be considered as. The first b notice, provided by the irs. This notice tells you how to help us make your account records accurate and how to avoid backup withholding and the penalty. You can also download it, export it or print it out. Up to 40% cash back a first b notice is defined as a name and tin combination that hasn't been identified in a b notice received within the last three calendar years. Why your tin may be considered as incorrect?. A b notice is a message from the irs, usually arriving in september or october, in the form of irs notice cp2100 or cp2100a. Get first b notice form the first b notice is a critical document that the internal revenue service (irs) issues to inform individuals and entities that the taxpayer identification number. Before you go, you should call ssa so that they can explain what. When you send the first b notice to a payee, you need to include: Up to 40% cash back notice cp2100/cp2100a is known as the backup withholding notice and is sent when the irs identifies discrepancies between a payees name and tin on a. This notice contains a list of 1099 forms that. Irs publication 1281, backup withholding for missing and incorrect names/tin (s), contains detailed information with respect to backup withholding and the “b” notice.Free First B Notice Template Edit Online & Download

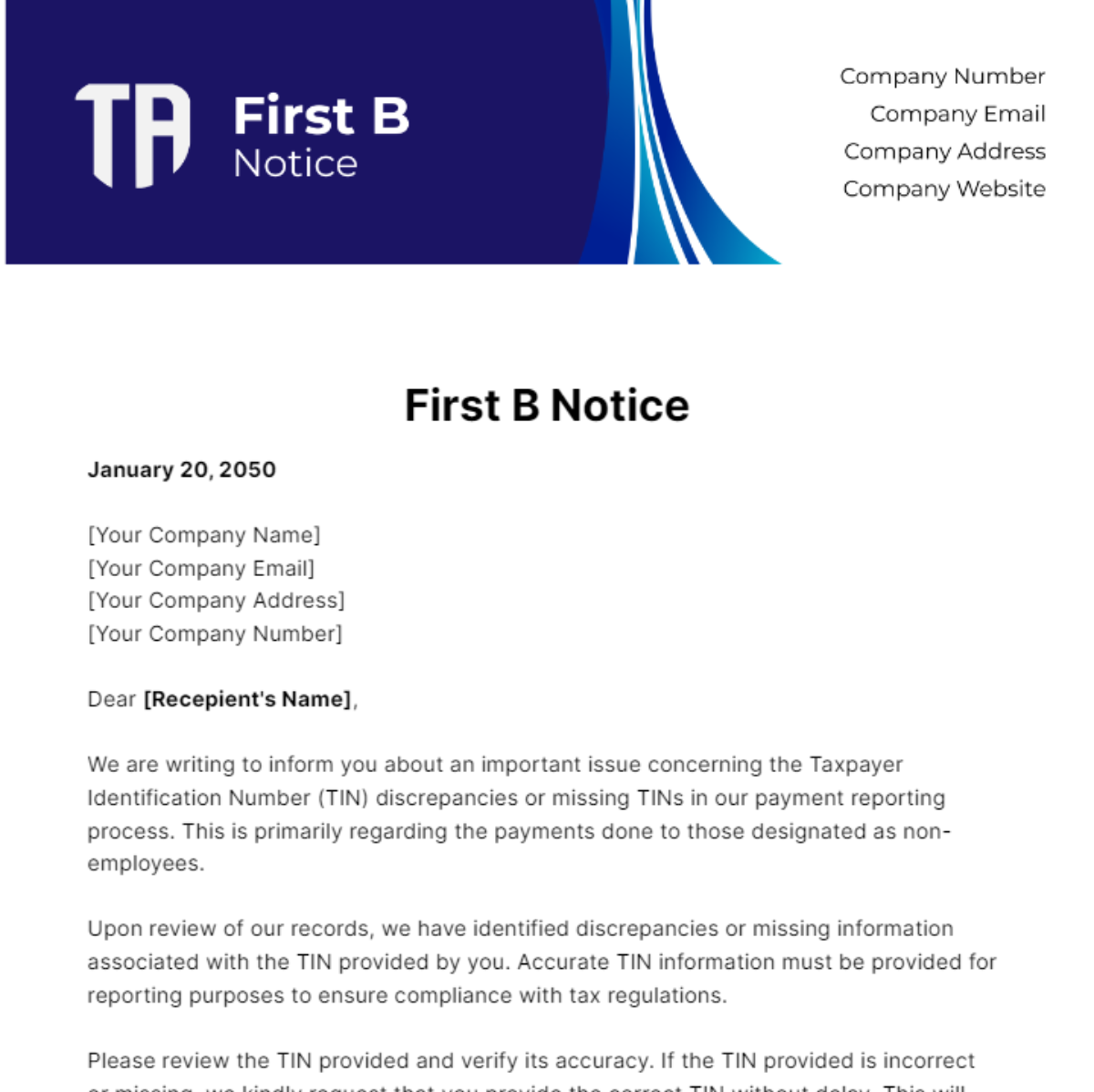

Browse Our Example of First B Notice Form Template Label templates

First b notice template word Artofit

First B Notice Template

First B Notice Fill and Sign Printable Template Online US Legal Forms

First B Notice Template

Costum First B Notice Template Irs Example Tacitproject

Printable First B Notice Template Free Printable

First B Notice Form Template Word

First B Notice Template Word

You Are Required To Visit An Ssa Office, Take This Notice, Your Social Security Card, And Any Other Related Documents With You.

Up To 40% Cash Back The B Notice Creates Potential Backup Withholding Exposure, Incorrect Filing Penalties, And Potentially An Irs Form 1099 Audit.

B Notices Are Sent To Irs Form 1099.

The First B Notice Is A Critical Notification That Alerts Individuals And Entities About Discrepancies Between Their Account Information And The Data Held By The Internal Revenue Service (Irs) Or.

Related Post: