Free Debt Verification Letter Template To Credit Bureau

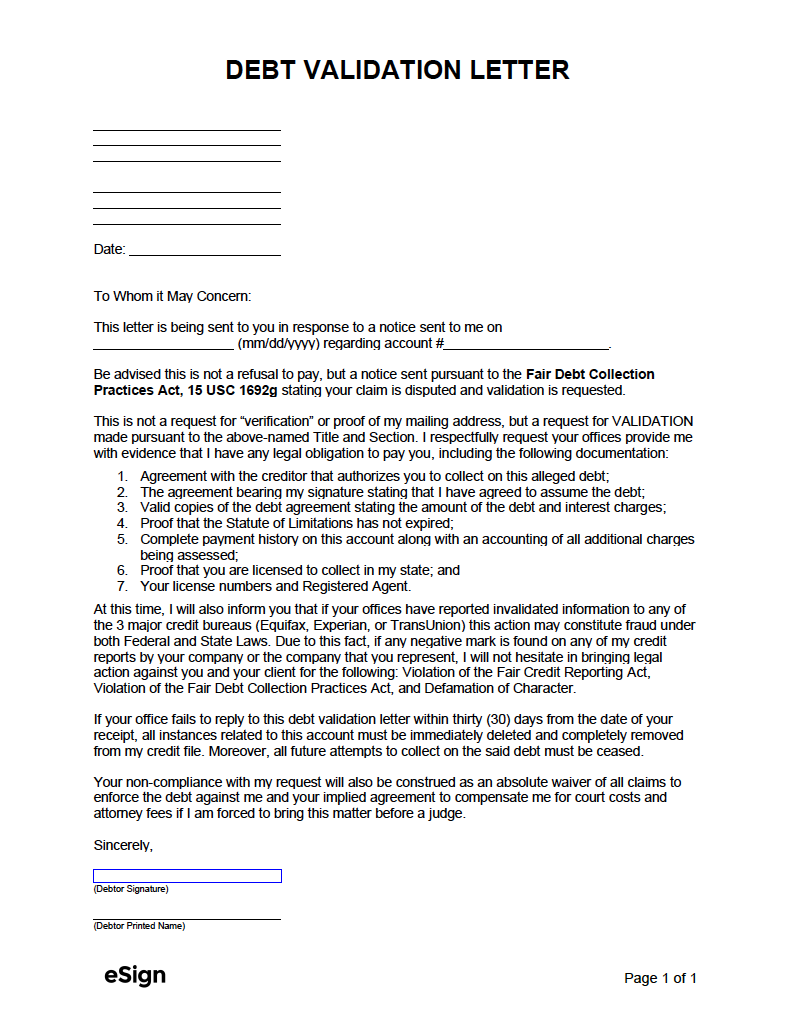

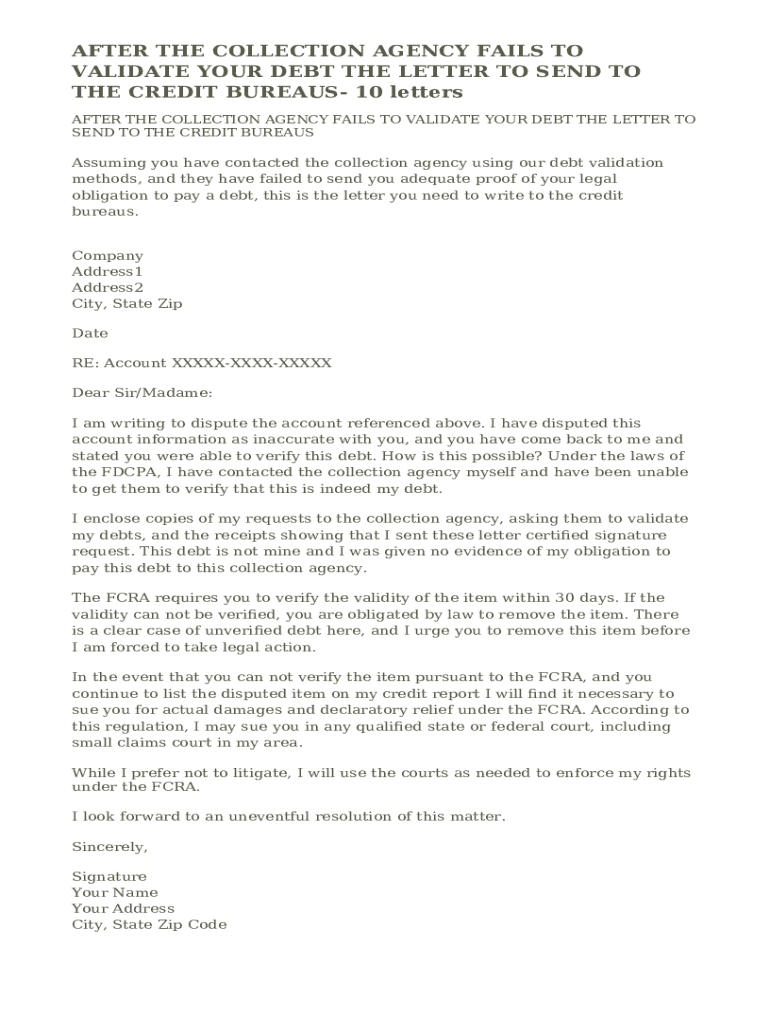

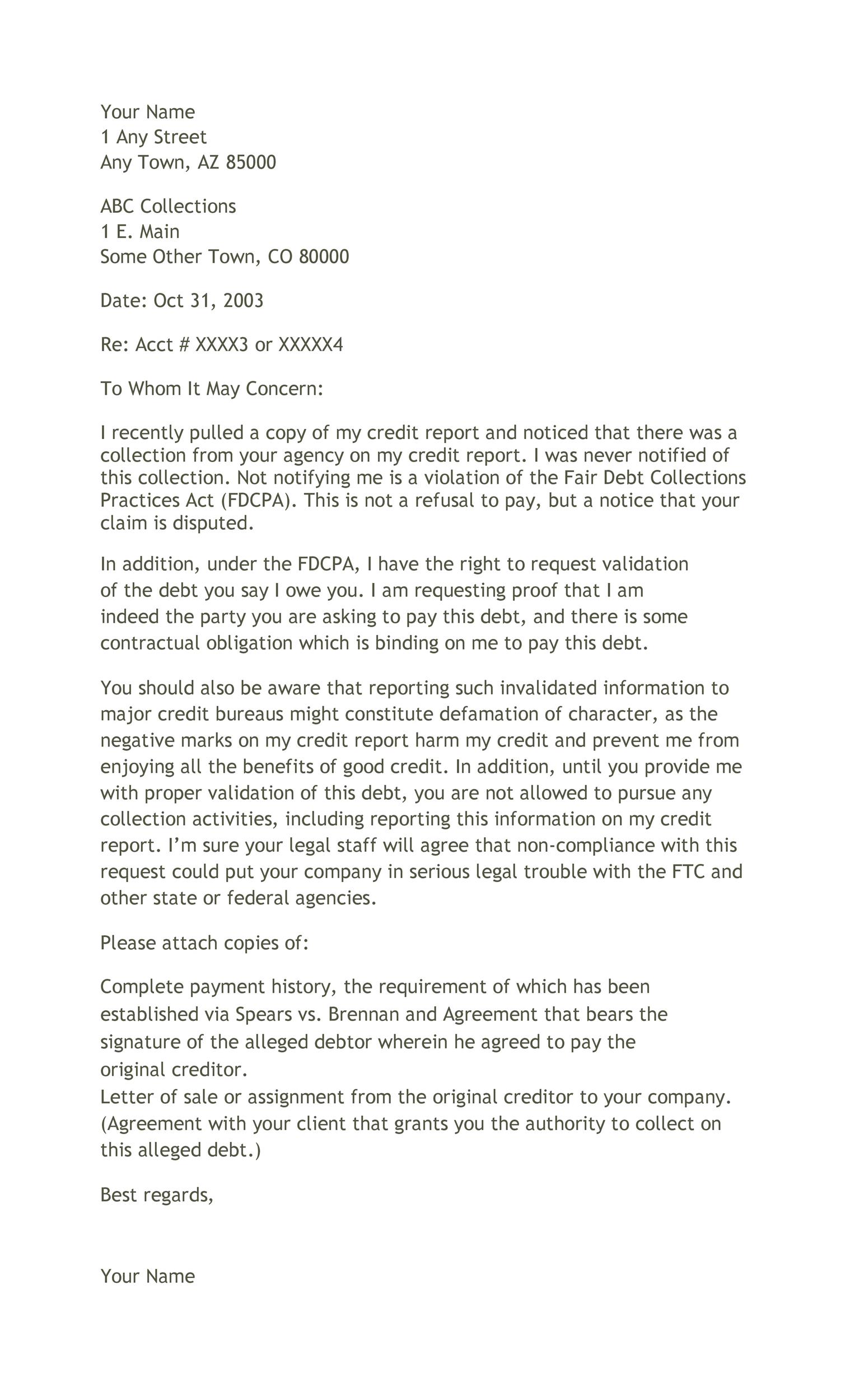

Free Debt Verification Letter Template To Credit Bureau - If you have been contacted regarding outstanding debts, collectors are legally. Reference the fair debt collection practices act (fdcpa), which regulates debt collectors. Sending a debt verification letter can help ensure that you do not bring back an old debt that has passed the statute of limitations. We’ll also provide a debt verification letter sample and a free template to help you get started. At this time, i will also inform you that if your offices have reported invalidated information to any of the 3 major credit bureaus (equifax, experian or transunion) this action may constitute. In this guide, i’ll share my unique experiences, provide three proven templates, and offer tips to ensure your debt validation letters are persuasive and effective. Need a quick debt validation? Requesting creditors to stop collection activities is a critical part of the letter. • commission for debt collector if collection efforts are successful. Sample debt validation letter to credit bureaus. • verification that this debt was assigned or sold to collector. If you have been contacted regarding outstanding debts, collectors are legally. Sending a debt verification letter can help ensure that you do not bring back an old debt that has passed the statute of limitations. Send the bureau a request for a validation of debt on behalf of your client. Need a quick debt validation? Debt collectors are legally required to send you a debt validation. It is a crucial tool in protecting consumers’ rights. Sample debt validation letter to credit bureaus. Requesting creditors to stop collection activities is a critical part of the letter. Reference the fair debt collection practices act (fdcpa), which regulates debt collectors. We’ll also provide a debt verification letter sample and a free template to help you get started. • commission for debt collector if collection efforts are successful. • verification that this debt was assigned or sold to collector. A debt verification letter is a written request sent by a consumer to a debt collector or creditor to verify the legitimacy. A debt verification letter is a written request sent by a consumer to a debt collector or creditor to verify the legitimacy of a debt. Debt collectors are legally required to send you a debt validation. Download, customize, and send the letter in minutes. If you have been contacted regarding outstanding debts, collectors are legally. We’ll also provide a debt. We’ll also provide a debt verification letter sample and a free template to help you get started. • commission for debt collector if collection efforts are successful. Send the bureau a request for a validation of debt on behalf of your client. Requesting creditors to stop collection activities is a critical part of the letter. If you have been contacted. • verification that this debt was assigned or sold to collector. A debt verification letter is a form used to confirm whether or not a debt is genuine. Sending a debt verification letter can help ensure that you do not bring back an old debt that has passed the statute of limitations. This letter is a request for debt validation. Making a single payment or agreeing to a. A debt validation letter is an essential document to send to the credit bureaus in order to obtain verifiable proof that a. We’ll also provide a debt verification letter sample and a free template to help you get started. It is sent to a creditor or collection agency after receiving a letter. A debt validation letter is an essential document to send to the credit bureaus in order to obtain verifiable proof that a. A debt verification letter is a written request sent by a consumer to a debt collector or creditor to verify the legitimacy of a debt. It is sent to a creditor or collection agency after receiving a letter. At this time, i will also inform you that if your offices have reported invalidated information to any of the 3 major credit bureaus (equifax, experian or transunion) this action may constitute. Debt collectors are legally required to send you a debt validation. If you have been contacted regarding outstanding debts, collectors are legally. Send them our free, printable debt. Send the bureau a request for a validation of debt on behalf of your client. Need a quick debt validation? Debt collectors are legally required to send you a debt validation. The credit bureaus keep the information on file and. Reference the fair debt collection practices act (fdcpa), which regulates debt collectors. Requesting creditors to stop collection activities is a critical part of the letter. If you have been contacted regarding outstanding debts, collectors are legally. Sample debt validation letter to credit bureaus. Send them our free, printable debt validation letter template to require verification before you pay. Download, customize, and send the letter in minutes. It is sent to a creditor or collection agency after receiving a letter requesting payment for an. Send them our free, printable debt validation letter template to require verification before you pay. A debt verification letter is a form used to confirm whether or not a debt is genuine. It is a crucial tool in protecting consumers’ rights. Debt collectors. A debt validation letter is an essential document to send to the credit bureaus in order to obtain verifiable proof that a. Easily dispute and validate your debts with our free debt validation letter template. It is sent to a creditor or collection agency after receiving a letter requesting payment for an. This letter is a request for debt validation sent to a. Sample debt validation letter to credit bureaus. Send the bureau a request for a validation of debt on behalf of your client. At this time, i will also inform you that if your offices have reported invalidated information to any of the 3 major credit bureaus (equifax, experian or transunion) this action may constitute. If you’re contacted by a debt collector and something doesn’t seem right about the collection agency or the debt itself, you can use a debt verification letter to learn more about. Making a single payment or agreeing to a. Any party, an original creditor or a debt collector, can report a missed payment or other negative financial information to a credit bureau. Reference the fair debt collection practices act (fdcpa), which regulates debt collectors. If you have been contacted regarding outstanding debts, collectors are legally. Sending a debt verification letter can help ensure that you do not bring back an old debt that has passed the statute of limitations. Is a collector demanding payment for unfamiliar debts? Requesting creditors to stop collection activities is a critical part of the letter. • verification that this debt was assigned or sold to collector.Free Debt Validation Letter Template PDF & Word

50 Free Debt Validation Letter Templates [& Samples] ᐅ TemplateLab

50 Free Debt Validation Letter Templates [& Samples] ᐅ TemplateLab

DEBT VALIDATION LETTER Template to Creditor Validate Debt Letter to

50 Free Debt Validation Letter Samples & Templates ᐅ TemplateLab

50 Free Debt Validation Letter Templates [& Samples] ᐅ TemplateLab

Printable Debt Validation Letter

Debt Validation Letter to Send to Credit Bureau Doc Template pdfFiller

50 Free Debt Validation Letter Samples & Templates ᐅ TemplateLab

50 Free Debt Validation Letter Templates [& Samples] ᐅ TemplateLab

It Is A Crucial Tool In Protecting Consumers’ Rights.

The Credit Bureaus Keep The Information On File And.

• Commission For Debt Collector If Collection Efforts Are Successful.

Need A Quick Debt Validation?

Related Post:

![50 Free Debt Validation Letter Templates [& Samples] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2019/06/debt-validation-letter-31-790x1301.jpg)

![50 Free Debt Validation Letter Templates [& Samples] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2019/06/debt-validation-letter-12-790x1022.jpg)

![50 Free Debt Validation Letter Templates [& Samples] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2019/06/debt-validation-letter-26-790x1022.jpg)

![50 Free Debt Validation Letter Templates [& Samples] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2019/06/debt-validation-letter-47-790x1301.jpg)