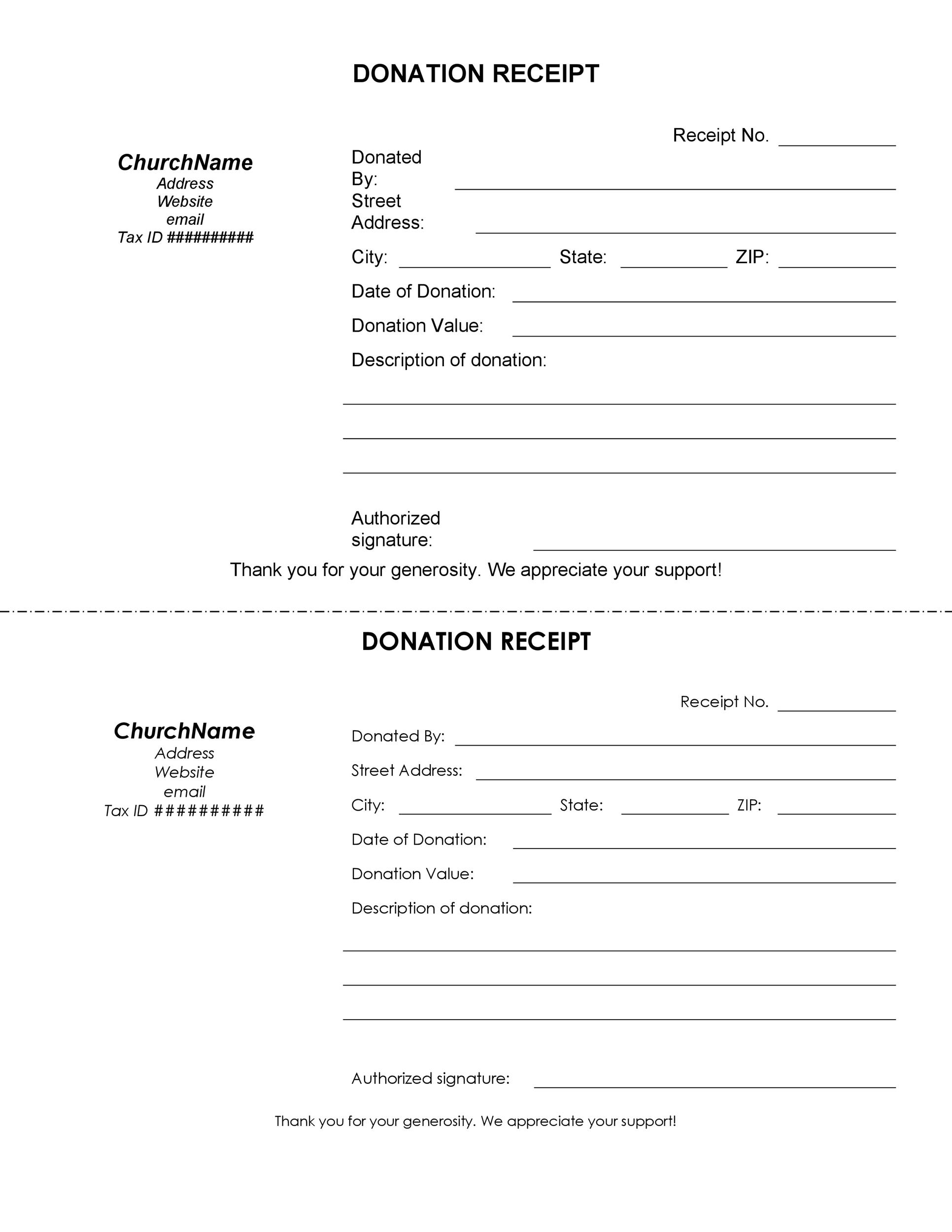

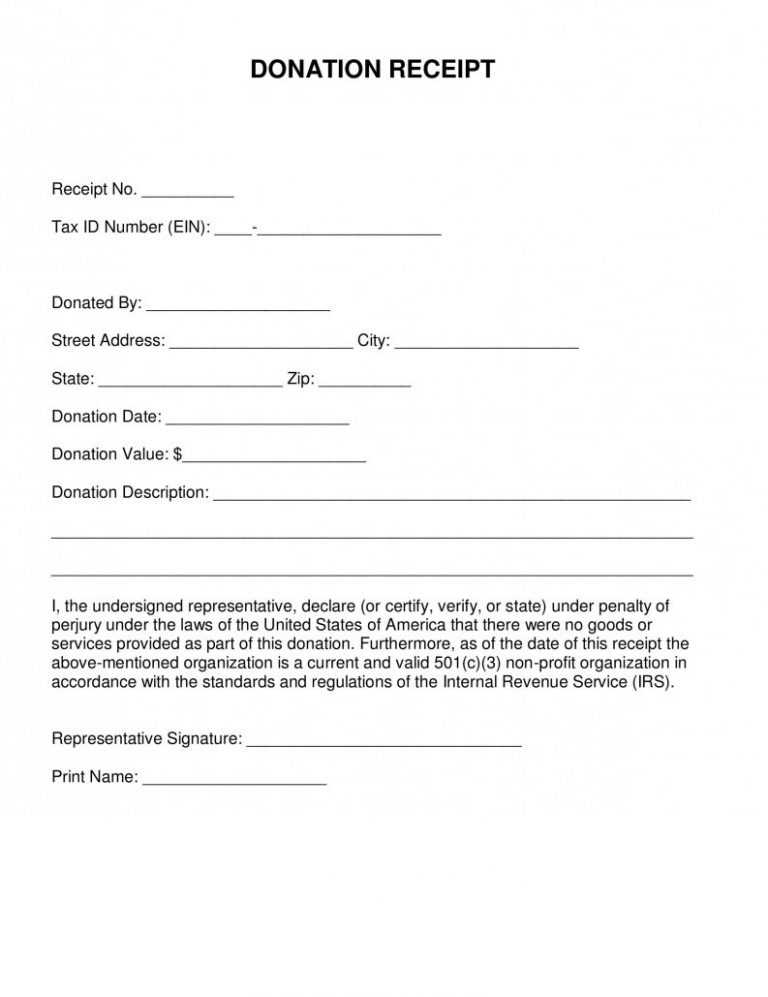

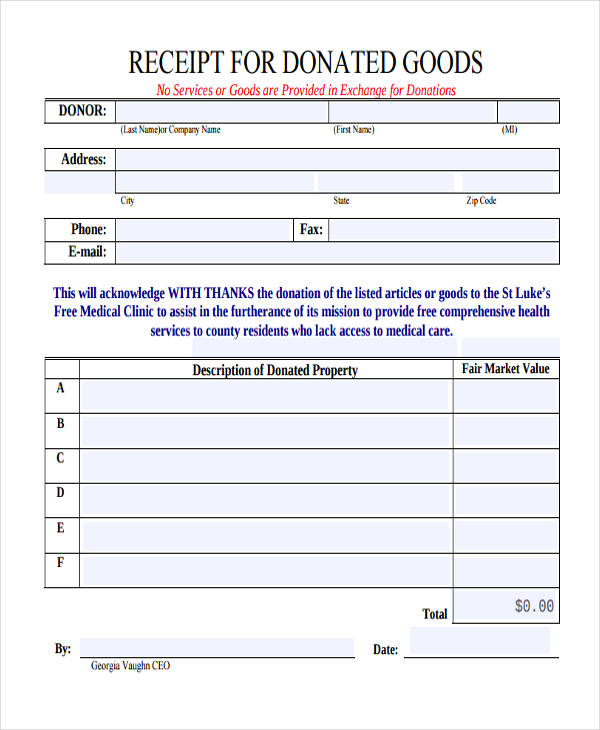

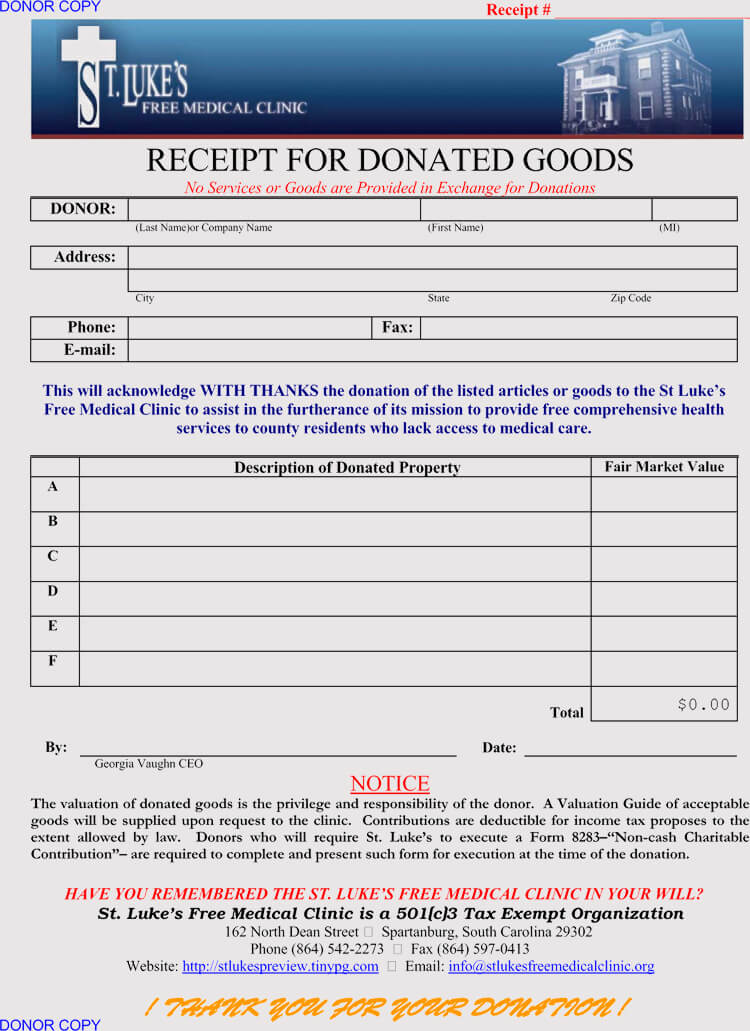

Free Printable Donation Receipt Template

Free Printable Donation Receipt Template - It is the duty of the organization receiving the donation to issue a receipt for the donor’s tax purposes. Feel free to download, modify and use any you like. Given below are donation receipt templates: Donation receipts are quite simply the act of providing a donor with a receipt for their monetary contribution to an organization, such as a charity or foundation. Get simple, free templates that can be used for any donation or gift here. Here are some free 501(c)(3) donation receipt templates for you to. It is typically provided by. One of the reasons an individual might need. This guide will explore the importance of donation receipts, their different types, and how to write them effectively. When you make a charitable. Have you ever donated to your favorite charities or for worthy causes to help certain advocacies? Using a (501)(c)(3) donation receipt template helps the donor captures all the relevant information for the donor’s tax returns. Learn what information to include on a donation receipt, why they are needed, and when they are required by the irs. It is typically provided by. A donation receipt is an official document that provides evidence of donations or gifts given to an organization by donors. When you make a charitable. This guide will explore the importance of donation receipts, their different types, and how to write them effectively. A printable donation receipt template can be downloaded through the link below. A donation receipt is a document that acknowledges that an individual or organization has made a charitable contribution. Here’s our collection of donation receipt templates. Here are some free 501(c)(3) donation receipt templates for you to. For more templates, refer to our main receipt templates page here. A printable donation receipt template can be downloaded through the link below. Feel free to download, modify and use any you like. Get simple, free templates that can be used for any donation or gift here. When you make a charitable. Get simple, free templates that can be used for any donation or gift here. Feel free to download, modify and use any you like. A nonprofit receipt template is a helpful document used to create a form of receipt states that a benefactor has been donated a certain value to a beneficiary. A donation receipt. When you make a charitable. A nonprofit receipt template is a helpful document used to create a form of receipt states that a benefactor has been donated a certain value to a beneficiary. Given below are donation receipt templates: Learn what information to include on a donation receipt, why they are needed, and when they are required by the irs.. One of the reasons an individual might need. A printable donation receipt template can be downloaded through the link below. Learn what information to include on a donation receipt, why they are needed, and when they are required by the irs. Get simple, free templates that can be used for any donation or gift here. Donation receipts are quite simply. Learn what information to include on a donation receipt, why they are needed, and when they are required by the irs. Have you ever donated to your favorite charities or for worthy causes to help certain advocacies? Given below are donation receipt templates: Donation receipts are quite simply the act of providing a donor with a receipt for their monetary. When you make a charitable. A nonprofit receipt template is a helpful document used to create a form of receipt states that a benefactor has been donated a certain value to a beneficiary. A printable donation receipt template can be downloaded through the link below. This guide will explore the importance of donation receipts, their different types, and how to. It is typically provided by. Get simple, free templates that can be used for any donation or gift here. Donation receipt templates are a necessity when it comes to charitable donations. Using a (501)(c)(3) donation receipt template helps the donor captures all the relevant information for the donor’s tax returns. Donation receipts are quite simply the act of providing a. A nonprofit receipt template is a helpful document used to create a form of receipt states that a benefactor has been donated a certain value to a beneficiary. After the receipt has been issued, the donor will be able to save for their. Using a (501)(c)(3) donation receipt template helps the donor captures all the relevant information for the donor’s. It is the duty of the organization receiving the donation to issue a receipt for the donor’s tax purposes. A donation receipt is an official document that provides evidence of donations or gifts given to an organization by donors. When you make a charitable. Download and customize free donation receipt templates for your organization. A donation receipt is a document. Learn what information to include on a donation receipt, why they are needed, and when they are required by the irs. Feel free to download, modify and use any you like. Here are some free 501(c)(3) donation receipt templates for you to. Given below are donation receipt templates: Get simple, free templates that can be used for any donation or. A printable donation receipt template can be downloaded through the link below. Learn what information to include on a donation receipt, why they are needed, and when they are required by the irs. Using a (501)(c)(3) donation receipt template helps the donor captures all the relevant information for the donor’s tax returns. It is typically provided by. A nonprofit receipt template is a helpful document used to create a form of receipt states that a benefactor has been donated a certain value to a beneficiary. One of the reasons an individual might need. A donation receipt is a document that acknowledges that an individual or organization has made a charitable contribution. Donation receipts are quite simply the act of providing a donor with a receipt for their monetary contribution to an organization, such as a charity or foundation. Feel free to download, modify and use any you like. Get simple, free templates that can be used for any donation or gift here. Have you ever donated to your favorite charities or for worthy causes to help certain advocacies? A donation receipt is an official document that provides evidence of donations or gifts given to an organization by donors. If so, you would have received a donation receipt that details your. This guide will explore the importance of donation receipts, their different types, and how to write them effectively. It is the duty of the organization receiving the donation to issue a receipt for the donor’s tax purposes. When you make a charitable.Free Printable Donation Receipt Template Printable Templates Your Go

Nonprofit Donation Receipt, Donation Receipt Forms, Donation Receipt

40 Donation Receipt Templates & Letters [Goodwill, Non Profit]

Free Printable Donation Receipt Templates [PDF, Word, Excel]

Free Sample Printable Donation Receipt Template Form

FREE 16+ Donation Receipt Form Samples, PDF, MS Word, Google Docs, Excel

46 Free Donation Receipt Templates (501c3, NonProfit)

Free Printable Donation Receipt Templates [PDF, Word, Excel]

FREE 5+ Donation Receipt Forms in PDF MS Word

Free Printable Donation Receipt Template Nisma.Info

Here’s Our Collection Of Donation Receipt Templates.

Here Are Some Free 501(C)(3) Donation Receipt Templates For You To.

Donation Receipt Templates Are A Necessity When It Comes To Charitable Donations.

After The Receipt Has Been Issued, The Donor Will Be Able To Save For Their.

Related Post:

![40 Donation Receipt Templates & Letters [Goodwill, Non Profit]](https://templatearchive.com/wp-content/uploads/2017/05/donation-receipt-template-23.jpg)

![Free Printable Donation Receipt Templates [PDF, Word, Excel]](https://www.typecalendar.com/wp-content/uploads/2023/07/Fillable-Donation-Receipt-Free.jpg?gid=710)

![Free Printable Donation Receipt Templates [PDF, Word, Excel]](https://www.typecalendar.com/wp-content/uploads/2023/07/Donation-Receipt-Template.jpg)