Hard Money Loan Contract Template

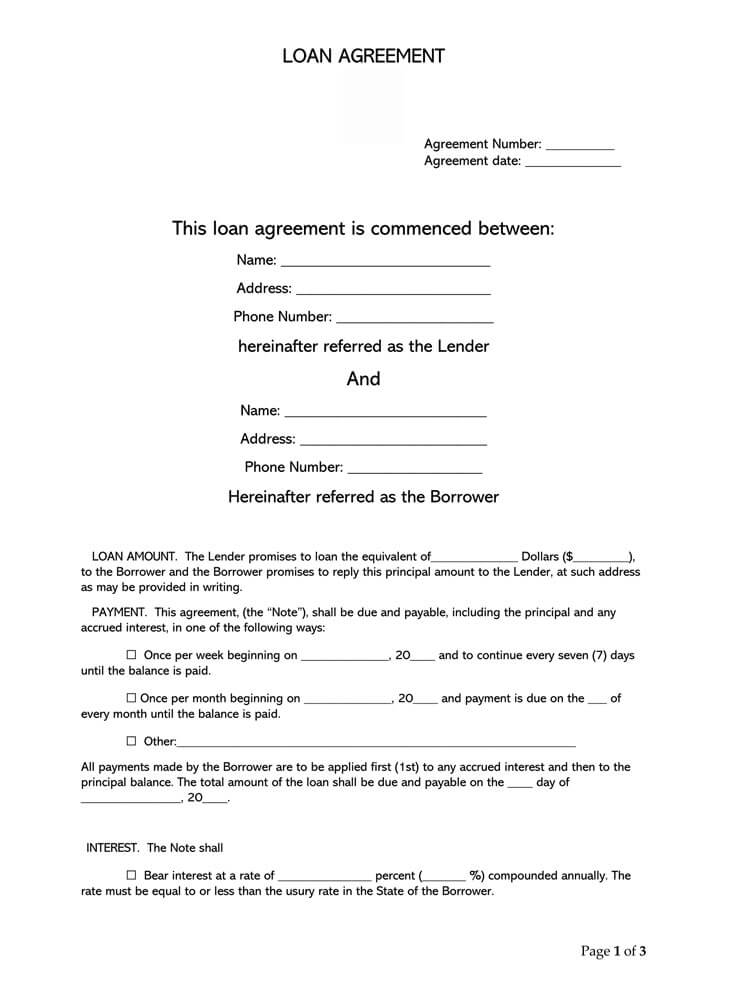

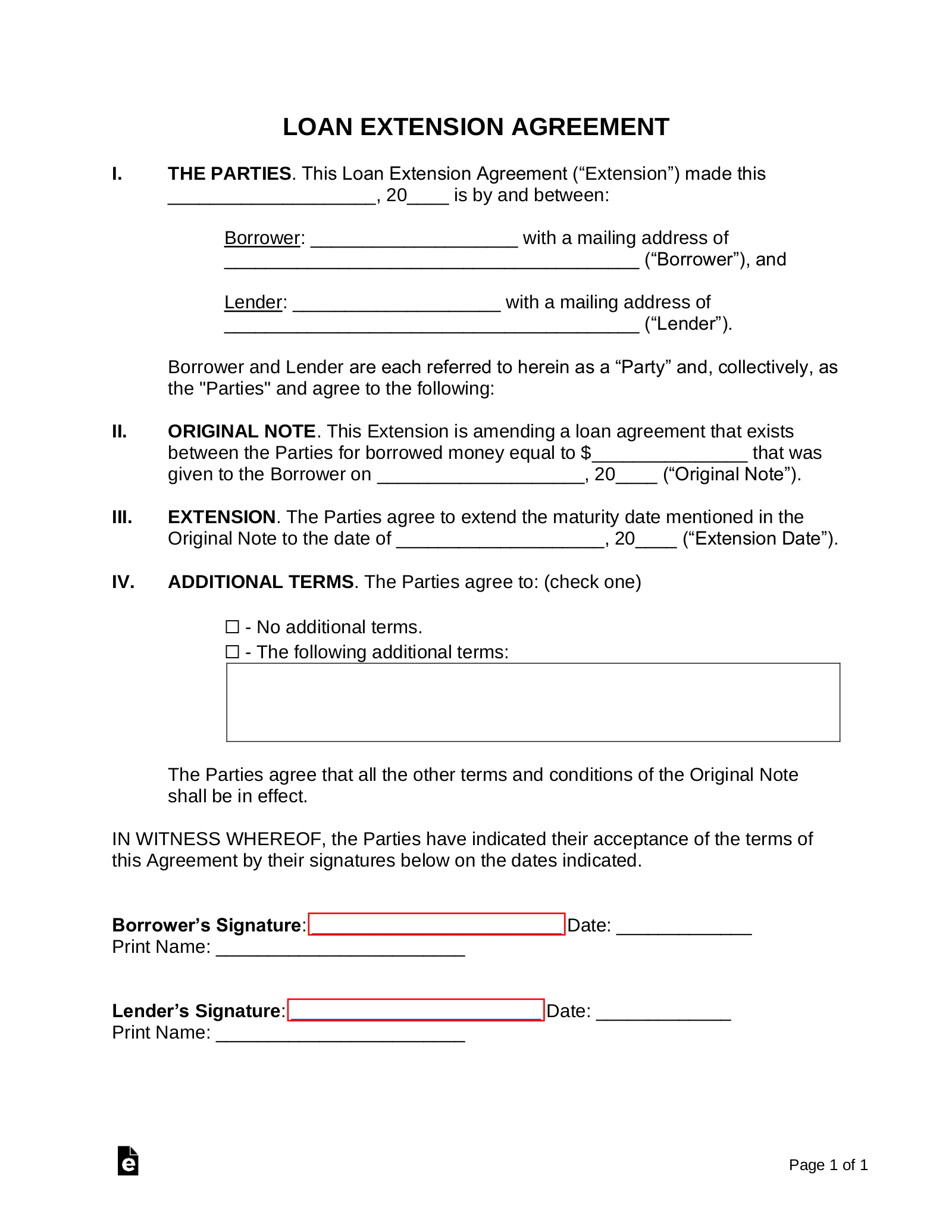

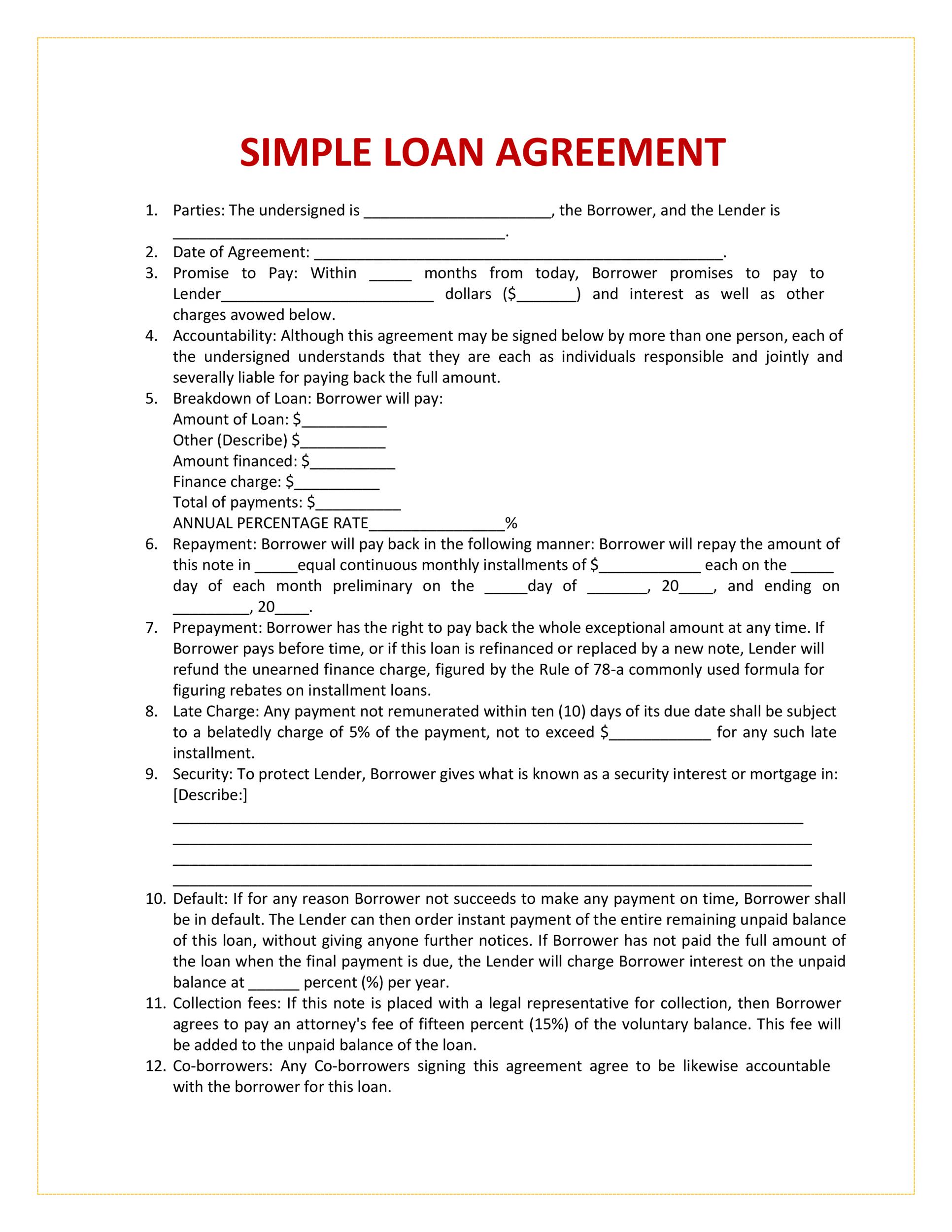

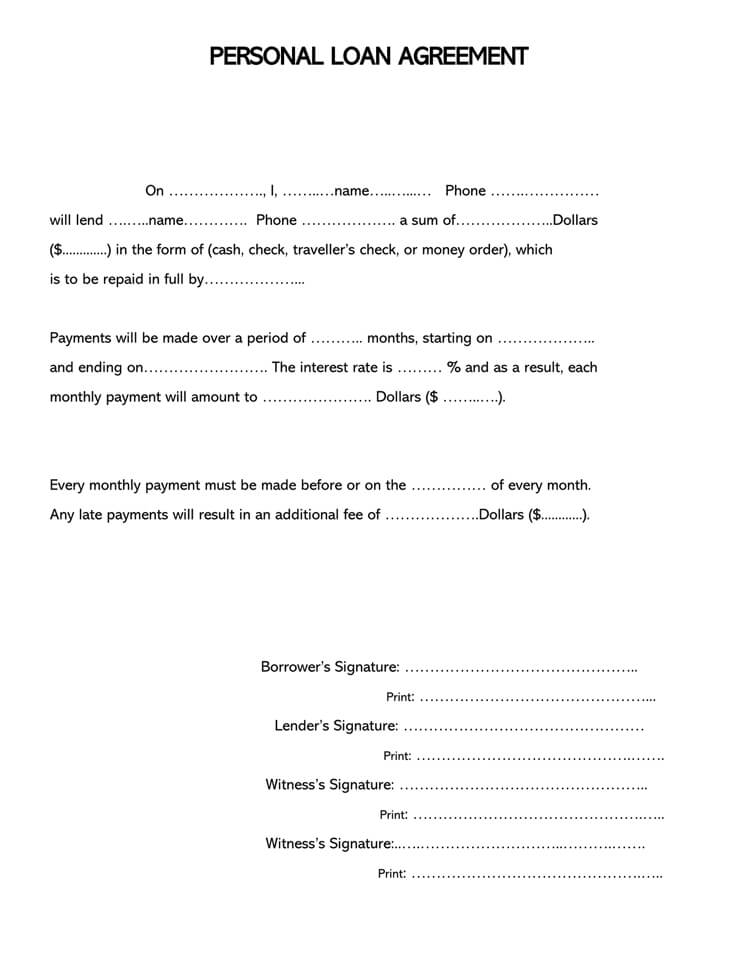

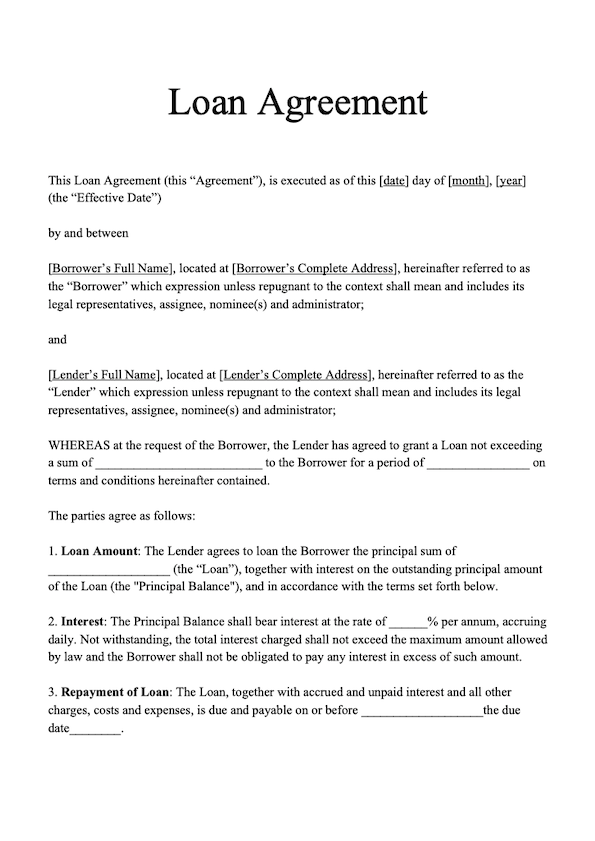

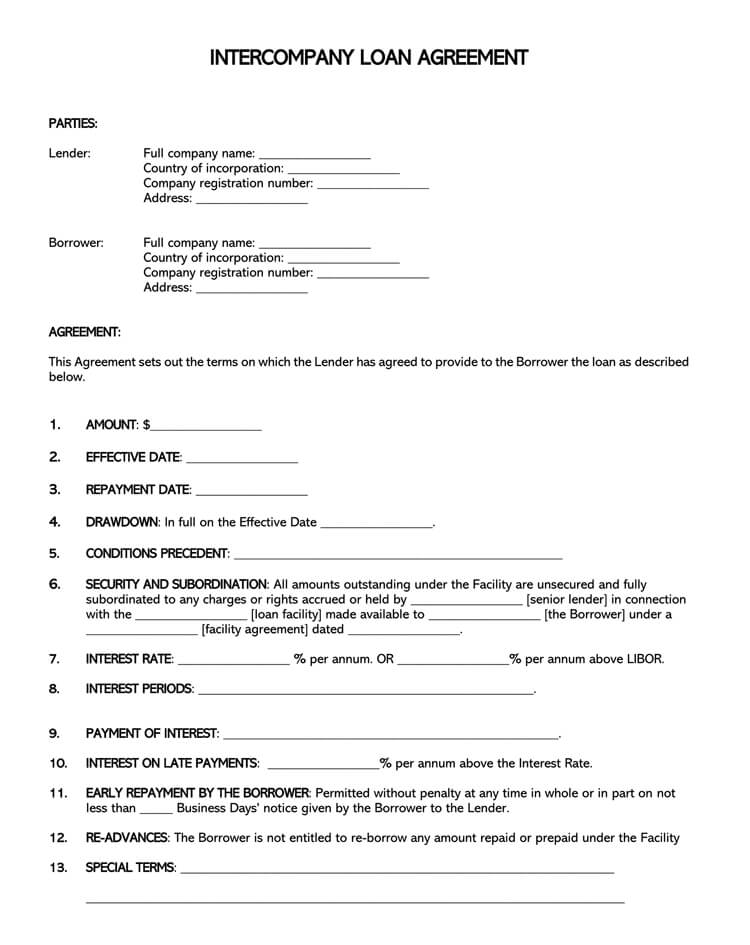

Hard Money Loan Contract Template - Loan agreements are legally binding contracts that. Typically, when the federal government spends money through a grant or a loan program approved by congress, it signs a legally binding agreement, known as an obligation,. Whereas, the borrower desires to borrow a fixed amount of money; Get a detailed copy that will help you simplify the entire process, secure your interests, and,. Whereas, the lender agrees to lend a fixed amount of money; Loans such as these should be avoided as lenders will charge maximum rates, as the apr (annual percentage rate) can easily go over 200%. Up to 40% cash back send hard money loan contract template via email, link, or fax. Since lenders face higher risk. Most online services offering loans usually offer quick cash type loans such as pay day loans, installment loans, line of credit loans and title loans. Here are the key steps to creating an effective loan agreement for hard money lending. Start and finish in minutes. Print and download for free. Obtaining a loan can be a significant financial decision that requires careful consideration and understanding of the loan agreement. Up to 40% cash back send hard money loan contract template via email, link, or fax. You can also download it, export it or print it out. For purposes of this agreement, third party shall be treated as having loaned or contributed an amount which the third party assists in providing by way of third party guarantees. What should i include in a loan agreement? Outline the terms of a loan with your customized loan agreement. Typically, when the federal government spends money through a grant or a loan program approved by congress, it signs a legally binding agreement, known as an obligation,. Learn how to write a loan agreement with clear and legal language. Print and download for free. Up to 40% cash back send hard money loan contract template via email, link, or fax. Here are the key steps to creating an effective loan agreement for hard money lending. Clearly define the parties involved. Most online services offering loans usually offer quick cash type loans such as pay day loans, installment loans, line. Outline the terms of a loan with your customized loan agreement. Most online services offering loans usually offer quick cash type loans such as pay day loans, installment loans, line of credit loans and title loans. Whereas, the lender agrees to lend a fixed amount of money; Since lenders face higher risk. Learn how to write a loan agreement with. Use a loan agreement template to guarantee that your document is enforceable. Most online services offering loans usually offer quick cash type loans such as pay day loans, installment loans, line of credit loans and title loans. For purposes of this agreement, third party shall be treated as having loaned or contributed an amount which the third party assists in. Whereas, the borrower desires to borrow a fixed amount of money; Find over 40 simple loan agreement templates for various purposes and situations. This contract keeps everyone on the same page so they understand loan terms and expectations. Whereas, the lender agrees to lend a fixed amount of money; Use our loan agreement template as a helpful base to follow. Most online services offering loans usually offer quick cash type loans such as pay day loans, installment loans, line of credit loans and title loans. It establishes when (and for how long) the borrower needs to make. Typically, when the federal government spends money through a grant or a loan program approved by congress, it signs a legally binding agreement,. Loans such as these should be avoided as lenders will charge maximum rates, as the apr (annual percentage rate) can easily go over 200%. Get a detailed copy that will help you simplify the entire process, secure your interests, and,. Here are the key steps to creating an effective loan agreement for hard money lending. Print and download for free. Outline the. Get legal documents for leases, contracts, ndas, and more. Find over 40 simple loan agreement templates for various purposes and situations. Outline the terms of a loan with your customized loan agreement. Clearly define the parties involved. Typical loan terms for hard money loans range from 6 months to 2 years, which again is shorter than the terms on most. A loan agreement is a document used to structure the terms and conditions of borrowed money. Most online services offering loans usually offer quick cash type loans such as pay day loans, installment loans, line of credit loans and title loans. In consideration of, the mutual. It establishes when (and for how long) the borrower needs to make. Up to. Get a detailed copy that will help you simplify the entire process, secure your interests, and,. Print and download for free. Find over 40 simple loan agreement templates for various purposes and situations. Begin the agreement by clearly identifying all. Learn how to write a loan agreement with clear and legal language. Most online services offering loans usually offer quick cash type loans such as pay day loans, installment loans, line of credit loans and title loans. What should i include in a loan agreement? Here are the key steps to creating an effective loan agreement for hard money lending. Start and finish in minutes. It establishes when (and for how long). Get legal documents for leases, contracts, ndas, and more. Obtaining a loan can be a significant financial decision that requires careful consideration and understanding of the loan agreement. Use our loan agreement template as a helpful base to follow these steps better and create your document. Whereas, the lender agrees to lend a fixed amount of money; Typically, when the federal government spends money through a grant or a loan program approved by congress, it signs a legally binding agreement, known as an obligation,. Typical loan terms for hard money loans range from 6 months to 2 years, which again is shorter than the terms on most traditional home loans. Use a loan agreement template to guarantee that your document is enforceable. Here are the key steps to creating an effective loan agreement for hard money lending. For purposes of this agreement, third party shall be treated as having loaned or contributed an amount which the third party assists in providing by way of third party guarantees. Whereas, the borrower desires to borrow a fixed amount of money; You can also download it, export it or print it out. Start and finish in minutes. This contract keeps everyone on the same page so they understand loan terms and expectations. Clearly define the parties involved. Most online services offering loans usually offer quick cash type loans such as pay day loans, installment loans, line of credit loans and title loans. Loans such as these should be avoided as lenders will charge maximum rates, as the apr (annual percentage rate) can easily go over 200%.38 Free Loan Agreement Templates & Forms (Word PDF)

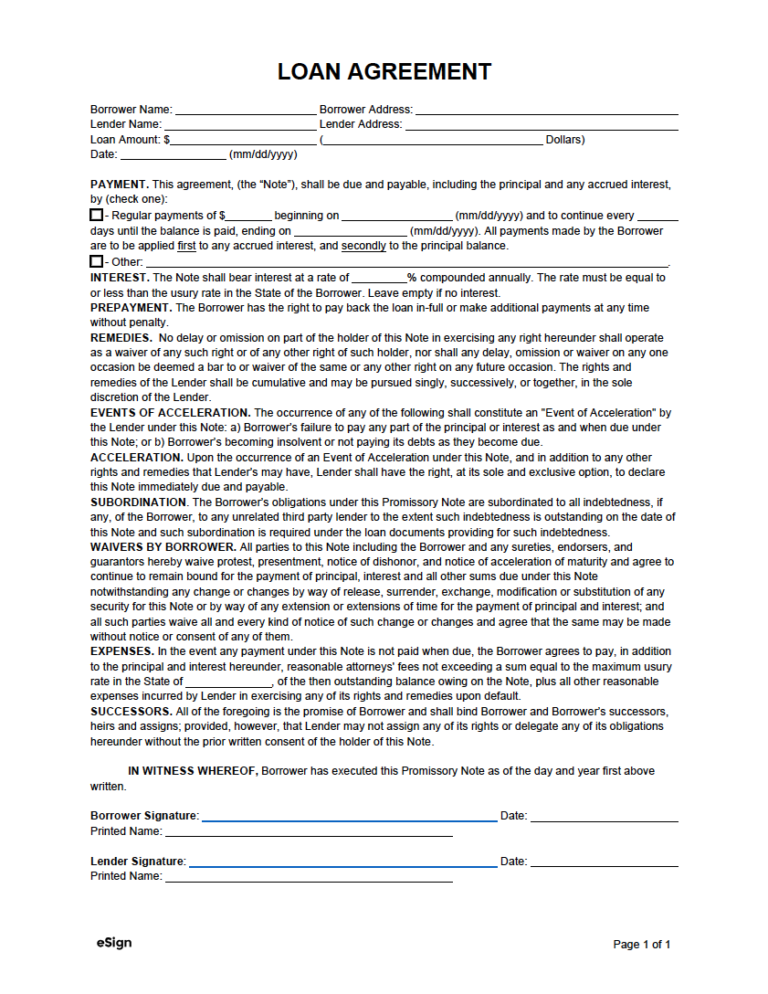

Free Loan Agreement Templates PDF Word eForms

Printable Free Loan Agreement Template Printable Templates

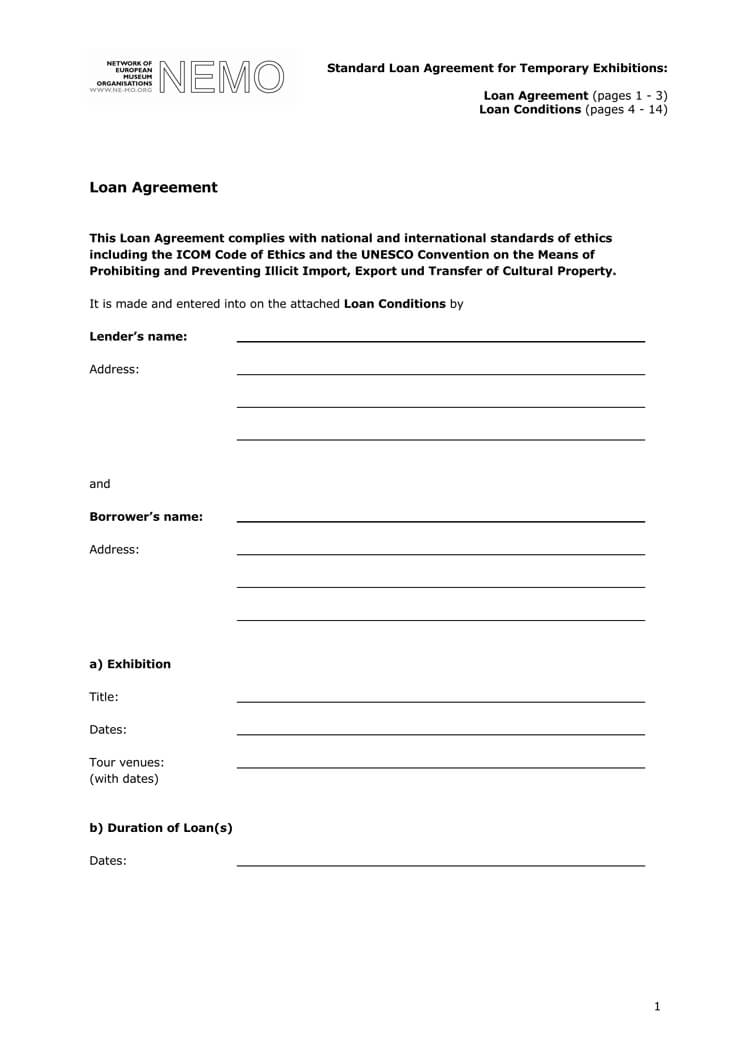

38 Free Loan Agreement Templates & Forms (Word PDF)

Loan Agreement Template Download Loan Agreement Sample

Hard Money Loan Contract Template

38 Free Loan Agreement Templates & Forms (Word PDF)

40+ Free Loan Agreement Templates [Word & PDF] Template Lab

Free Simple (1Page) Loan Agreement Template PDF Word

38 Free Loan Agreement Templates & Forms (Word PDF)

Use A Loan Agreement To Set Clear Terms When Lending Or Borrowing Money.

Outline The Terms Of A Loan With Your Customized Loan Agreement.

Begin The Agreement By Clearly Identifying All.

It Establishes When (And For How Long) The Borrower Needs To Make.

Related Post:

![40+ Free Loan Agreement Templates [Word & PDF] Template Lab](https://templatelab.com/wp-content/uploads/2017/04/loan-agreement-template-06.jpg)