Insurance Recorded Statement Template

Insurance Recorded Statement Template - Often after a property loss, the insurance company may request a recorded statement of a policyholder in the days following the loss. The session is recorded and later transcribed into a. Learn how to give a recorded statement to an insurance company with 7 simple tips from sussman & simcox to avoid costly mistakes and safeguard your claim This guide outlines a structured interview process for documenting a detailed statement from a vehicle accident claimant, with their consent. Here are some costly mistakes to avoid. The goal of an insurance adjuster when creating a recorded statement is to gather as much information as possible about you and what you believe to have occurred so that the. Giving a recorded statement for an insurance claim can be a crucial step in the process. Most insurance companies have a template of questions (recorded statement guide) for taking recorded statements, which is very useful. This section is a guide for obtaining the following statements: What is a recorded statement transcription? Beware of the friendly insurance adjuster who asks for your recorded statement after an accident. Most attorneys advise their clients not to give a recorded statement. Coverage under a property insurance policy is generally subject to a number of policy conditions, giving a statement can be one of those conditions. Insurance companies commonly take a recorded statement to gather information from the victim soon after an accident or issue that has led. The session is recorded and later transcribed into a. However, some policies are silent and don’t. Here are some costly mistakes to avoid. Auto accident, police officer interview, late notice, auto theft, eyewitness interview, uninsured motorist and permissive use. This guide outlines a structured interview process for documenting a detailed statement from a vehicle accident claimant, with their consent. Most insurance companies have a template of questions (recorded statement guide) for taking recorded statements, which is very useful. What is a recorded statement transcription? This guide outlines a structured interview process for documenting a detailed statement from a vehicle accident claimant, with their consent. In this blog post, we'll guide you through creating a customised microsoft word template that’s specifically designed to help optimise your workflow when typing recorded. Here are some things to consider when providing a. Providing a recorded statement to your insurance company is crucial in the claims process. It is an interview that takes place between the claims adjuster and the injured. Most attorneys advise their clients not to give a recorded statement. However, some policies are silent and don’t. Beware of the friendly insurance adjuster who asks for your recorded statement after an. It’s important to approach this task with careful preparation and a clear understanding. Coverage under a property insurance policy is generally subject to a number of policy conditions, giving a statement can be one of those conditions. Insurance companies commonly take a recorded statement to gather information from the victim soon after an accident or issue that has led. Auto. Providing a recorded statement to your insurance company is crucial in the claims process. A recorded statement is a session where the insurance adjuster asks you questions about your car accident and the injuries you suffered. The goal of an insurance adjuster when creating a recorded statement is to gather as much information as possible about you and what you. The goal of an insurance adjuster when creating a recorded statement is to gather as much information as possible about you and what you believe to have occurred so that the. I am representing name of insurance company in regards to a (workers compensation claim, auto accident, slip and fall, etc.), which occurred in name of city. Coverage under a. A recorded statement transcription is an integral part of the claims file. It’s important to approach this task with careful preparation and a clear understanding. This section is a guide for obtaining the following statements: The goal of an insurance adjuster when creating a recorded statement is to gather as much information as possible about you and what you believe. This section is a guide for obtaining the following statements: A recorded statement transcription is an integral part of the claims file. Often after a property loss, the insurance company may request a recorded statement of a policyholder in the days following the loss. The goal of an insurance adjuster when creating a recorded statement is to gather as much. This section is a guide for obtaining the following statements: This guide outlines a structured interview process for documenting a detailed statement from a vehicle accident claimant, with their consent. Often after a property loss, the insurance company may request a recorded statement of a policyholder in the days following the loss. It is an interview that takes place between. Often after a property loss, the insurance company may request a recorded statement of a policyholder in the days following the loss. What is a recorded statement transcription? Here are some things to consider when providing a recorded statement: Most attorneys advise their clients not to give a recorded statement. This section is a guide for obtaining the following statements: This differs from a request for an. The goal of an insurance adjuster when creating a recorded statement is to gather as much information as possible about you and what you believe to have occurred so that the. Giving a recorded statement for an insurance claim can be a crucial step in the process. Insurance companies commonly take a recorded. Most attorneys advise their clients not to give a recorded statement. It is an interview that takes place between the claims adjuster and the injured. Providing a recorded statement to your insurance company is crucial in the claims process. This guide outlines a structured interview process for documenting a detailed statement from a vehicle accident claimant, with their consent. A recorded statement transcription is an integral part of the claims file. The goal of an insurance adjuster when creating a recorded statement is to gather as much information as possible about you and what you believe to have occurred so that the. Beware of the friendly insurance adjuster who asks for your recorded statement after an accident. In this blog post, we'll guide you through creating a customised microsoft word template that’s specifically designed to help optimise your workflow when typing recorded. The session is recorded and later transcribed into a. Coverage under a property insurance policy is generally subject to a number of policy conditions, giving a statement can be one of those conditions. Insurance companies commonly take a recorded statement to gather information from the victim soon after an accident or issue that has led. Here are some costly mistakes to avoid. What is a recorded statement transcription? It covers a broad spectrum of information,. However, some policies are silent and don’t. Here are some things to consider when providing a recorded statement:Insurance Recorded Statement Template

Insurance Claim Template

Insurance Recorded Statement Template

Insurance Recorded Statement Template

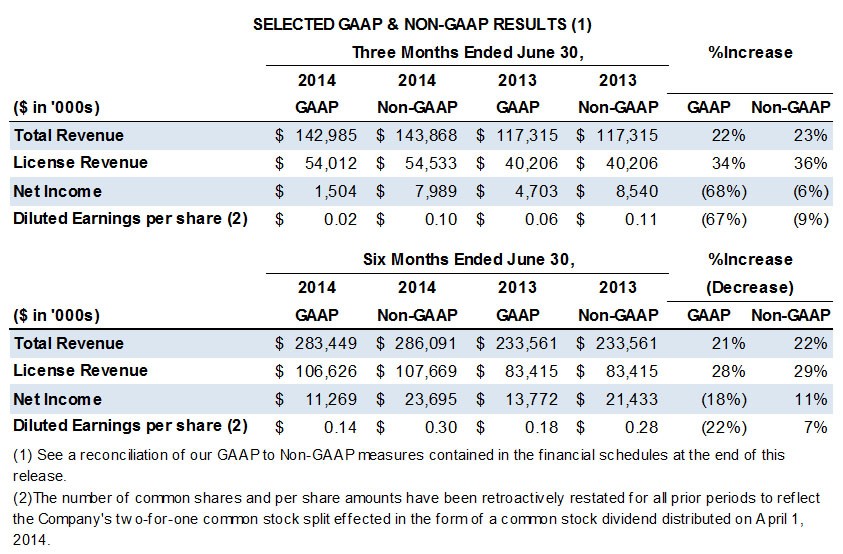

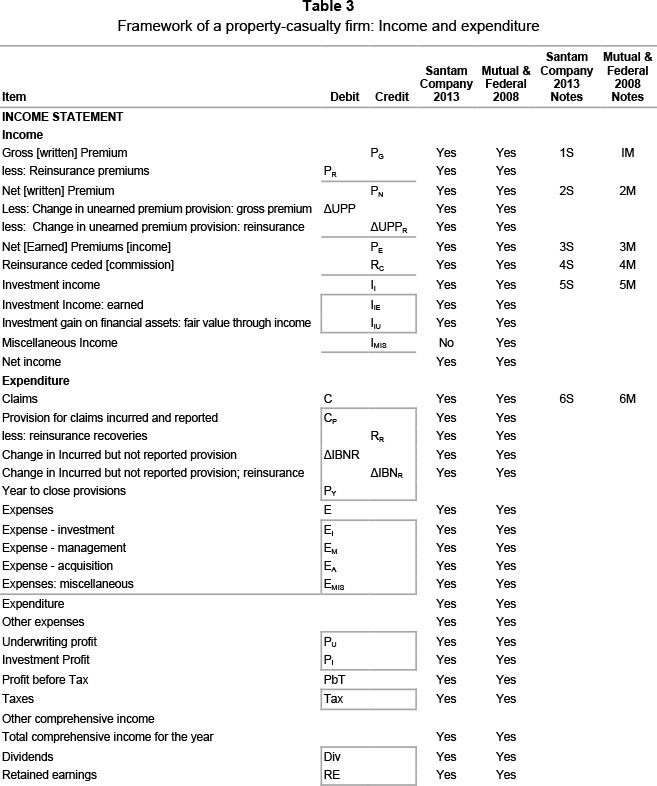

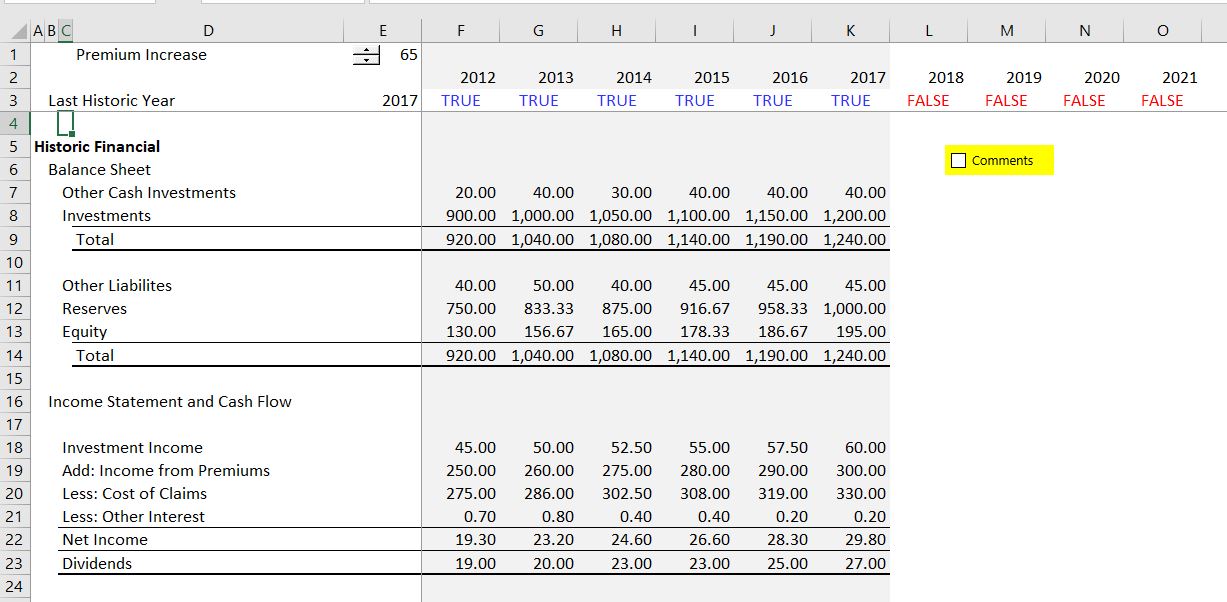

Understanding financial statements of an insurance company Investing Post

Insurance Recorded Statement Template

Insurance Company Insurance Company Financial Statements

Understanding Prepaid Insurance In Statements Cuztomize

Financial Institution Analysis Banks and Insurance Edward Bodmer

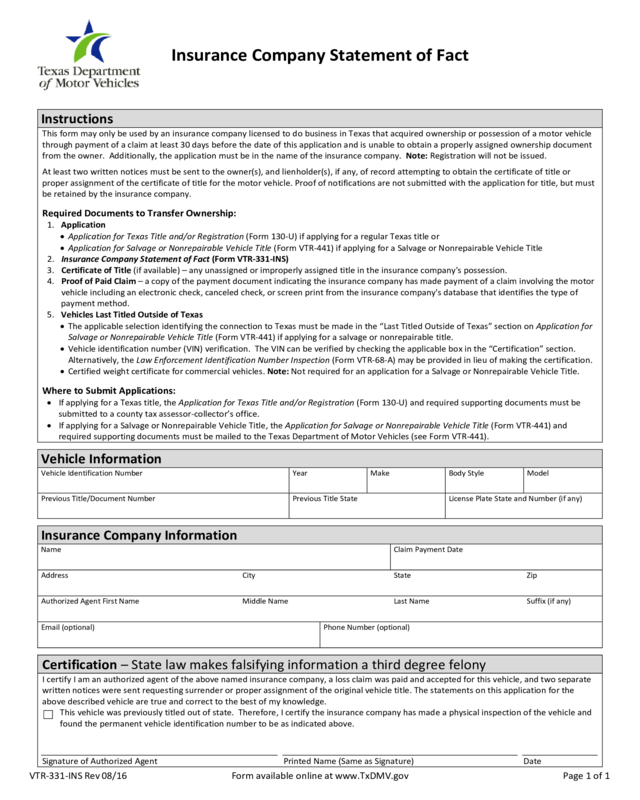

Vtr 331 Ins Insurance Company Statement Of Fact Edit, Fill, Sign

Insurance Adjusters Are Experts At Trying To Get You To Say Things That Will Hurt Your Claim.

A Recorded Statement Is A Session Where The Insurance Adjuster Asks You Questions About Your Car Accident And The Injuries You Suffered.

Auto Accident, Police Officer Interview, Late Notice, Auto Theft, Eyewitness Interview, Uninsured Motorist And Permissive Use.

Often After A Property Loss, The Insurance Company May Request A Recorded Statement Of A Policyholder In The Days Following The Loss.

Related Post: