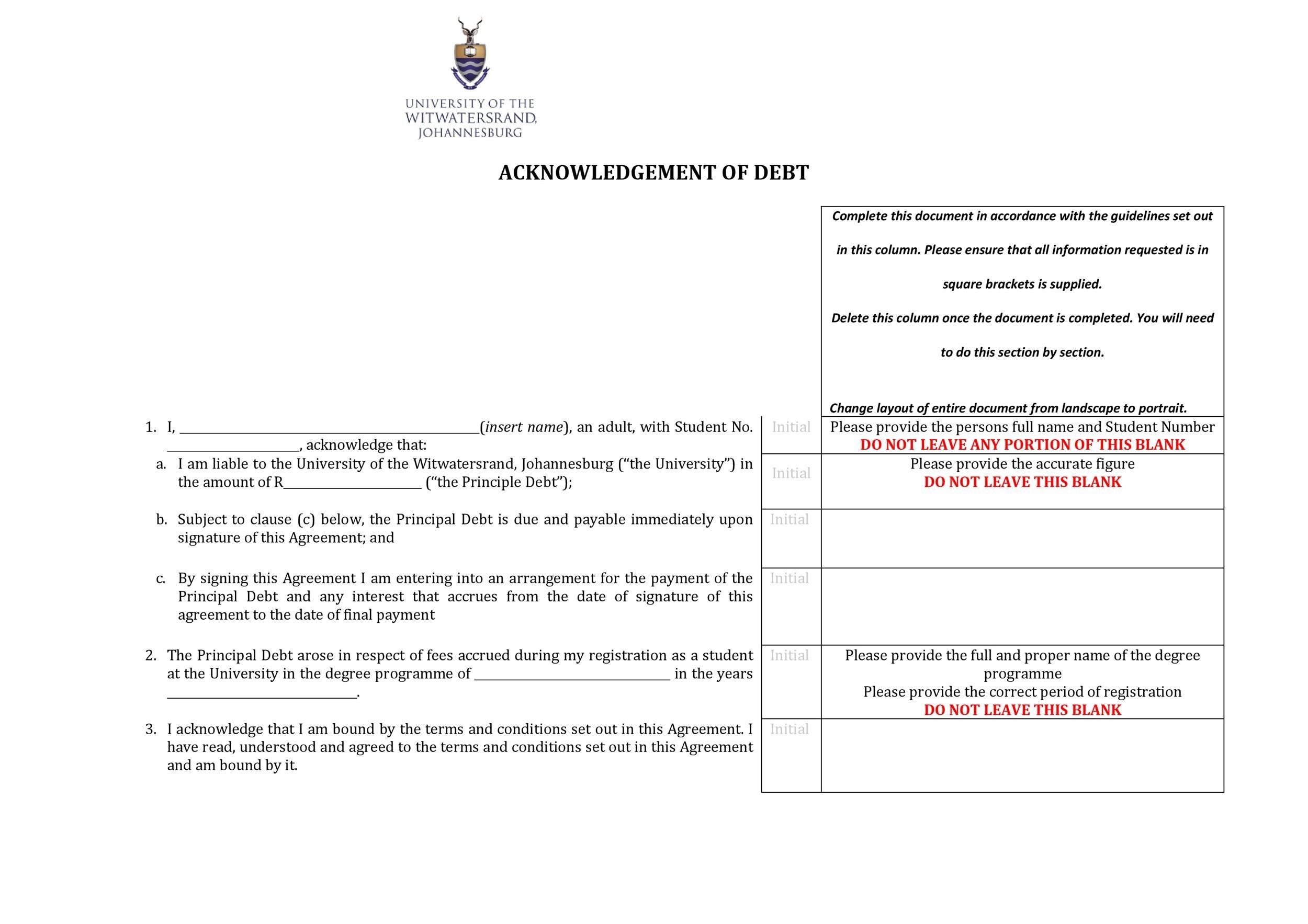

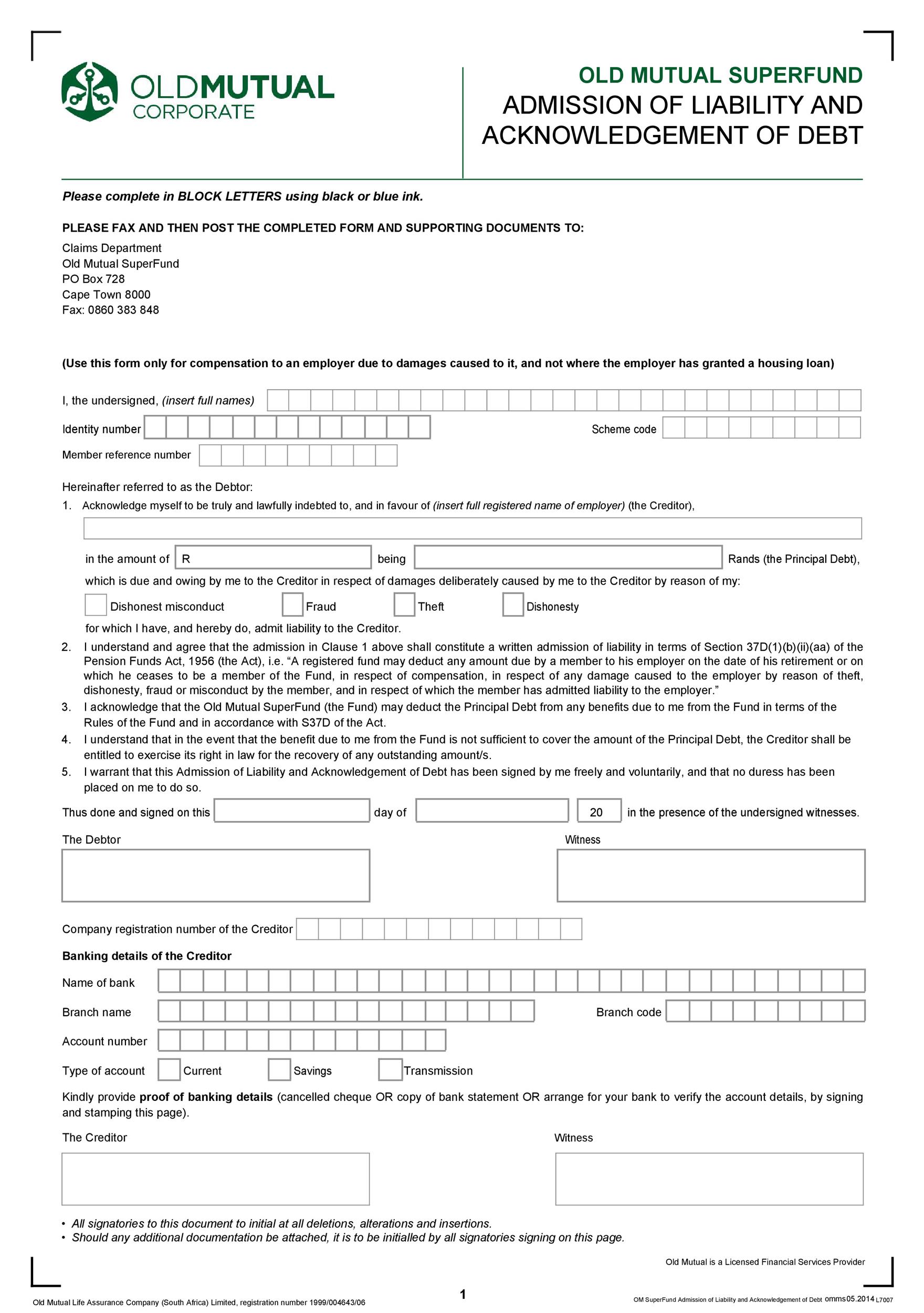

Ioi Template

Ioi Template - Does anyone have a template for ioi (indication of interest)? The ioi is the first. In this post, i’ll provide you with a comprehensive breakdown of the. An indication of interest is usually structured as a. This document provided by the buyer suggests a valuation range that he is willing to pay for a. The indication of interest (also known as the indication or ioi) is a key landmark in any m&a deal. An ioi initiates the negotiation process,. If the vendor is amenable to the general. Is it drastically different from an loi? When it comes to mergers and acquisitions, an indication of interest (ioi) is a critical first step for both buyers and sellers. First, the prospective buyer produces an indication of interest (ioi) which outlines the general terms and conditions for the intended transaction. This document provided by the buyer suggests a valuation range that he is willing to pay for a. Does anyone have a template for ioi (indication of interest)? An ioi is an informal notice expressing interest, whereas an loi is a more formal document outlining specific details of a transaction. Check out our free iou template to get started. Free small business loan agreement. An indication of interest is usually structured as a. In this post, i’ll provide you with a comprehensive breakdown of the. The indication of interest (ioi) is the document given to a seller by the interested buyer to indicate his or her genuine interest in purchasing the business. When it comes to mergers and acquisitions, an indication of interest (ioi) is a critical first step for both buyers and sellers. Get your transaction and financing templates and make your transaction communication professional. If the vendor is amenable to the general. In this post, i’ll provide you with a comprehensive breakdown of the. An ioi is an informal notice expressing interest, whereas an loi is a more formal document outlining specific details of a transaction. The indication of interest (also known. In this post, i’ll provide you with a comprehensive breakdown of the. An ioi is an informal notice expressing interest, whereas an loi is a more formal document outlining specific details of a transaction. The indication of interest (ioi) is the document given to a seller by the interested buyer to indicate his or her genuine interest in purchasing the. This document provided by the buyer suggests a valuation range that he is willing to pay for a. Purchase price and form of. Pursuant to our discussions, we submit this indication of interest (“ioi”) which outlines our intentions with respect to the contemplated transaction. Is it drastically different from an loi? An ioi initiates the negotiation process,. An ioi initiates the negotiation process,. Get your transaction and financing templates and make your transaction communication professional. The indication of interest (ioi) is the document given to a seller by the interested buyer to indicate his or her genuine interest in purchasing the business. Is it drastically different from an loi? The ioi is the first. The ioi is the first. Does anyone have a template for ioi (indication of interest)? Pursuant to our discussions, we submit this indication of interest (“ioi”) which outlines our intentions with respect to the contemplated transaction. Free small business loan agreement. When it comes to mergers and acquisitions, an indication of interest (ioi) is a critical first step for both. Is it drastically different from an loi? When it comes to mergers and acquisitions, an indication of interest (ioi) is a critical first step for both buyers and sellers. An indication of interest (ioi) is a key tool in finance that lets parties express preliminary interest in a transaction without binding obligations. The stanford exhibits includes templates for an loi,. The indication of interest (ioi) is the document given to a seller by the interested buyer to indicate his or her genuine interest in purchasing the business. An indication of interest (ioi) is a key tool in finance that lets parties express preliminary interest in a transaction without binding obligations. Iois help businesses assess compatibility,. The indication of interest (also. Purchase price and form of. An indication of interest is usually structured as a. In this post, i’ll provide you with a comprehensive breakdown of the. The indication of interest (also known as the indication or ioi) is a key landmark in any m&a deal. An ioi is an informal notice expressing interest, whereas an loi is a more formal. Get your transaction and financing templates and make your transaction communication professional. Free small business loan agreement. Check out our free iou template to get started. An ioi initiates the negotiation process,. Iois help businesses assess compatibility,. If the vendor is amenable to the general. This document provided by the buyer suggests a valuation range that he is willing to pay for a. The ioi is the first. An indication of interest is usually structured as a. Pursuant to our discussions, we submit this indication of interest (“ioi”) which outlines our intentions with respect to the contemplated. Iois help businesses assess compatibility,. An indication of interest is usually structured as a. Purchase price and form of. This document provided by the buyer suggests a valuation range that he is willing to pay for a. The stanford exhibits includes templates for an loi, but i didn't see any ioi template. Get your transaction and financing templates and make your transaction communication professional. When it comes to mergers and acquisitions, an indication of interest (ioi) is a critical first step for both buyers and sellers. Pursuant to our discussions, we submit this indication of interest (“ioi”) which outlines our intentions with respect to the contemplated transaction. Free small business loan agreement. Check out our free iou template to get started. In this post, i’ll provide you with a comprehensive breakdown of the. An ioi is an informal notice expressing interest, whereas an loi is a more formal document outlining specific details of a transaction. First, the prospective buyer produces an indication of interest (ioi) which outlines the general terms and conditions for the intended transaction. An indication of interest (ioi) is a key tool in finance that lets parties express preliminary interest in a transaction without binding obligations. The ioi is the first. An ioi initiates the negotiation process,.ioi chrysalis ot11 photocard template Photocard, Ioi, Doyeon

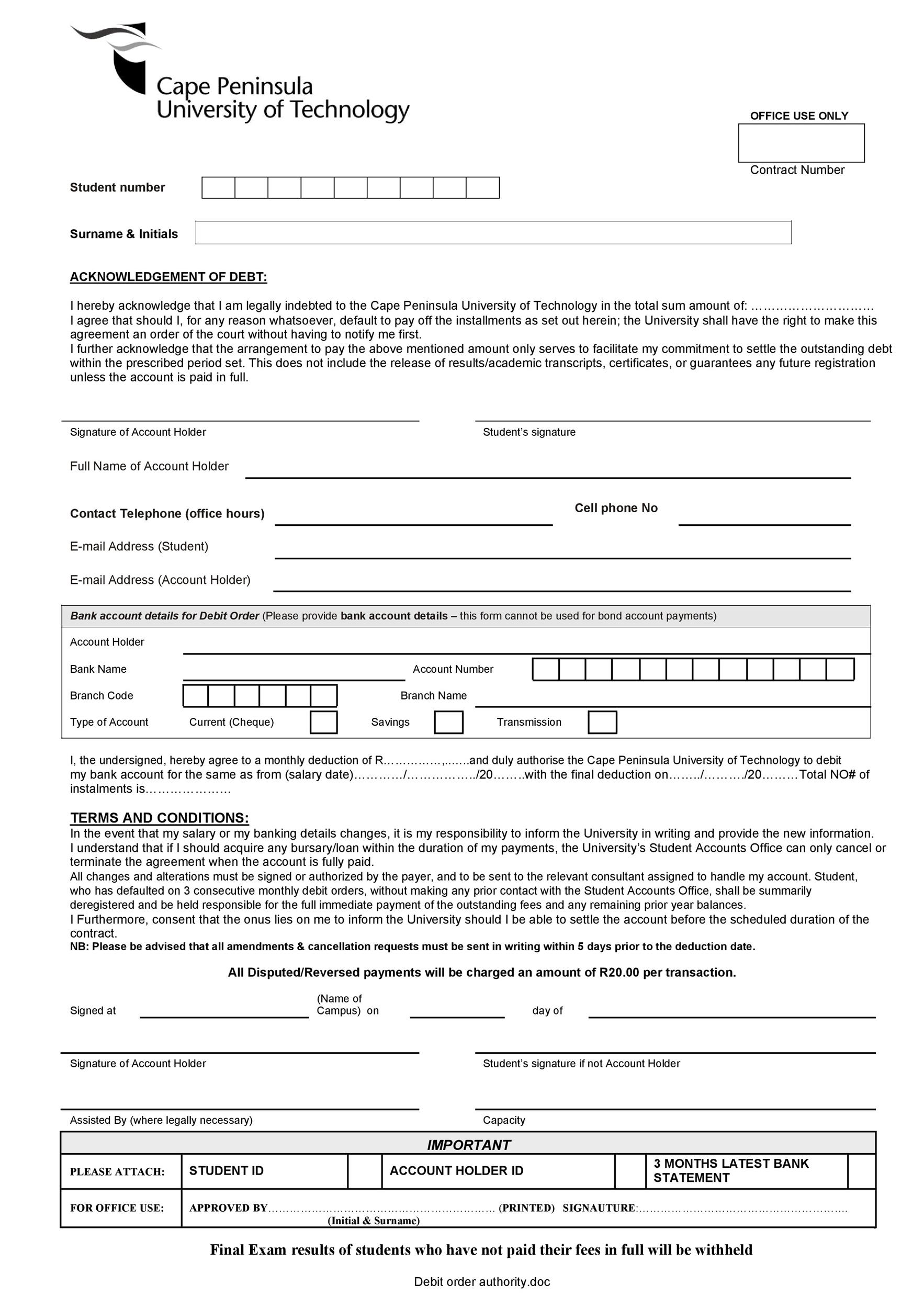

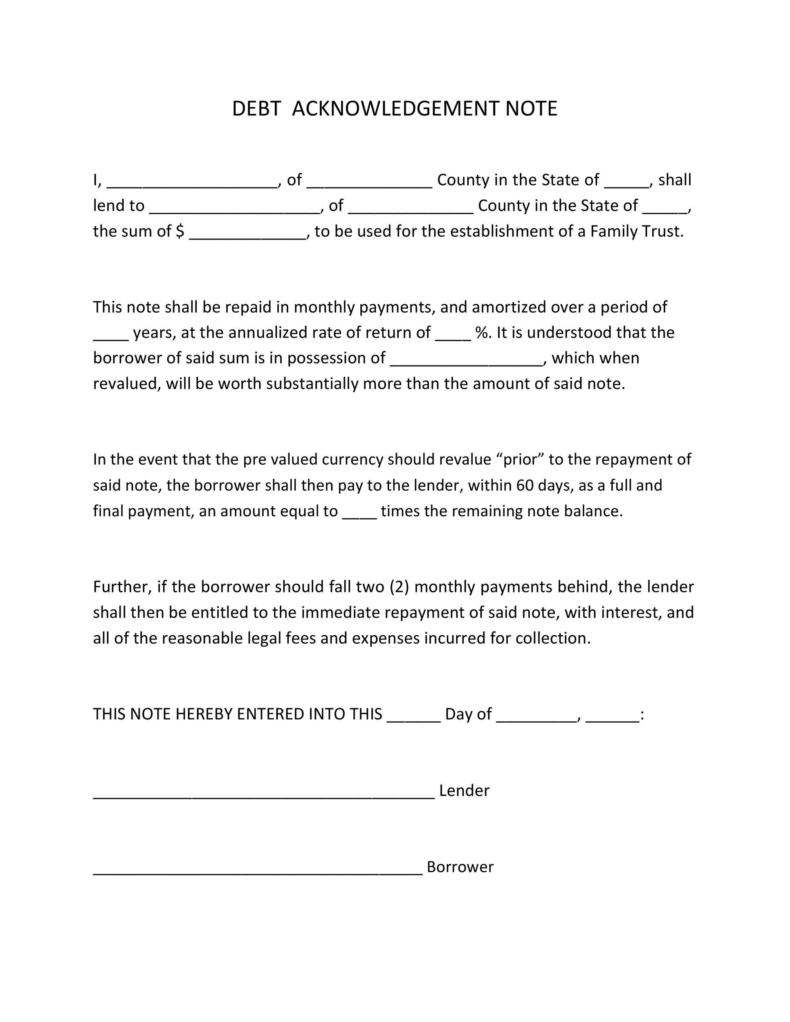

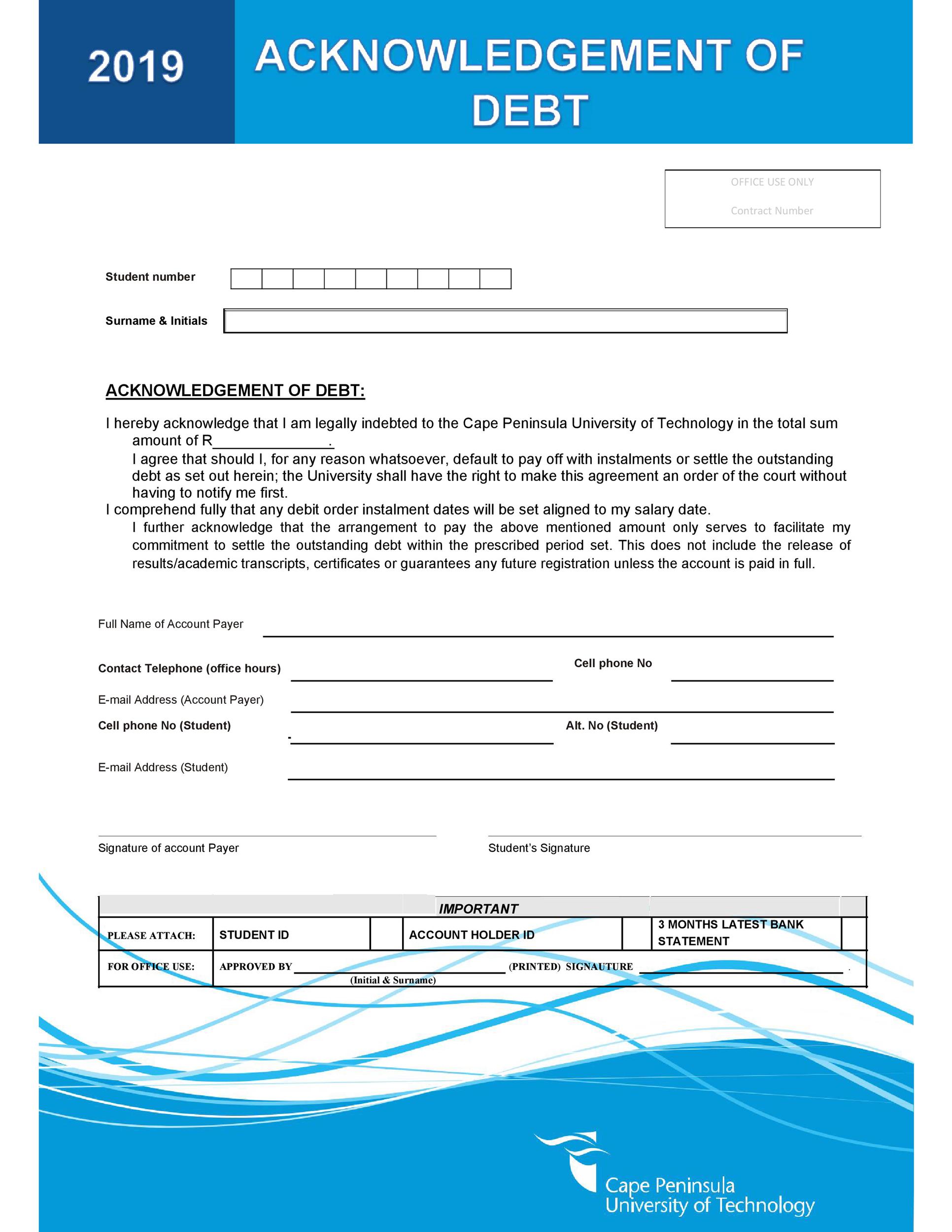

Printable IOU Template

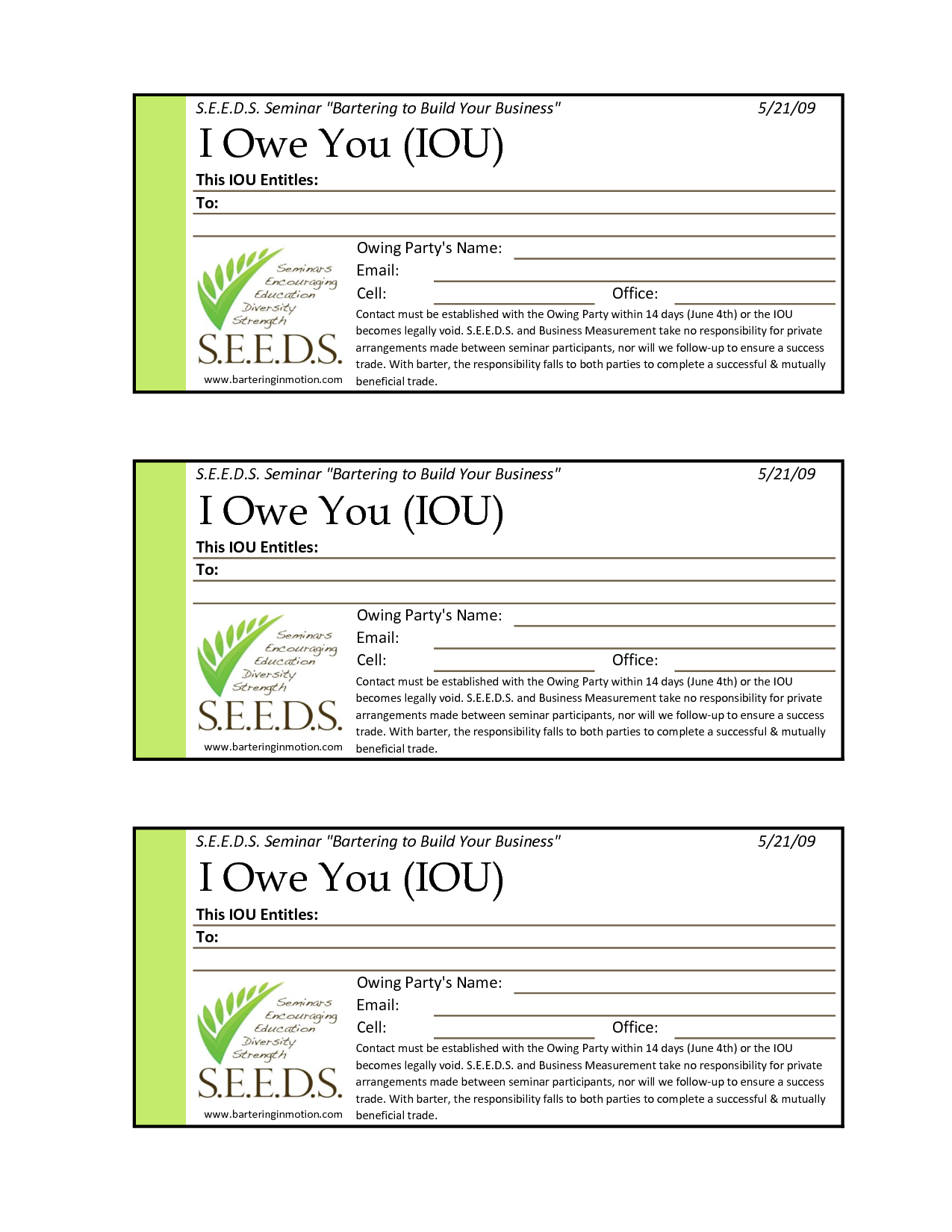

41 Free IOU Templates (I Owe You) ᐅ TemplateLab

41 Free IOU Templates (I Owe You) ᐅ TemplateLab

Ioi template Fill out & sign online DocHub

28 Free IOU Templates & Forms [I Owe You] TemplateArchive

41 Free IOU Templates (I Owe You) ᐅ TemplateLab

41 Free IOU Templates (I Owe You) ᐅ TemplateLab

Iou Template Free Printable Documents

LIHTC IDENTITY OF INTEREST (IOI) STATEMENT Doc Template pdfFiller

Is It Drastically Different From An Loi?

The Indication Of Interest (Also Known As The Indication Or Ioi) Is A Key Landmark In Any M&A Deal.

If The Vendor Is Amenable To The General.

The Indication Of Interest (Ioi) Is The Document Given To A Seller By The Interested Buyer To Indicate His Or Her Genuine Interest In Purchasing The Business.

Related Post:

![28 Free IOU Templates & Forms [I Owe You] TemplateArchive](https://templatearchive.com/wp-content/uploads/2020/08/iou-template-12.jpg)