Living Trust Templates

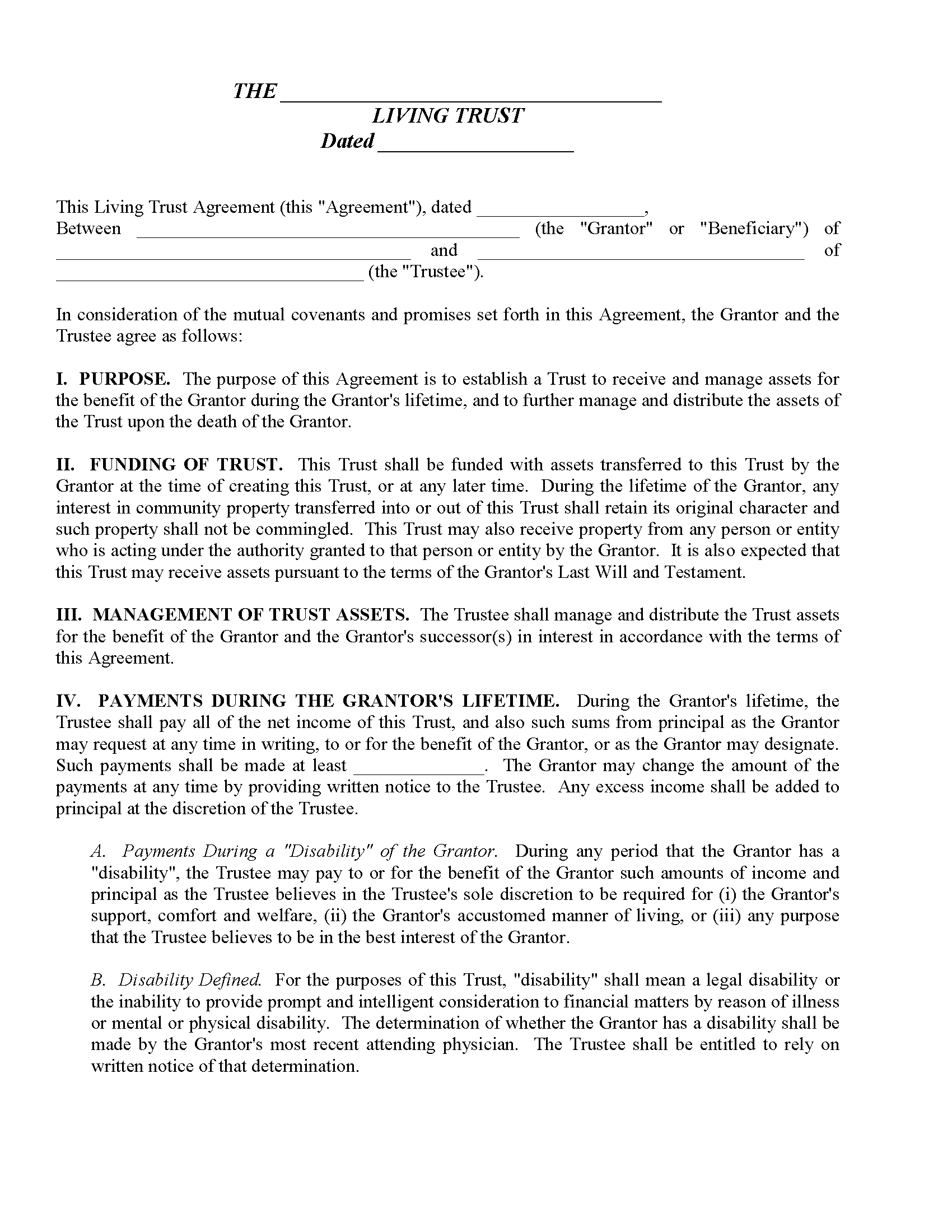

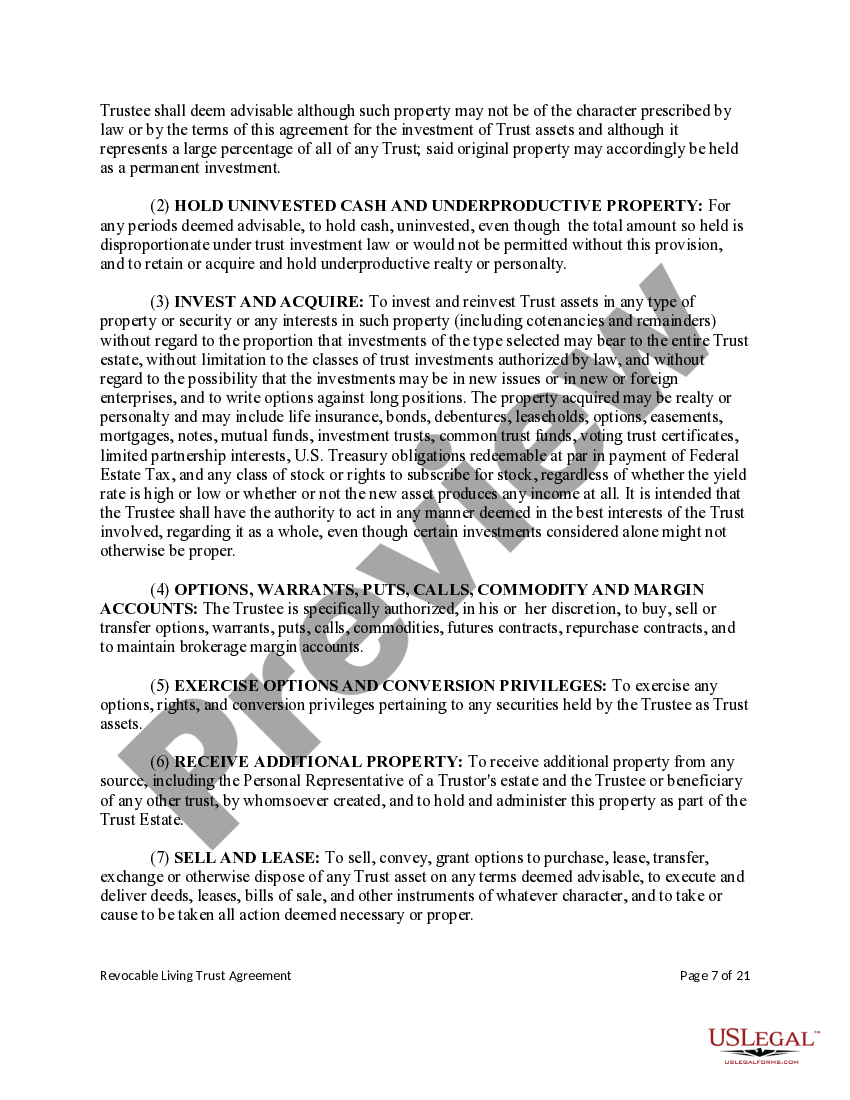

Living Trust Templates - The agreement should state that the grantor is making a trust for the sake of the beneficiaries. Protect assets, expedite distribution to beneficiaries, and safeguard your interests. What is a living trust? Up to 25% cash back below is an introduction to what a living trust does and a discussion of whether it makes sense for your situation. A revocable living trust is a legal document that allows you to control how your assets will be managed and distributed in the event that you become. A living trust can be a great way for you to make sure your wishes are followed after. What is a revocable living trust? During the life of the settlor, the trustee shall hold, manage, sell, exchange, invest, and reinvest the trust property, collect all income, and, after deducting such expenses as are properly. The trust hereby shall be known as the. A living trust and a will both distribute assets, but they cover different aspects of your estate. What is a revocable living trust? The trust hereby shall be known as the. A living trust and a will both distribute assets, but they cover different aspects of your estate. Establish your revocable living trust seamlessly. A living trust can be a great way for you to make sure your wishes are followed after. Not only do these documents allow you to dictate who will receive your estate at your death, but it gives your. Living trusts are one of most commonly used estate planning tools today with good reason. Manages only the assets placed in the trust, such as property, bank. Living trust forms can help you execute a will or revocable living trust. The agreement should state that the grantor is making a trust for the sake of the beneficiaries. A revocable living trust is a legal document that allows you to control how your assets will be managed and distributed in the event that you become. What is a revocable living trust? Given below are the steps to set up a revocable living trust: What is a living trust? A revocable living trust form is a legal document used. Establish your revocable living trust seamlessly. A living trust and a will both distribute assets, but they cover different aspects of your estate. Not only do these documents allow you to dictate who will receive your estate at your death, but it gives your. The trust hereby shall be known as the. A revocable living trust is a legal document. Not only do these documents allow you to dictate who will receive your estate at your death, but it gives your. The agreement should state that the grantor is making a trust for the sake of the beneficiaries. A living trust (or inter vivos trust) is a legal document allowing an individual (grantor) to place assets under the management of. In consideration of the mutual covenants and promises set forth in this agreement, the grantor and the trustee agree to the following: What is a revocable living trust? Establish your revocable living trust seamlessly. A living trust (or inter vivos trust) is a legal document allowing an individual (grantor) to place assets under the management of a trustee, who can. Protect assets, expedite distribution to beneficiaries, and safeguard your interests. A revocable living trust is a legal document that allows you to control how your assets will be managed and distributed in the event that you become. In consideration of the mutual covenants and promises set forth in this agreement, the grantor and the trustee agree to the following: It. A living trust can be a great way for you to make sure your wishes are followed after. In consideration of the mutual covenants and promises set forth in this agreement, the grantor and the trustee agree to the following: The agreement should state that the grantor is making a trust for the sake of the beneficiaries. Protect assets, expedite. A living trust can be a great way for you to make sure your wishes are followed after. During the life of the settlor, the trustee shall hold, manage, sell, exchange, invest, and reinvest the trust property, collect all income, and, after deducting such expenses as are properly. Download our living trust form free template to create your legal document.. Establish your revocable living trust seamlessly. Download our living trust form free template to create your legal document. During the life of the settlor, the trustee shall hold, manage, sell, exchange, invest, and reinvest the trust property, collect all income, and, after deducting such expenses as are properly. A revocable living trust form is a legal document used in estate. Manages only the assets placed in the trust, such as property, bank. The trust hereby shall be known as the. A revocable living trust is a legal document that allows you to control how your assets will be managed and distributed in the event that you become. What is a revocable living trust? A living trust can be a great. A living trust can be a great way for you to make sure your wishes are followed after. A revocable living trust is a legal document that allows you to control how your assets will be managed and distributed in the event that you become. In consideration of the mutual covenants and promises set forth in this agreement, the grantor. It should include all the assets and. During the life of the settlor, the trustee shall hold, manage, sell, exchange, invest, and reinvest the trust property, collect all income, and, after deducting such expenses as are properly. What is a revocable living trust? A living trust and a will both distribute assets, but they cover different aspects of your estate. In consideration of the mutual covenants and promises set forth in this agreement, the grantor and the trustee agree to the following: Living trust forms can help you execute a will or revocable living trust. Ensure you know exactly who will receive your assets after you pass away and who will be in. A revocable living trust is a legal document that allows you to control how your assets will be managed and distributed in the event that you become. A revocable living trust form is a legal document used in estate planning that enables you to retain control over your assets during your lifetime and determine how they'll. Living trusts are one of most commonly used estate planning tools today with good reason. Manages only the assets placed in the trust, such as property, bank. A living trust can be a great way for you to make sure your wishes are followed after. Protect assets, expedite distribution to beneficiaries, and safeguard your interests. The trust hereby shall be known as the. Given below are the steps to set up a revocable living trust: The agreement should state that the grantor is making a trust for the sake of the beneficiaries.Revocable Living Trust Template Classles Democracy

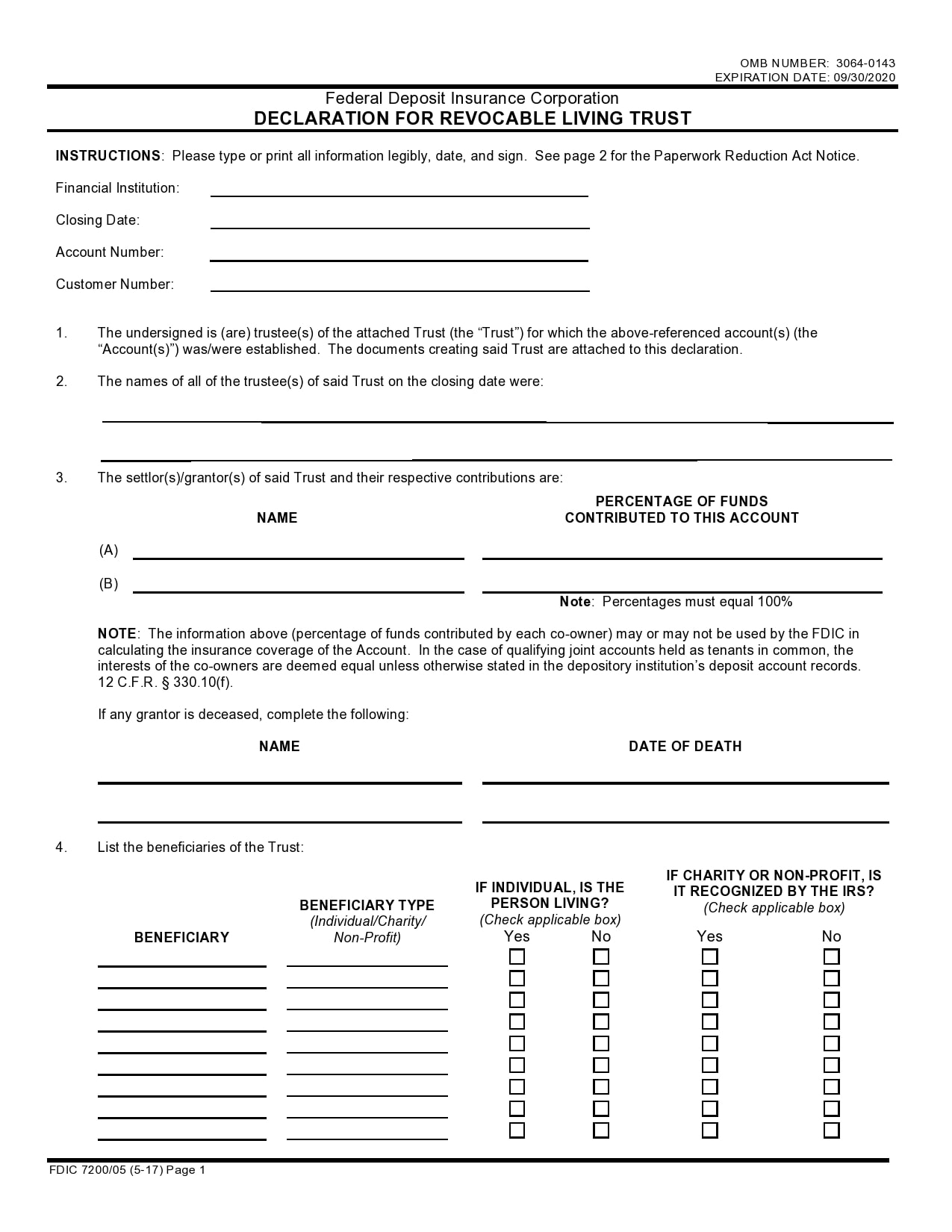

Free Printable Living Trust Templates [PDF] Irrevocable

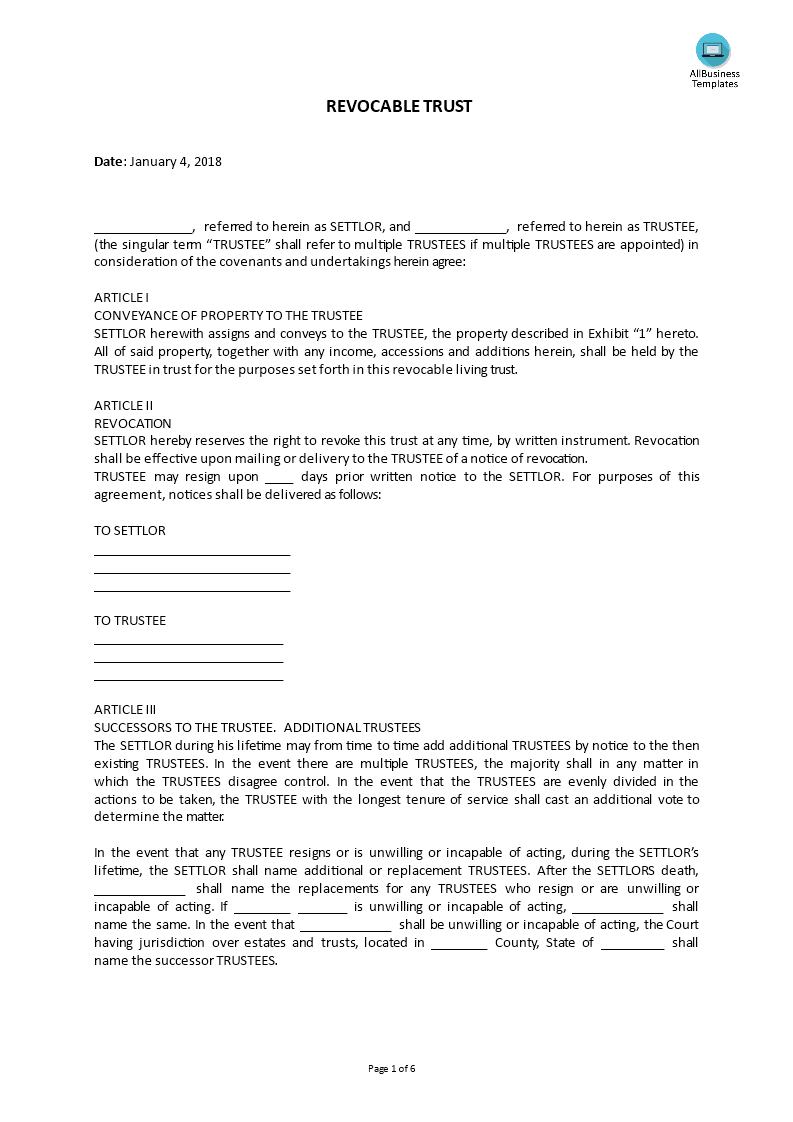

Revocable Trust Templates at

Printable Living Trust Forms

Free Printable Living Trust Templates [PDF] Irrevocable

Revocable Living Trust for Married Couple US Legal Forms

Free Revocable Living Trust Form PDF & Word

Free Printable Living Trust Templates [PDF] Irrevocable

Printable Revocable Living Trust Form Printable Forms Free Online

FREE 10+ Sample Living Trust Form Templates in PDF Word

Not Only Do These Documents Allow You To Dictate Who Will Receive Your Estate At Your Death, But It Gives Your.

What Is A Living Trust?

A Living Trust (Or Inter Vivos Trust) Is A Legal Document Allowing An Individual (Grantor) To Place Assets Under The Management Of A Trustee, Who Can Be The Grantor Or.

Establish Your Revocable Living Trust Seamlessly.

Related Post:

![Free Printable Living Trust Templates [PDF] Irrevocable](https://www.typecalendar.com/wp-content/uploads/2023/06/PDF-Living-Trust-Template.jpg)

![Free Printable Living Trust Templates [PDF] Irrevocable](https://www.typecalendar.com/wp-content/uploads/2023/06/Free-Living-Trust-Form-Fillable.jpg)

![Free Printable Living Trust Templates [PDF] Irrevocable](https://www.typecalendar.com/wp-content/uploads/2023/06/Download-Free-Living-Trust-Word-Document.jpg)