Merger Model Template

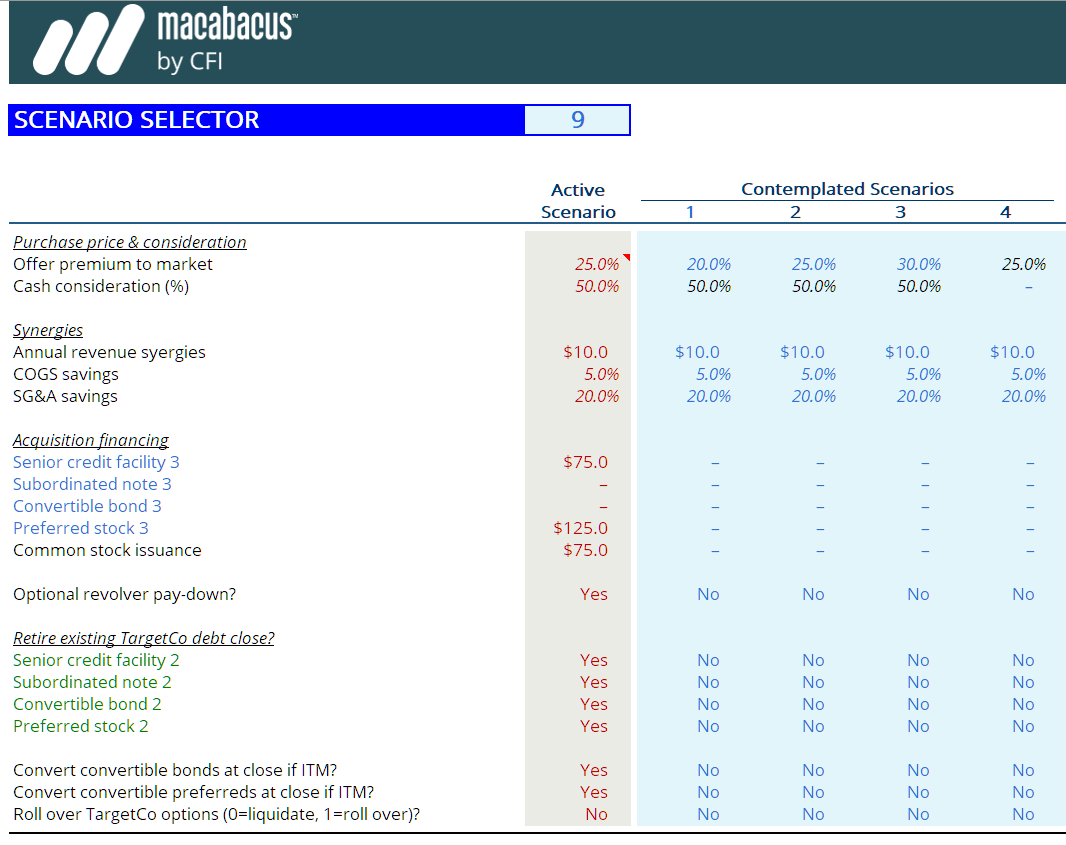

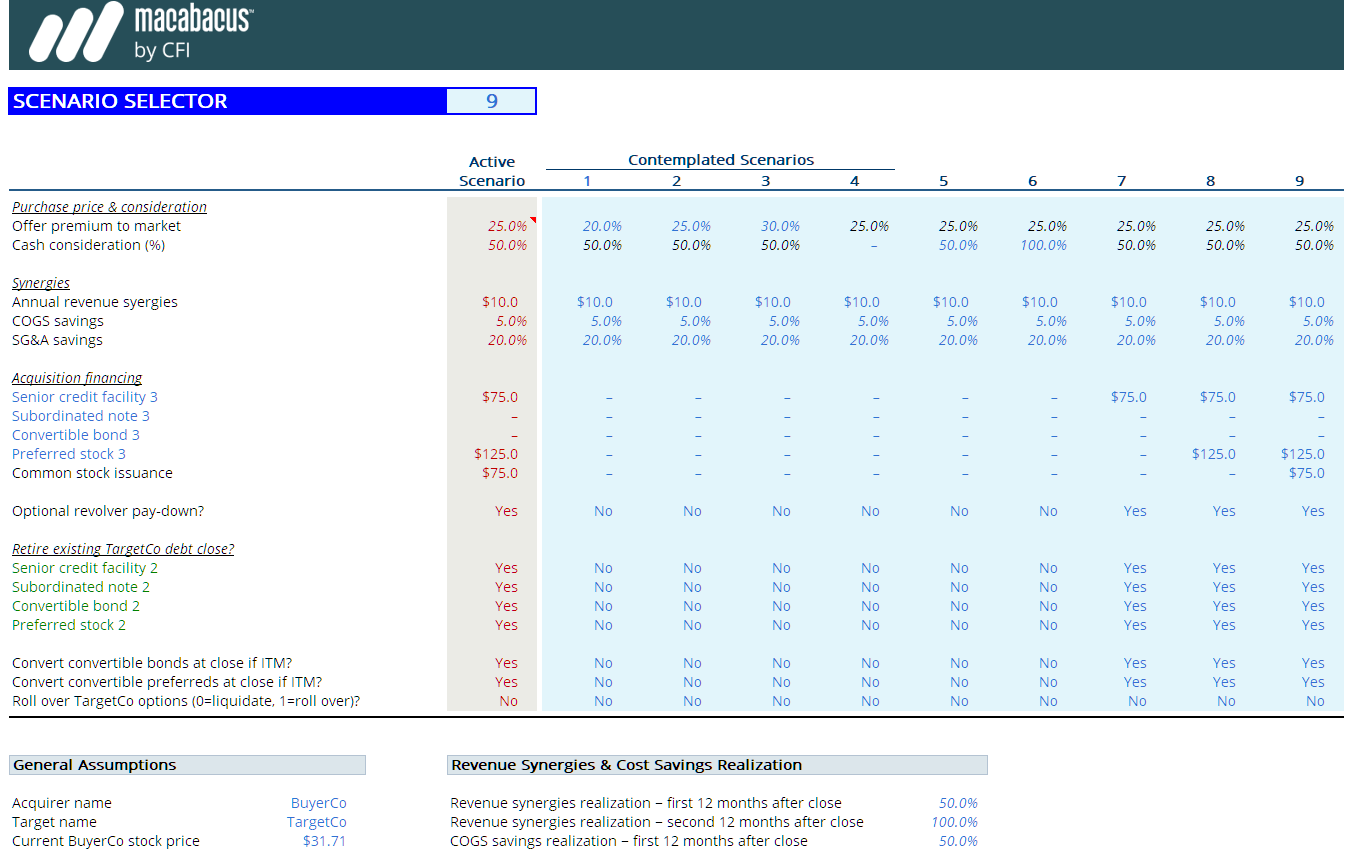

Merger Model Template - What is a merger model? Improve your m&a analysis download the template the macabacus merger model implements advanced m&a, accounting, and tax concepts, and is. The mergers & acquisition (m&a) model provides a projection for a company looking to potentially merge or acquire another company. Merger and acquisition model template assists the user to assess the financial viability of the resulting proforma merger of 2 companies and their synergies. An excel template with a merger and acquisition model and calculations of synergies, levered and unlevered cash flows, headcount projections, balance sheet, return on investment and. This sophisticated merger financial model template is a versatile and powerful solution tailored for intricate merger and acquisition (m&a) related scenarios. Improve your m&a analysis download the template the macabacus merger model implements advanced m&a, accounting, and tax concepts, and is. In this article, you’ll find 20 of the most useful merger and acquisition (m&a) templates for business (not legal) use, from planning to valuation to integration. How to interpret accretion / (dilution) analysis? Assess merger viability with proforma statements, accretion/dilution analysis, and detailed metrics. Assess merger viability with proforma statements, accretion/dilution analysis, and detailed metrics. Improve your m&a analysis download the template the macabacus merger model implements advanced m&a, accounting, and tax concepts, and is. The mergers & acquisition (m&a) model provides a projection for a company looking to potentially merge or acquire another company. Mergers and acquisitions (m&a) are among the most strategic ways for companies to accelerate growth, increase market share, or diversify their operations. Merger and acquisition model template assists the user to assess the financial viability of the resulting proforma merger of 2 companies and their synergies. This sophisticated merger financial model template is a versatile and powerful solution tailored for intricate merger and acquisition (m&a) related scenarios. Improve your m&a analysis download the template the macabacus merger model implements advanced m&a, accounting, and tax concepts, and is. What is a merger model? An excel template with a merger and acquisition model and calculations of synergies, levered and unlevered cash flows, headcount projections, balance sheet, return on investment and. This model runs through different scenarios and synergies. Merger and acquisition model template assists the user to assess the financial viability of the resulting proforma merger of 2 companies and their synergies. In this article, you’ll find 20 of the most useful merger and acquisition (m&a) templates for business (not legal) use, from planning to valuation to integration. Improve your m&a analysis download the template the macabacus merger. How to interpret accretion / (dilution) analysis? This model runs through different scenarios and synergies. Improve your m&a analysis download the template the macabacus merger model implements advanced m&a, accounting, and tax concepts, and is. The mergers & acquisition (m&a) model provides a projection for a company looking to potentially merge or acquire another company. An excel template with a. In this merger model lesson, you’ll learn how a company might decide what mix of cash, debt, and stock it might use to fund… how do you determine the cash / stock / debt mix in an m&a. Assess merger viability with proforma statements, accretion/dilution analysis, and detailed metrics. Improve your m&a analysis download the template the macabacus merger model. In this article, you’ll find 20 of the most useful merger and acquisition (m&a) templates for business (not legal) use, from planning to valuation to integration. How to interpret accretion / (dilution) analysis? This model runs through different scenarios and synergies. Improve your m&a analysis download the template the macabacus merger model implements advanced m&a, accounting, and tax concepts, and. The mergers & acquisition (m&a) model provides a projection for a company looking to potentially merge or acquire another company. What is a merger model? In this article, you’ll find 20 of the most useful merger and acquisition (m&a) templates for business (not legal) use, from planning to valuation to integration. An excel template with a merger and acquisition model. How to interpret accretion / (dilution) analysis? In this merger model lesson, you’ll learn how a company might decide what mix of cash, debt, and stock it might use to fund… how do you determine the cash / stock / debt mix in an m&a. Improve your m&a analysis download the template the macabacus merger model implements advanced m&a, accounting,. Mergers and acquisitions (m&a) are among the most strategic ways for companies to accelerate growth, increase market share, or diversify their operations. Improve your m&a analysis download the template the macabacus merger model implements advanced m&a, accounting, and tax concepts, and is. Merger and acquisition model template assists the user to assess the financial viability of the resulting proforma merger. An excel template with a merger and acquisition model and calculations of synergies, levered and unlevered cash flows, headcount projections, balance sheet, return on investment and. How to interpret accretion / (dilution) analysis? Improve your m&a analysis download the template the macabacus merger model implements advanced m&a, accounting, and tax concepts, and is. In this merger model lesson, you’ll learn. What is a merger model? In this merger model lesson, you’ll learn how a company might decide what mix of cash, debt, and stock it might use to fund… how do you determine the cash / stock / debt mix in an m&a. This sophisticated merger financial model template is a versatile and powerful solution tailored for intricate merger and. What is a merger model? Merger model tutorial (m&a) how to build a merger model; In this merger model lesson, you’ll learn how a company might decide what mix of cash, debt, and stock it might use to fund… how do you determine the cash / stock / debt mix in an m&a. How to interpret accretion / (dilution) analysis?. Improve your m&a analysis download the template the macabacus merger model implements advanced m&a, accounting, and tax concepts, and is. An excel template with a merger and acquisition model and calculations of synergies, levered and unlevered cash flows, headcount projections, balance sheet, return on investment and. Mergers and acquisitions (m&a) are among the most strategic ways for companies to accelerate growth, increase market share, or diversify their operations. This model runs through different scenarios and synergies. What is a merger model? Merger model tutorial (m&a) how to build a merger model; In this article, you’ll find 20 of the most useful merger and acquisition (m&a) templates for business (not legal) use, from planning to valuation to integration. How to interpret accretion / (dilution) analysis? This sophisticated merger financial model template is a versatile and powerful solution tailored for intricate merger and acquisition (m&a) related scenarios. Assess merger viability with proforma statements, accretion/dilution analysis, and detailed metrics. Improve your m&a analysis download the template the macabacus merger model implements advanced m&a, accounting, and tax concepts, and is.M&A Model Excel at Josie Goodwin blog

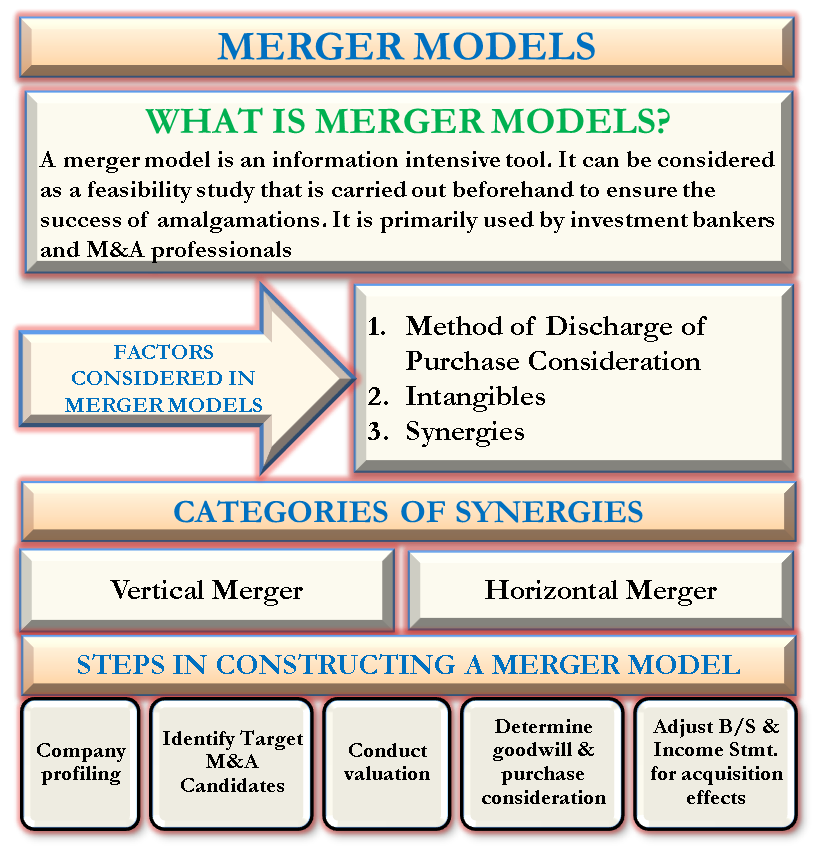

Merger Model, Factors affecting Merger Model, Steps in Merger Model

Merger Model (M&A) Free Excel Template Macabacus

Excel Template Mergers & Acquisitions (M&A) Financial Model (Excel

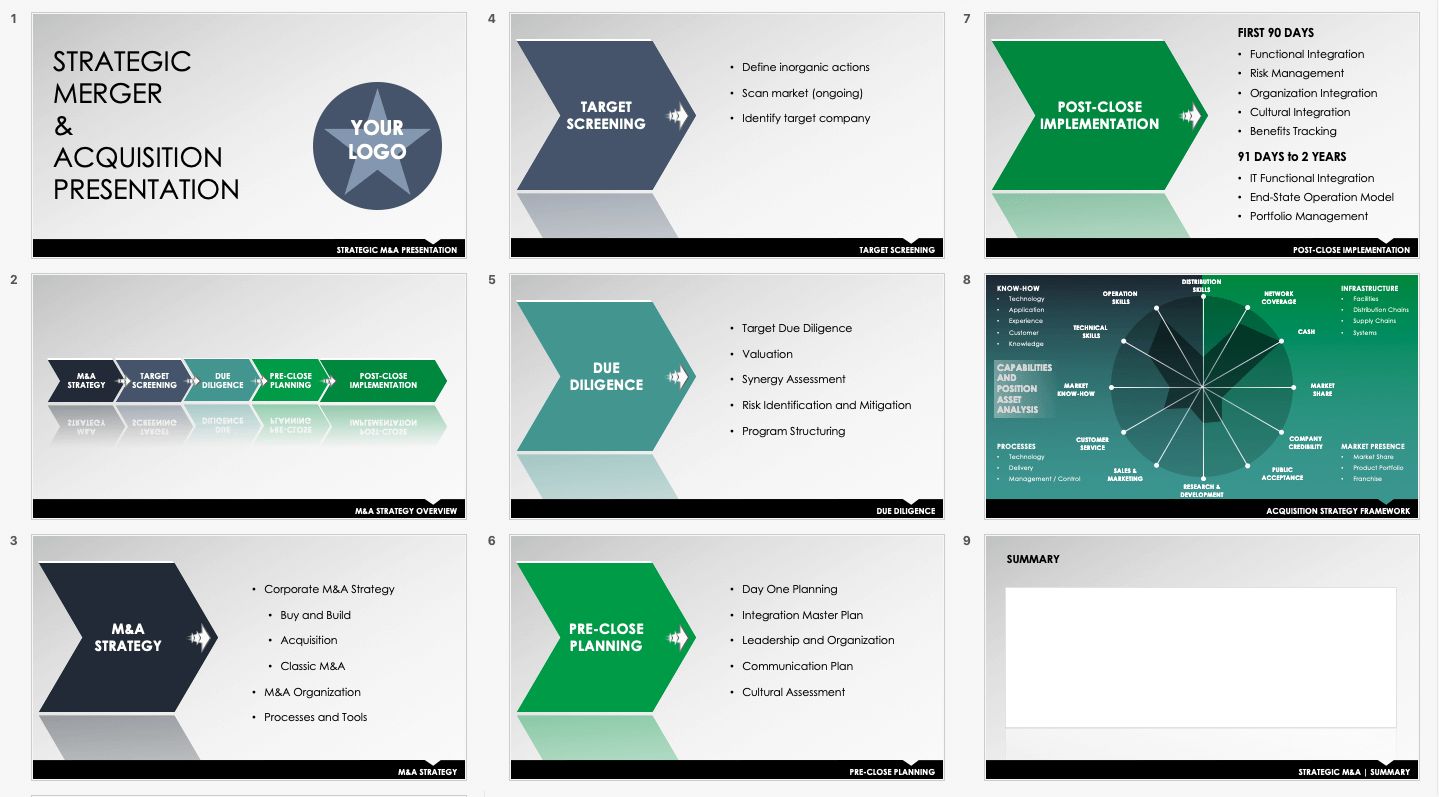

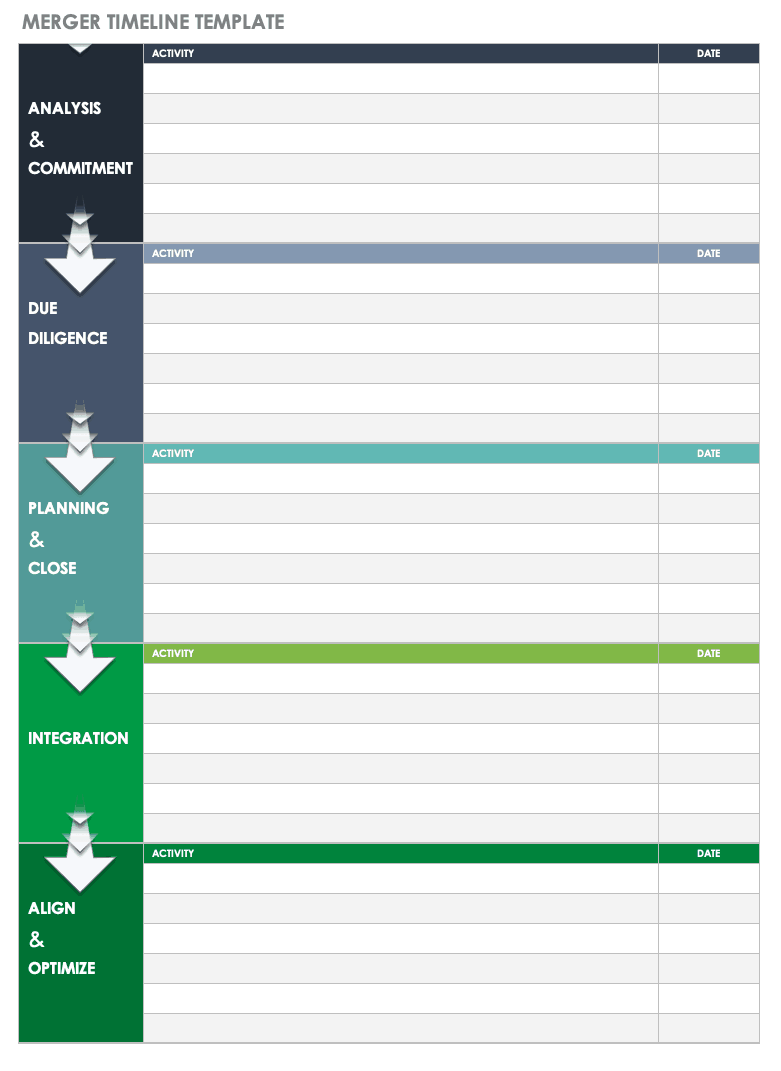

Download Free M&A Templates Smartsheet

Mergers and Acquisitions PowerPoint Template SlideModel

Download Free M&A Templates Smartsheet

Merger Model (M&A) Free Excel Template Macabacus

Merger Model M&A Acquisition Street Of Walls

Mergers and Acquisitions PowerPoint Template SlideModel

The Mergers & Acquisition (M&A) Model Provides A Projection For A Company Looking To Potentially Merge Or Acquire Another Company.

In This Merger Model Lesson, You’ll Learn How A Company Might Decide What Mix Of Cash, Debt, And Stock It Might Use To Fund… How Do You Determine The Cash / Stock / Debt Mix In An M&A.

Merger And Acquisition Model Template Assists The User To Assess The Financial Viability Of The Resulting Proforma Merger Of 2 Companies And Their Synergies.

Related Post: