Removing Hard Inquiries From Credit Report Letter Template

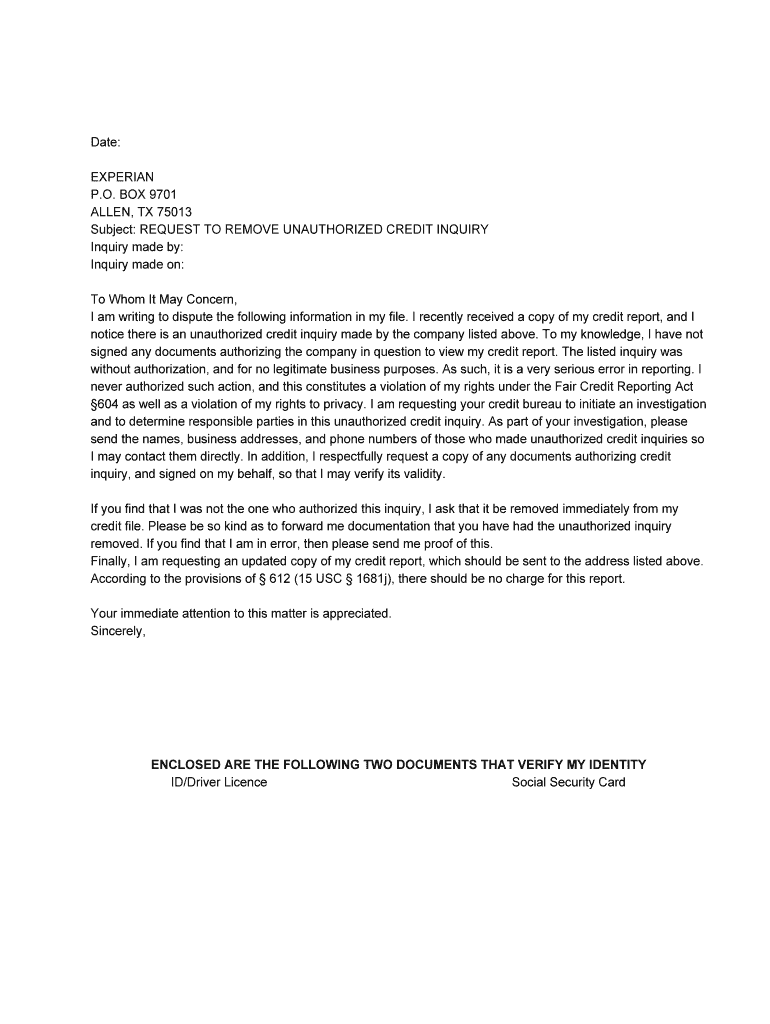

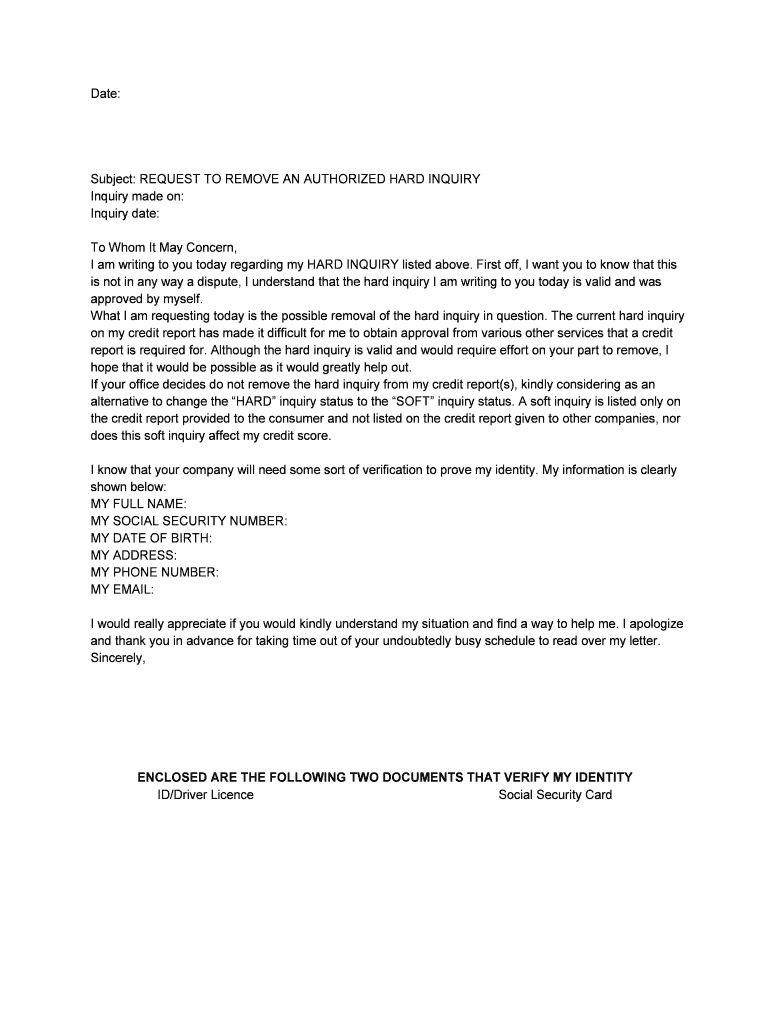

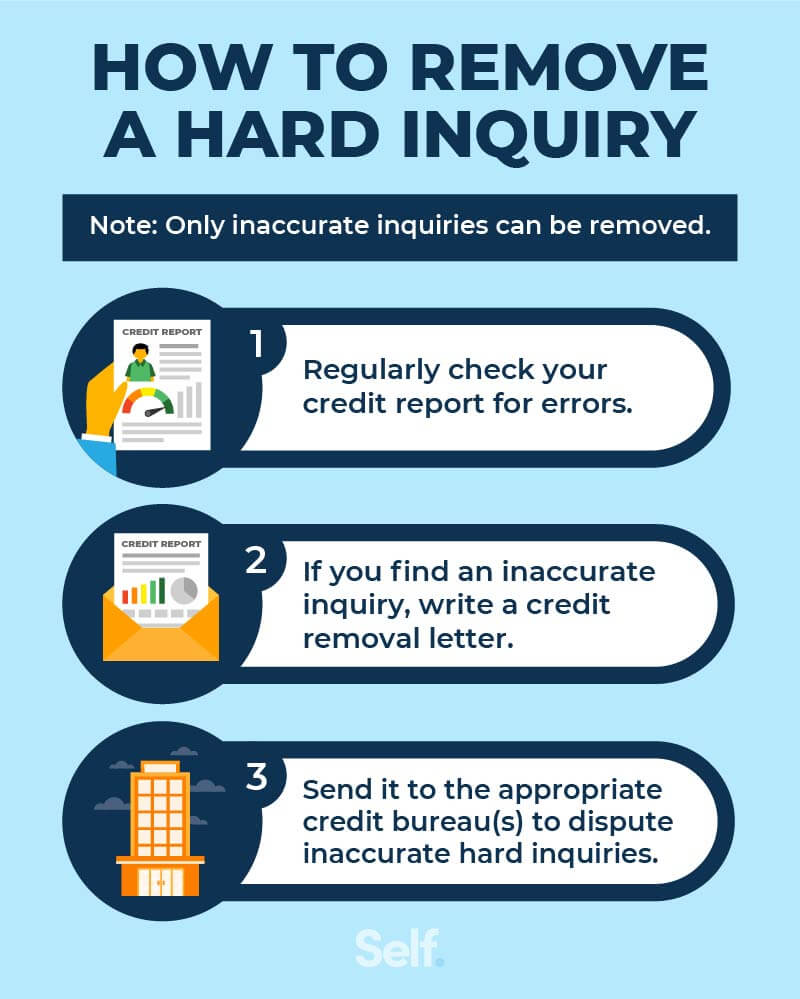

Removing Hard Inquiries From Credit Report Letter Template - Learn how to remove some inquiries from your credit report if you can show that you didn't authorize the inquiry. What you can do instead is take a break from stressing about the score and focus on identifying any errors in the credit report. Request to remove unauthorized hard inquiry. Know what to write when requesting your creditor for an inquiry removal from your credit report. Removing false inquiries from your report requires you to: Writing credit inquiry removal letters. In my personal experience, it’s crucial to act. A hard inquiry happens when a financial institution checks your credit before approving a loan or credit card. If you are unable to provide valid authorization for these inquiries, i request their immediate removal from my credit report. By following these steps and leveraging the provided template, you can effectively dispute and remove unauthorized inquiries from your credit report. Hard inquiries, also known as hard credit checks or hard pulls, occur when a financial. I am writing to request the removal of an unauthorized hard inquiry from my credit report. It's no secret that these inquiries can impact your credit score, making it essential to address them promptly. Writing credit inquiry removal letters. The next step is to draft up a letter to have. If you’ve noticed one or more hard inquiries on your credit report that you didn’t authorize, or if there are errors, you have every right to have them removed. If your credit score has too many credit inquiries, it. Are you feeling the weight of hard inquiries on your credit report? Accurately locate them in your credit report. Request to remove unauthorized hard inquiry. Anytime you apply for a mortgage, you trigger a hard inquiry on your credit report. Request to remove unauthorized hard inquiry. Why removing inquiries matters and how it can improve your credit score. For example, if a lender performed a hard pull. By following these steps and leveraging the provided template, you can effectively dispute and remove unauthorized inquiries from. Continue reading to learn more about credit inquiries, how they affect your credit. Below are three detailed templates you can adapt to your specific situation: If you are unable to provide valid authorization for these inquiries, i request their immediate removal from my credit report. What you can do instead is take a break from stressing about the score and. Continue reading to learn more about credit inquiries, how they affect your credit. It's no secret that these inquiries can impact your credit score, making it essential to address them promptly. The next step is to draft up a letter to have. If you are unable to provide valid authorization for these inquiries, i request their immediate removal from my. Below are three detailed templates you can adapt to your specific situation: It's no secret that these inquiries can impact your credit score, making it essential to address them promptly. Have you reviewed your credit report and noticed hard inquiries that you did not authorize? Dear [credit bureau name], i am. Continue reading to learn more about credit inquiries, how. Submit a formal removal letter to the major credit bureaus. A hard inquiry happens when a financial institution checks your credit before approving a loan or credit card. Please ensure that this information is updated within the. It's no secret that these inquiries can impact your credit score, making it essential to address them promptly. Our free credit report dispute. A simple, yet effective letter to remove unauthorized or inaccurate. Why removing inquiries matters and how it can improve your credit score. Continue reading to learn more about credit inquiries, how they affect your credit. What you can do instead is take a break from stressing about the score and focus on identifying any errors in the credit report. Our. The inquiry in question was conducted by [creditor or lender name] on [date of inquiry] and. The next step is to draft up a letter to have. Below we’ve provided some tips for removing unauthorized hard inquiries from your credit report, as well as a credit inquiry removal letter template for your professional use. For example, if a lender performed. Continue reading to learn more about credit inquiries, how they affect your credit. Luckily, the credit bureau will sometimes remove these unapproved inquiries from your report. Writing credit inquiry removal letters. Download the free sample template now! By following these steps and leveraging the provided template, you can effectively dispute and remove unauthorized inquiries from your credit report. By following these steps and leveraging the provided template, you can effectively dispute and remove unauthorized inquiries from your credit report. Writing credit inquiry removal letters. The next step is to draft up a letter to have. If your credit score has too many credit inquiries, it. Know what to write when requesting your creditor for an inquiry removal from. A simple, yet effective letter to remove unauthorized or inaccurate. Removing false inquiries from your report requires you to: In my personal experience, it’s crucial to act. Below we’ve provided some tips for removing unauthorized hard inquiries from your credit report, as well as a credit inquiry removal letter template for your professional use. Learn how to remove some inquiries. By following these steps and leveraging the provided template, you can effectively dispute and remove unauthorized inquiries from your credit report. Request to remove unauthorized hard inquiry. Removing false inquiries from your report requires you to: Since it is against federal law (fair credit reporting act—15 usc § 1681n (a) (1) (b) for an entity to view a customer’s credit report without a “permissible purpose,” i am writing. Writing credit inquiry removal letters. Download the free sample template now! Our free credit report dispute letter templates help you write effective dispute letters so you can get negative items removed from your credit file. A simple, yet effective letter to remove unauthorized or inaccurate. Submit a formal removal letter to the major credit bureaus. If your credit score has too many credit inquiries, it. Dear [credit bureau name], i am. I am writing to request the removal of an unauthorized hard inquiry from my credit report. Anytime you apply for a mortgage, you trigger a hard inquiry on your credit report. Learn how to remove some inquiries from your credit report if you can show that you didn't authorize the inquiry. A hard inquiry happens when a financial institution checks your credit before approving a loan or credit card. Luckily, the credit bureau will sometimes remove these unapproved inquiries from your report.Credit Inquiry Removal Letter Pdf Fill Online, Printable, Fillable

Can a hard inquiry be removed? Leia aqui Can you legally remove

Remove Hard Inquiry Letter Sample with Examples [Word]

Fillable Online hard credit inquiry removal tool pdf form Fax Email

How to Write a Credit Inquiry Removal Letter

Hard Inquiry Removal Letter

Free Credit Report Dispute Letter Template Sample PDF Word eForms

14 Sample Letter of Credit Templates Samples, Examples & Format

Credit Inquiry Removal Letter Fill and Sign Printable Template Online

Hard Inquiry Removal Letter Printable

Know What To Write When Requesting Your Creditor For An Inquiry Removal From Your Credit Report.

It's No Secret That These Inquiries Can Impact Your Credit Score, Making It Essential To Address Them Promptly.

What You Can Do Instead Is Take A Break From Stressing About The Score And Focus On Identifying Any Errors In The Credit Report.

Continue Reading To Learn More About Credit Inquiries, How They Affect Your Credit.

Related Post:

![Remove Hard Inquiry Letter Sample with Examples [Word]](https://i0.wp.com/templatediy.com/wp-content/uploads/2023/04/Printable-Remove-Hard-Inquiry-Letter.jpg?fit=1414%2C2000&ssl=1)