Rental Property Income And Expenses Spreadsheet Template

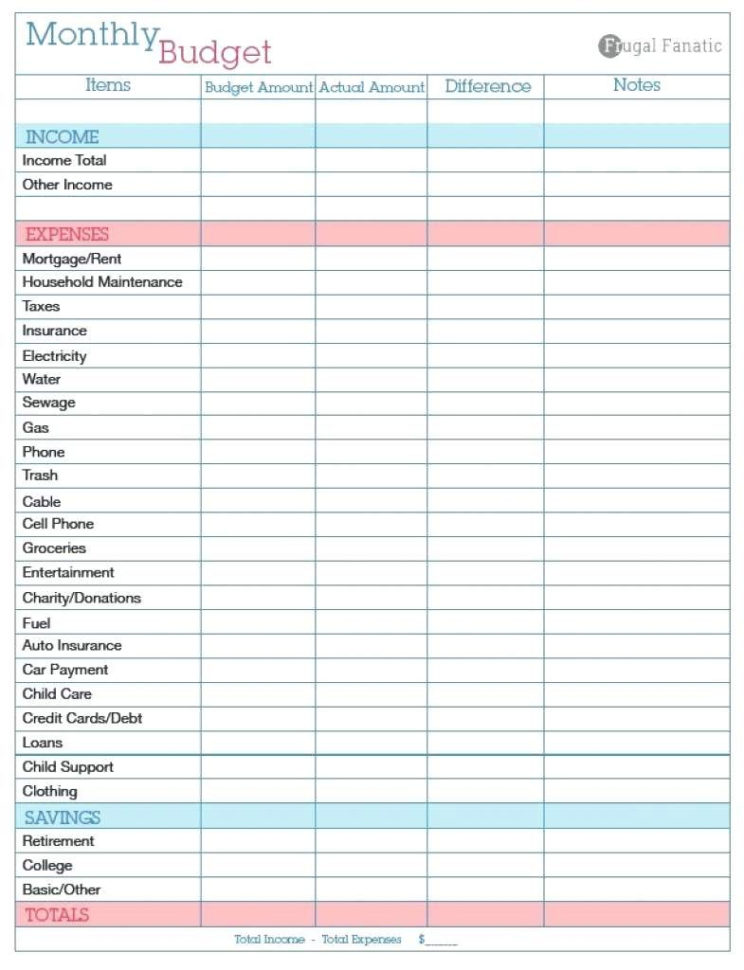

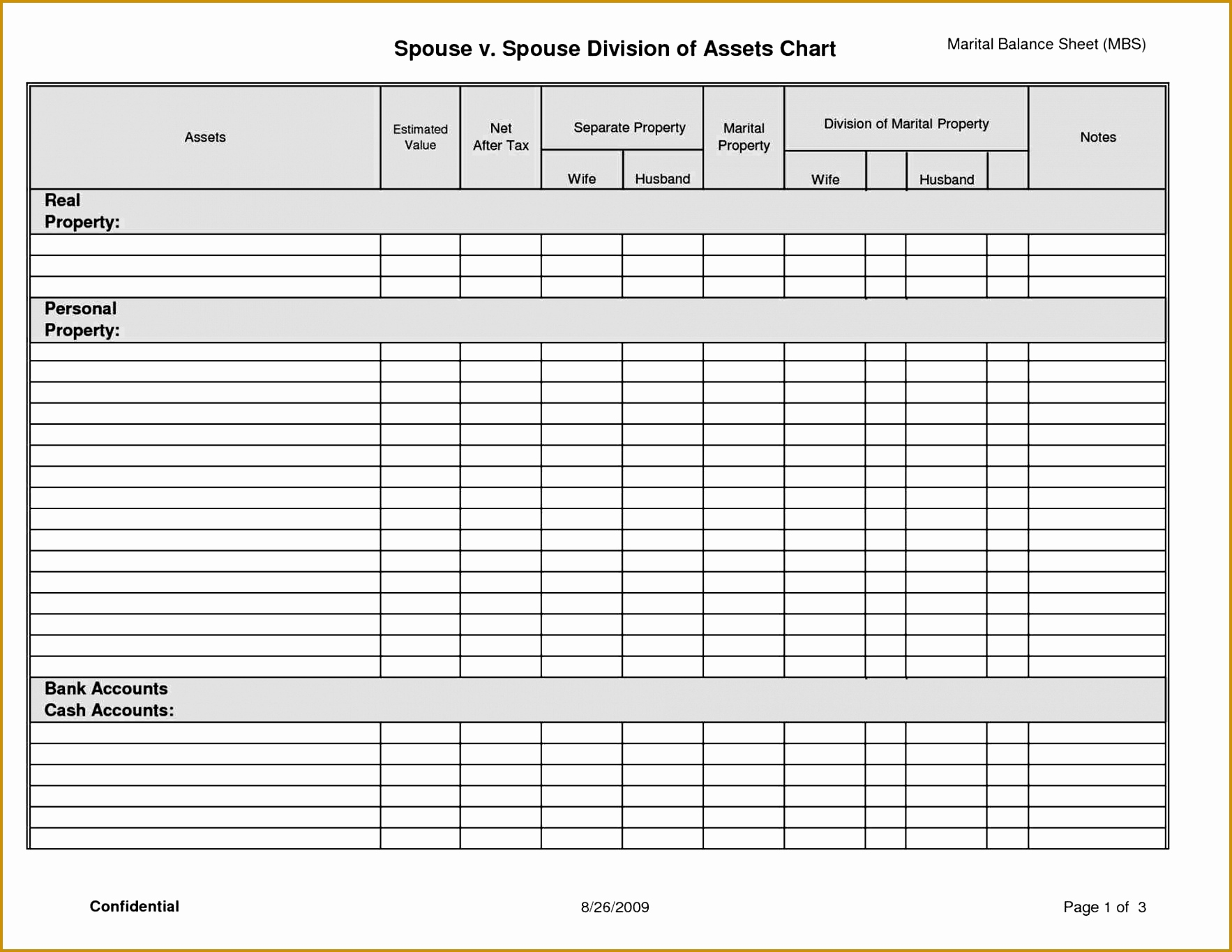

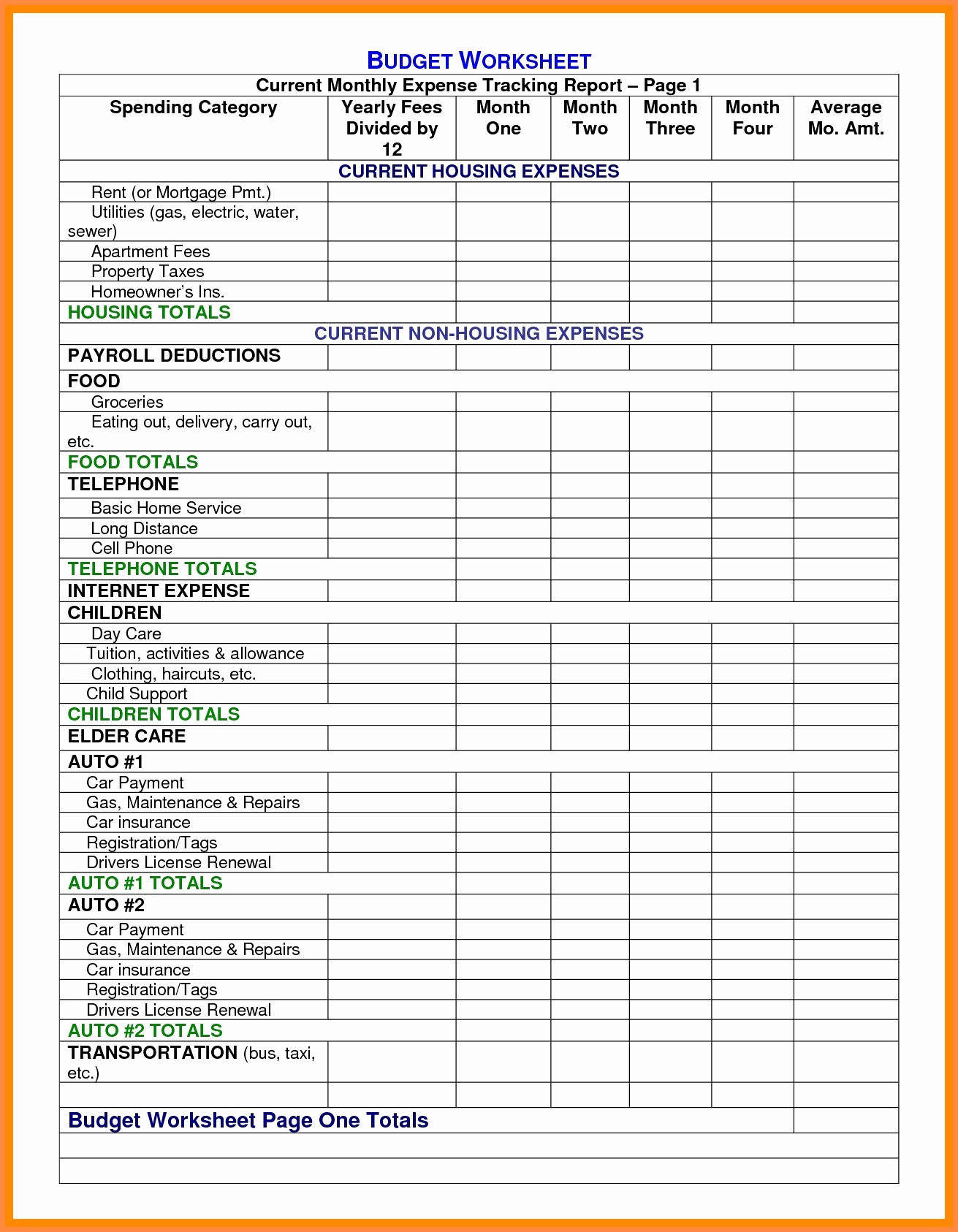

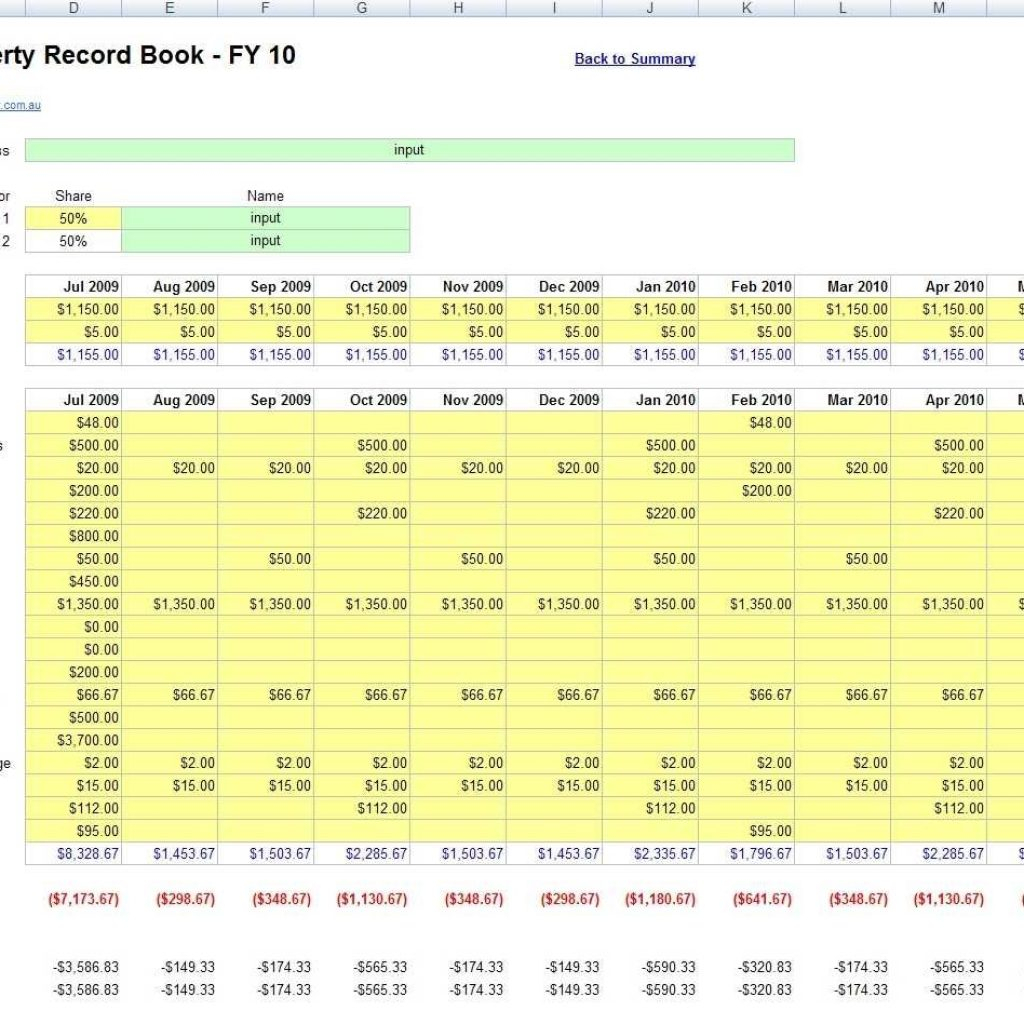

Rental Property Income And Expenses Spreadsheet Template - $10,000 (including property management, taxes, insurance, and maintenance) holding period: Streamline rental property finances with a balance sheet excel template, tracking income, expenses, and cash flow for optimal investment analysis and tax reporting, using key metrics. In this article, we’ll explain how rental property owners can track every expense down to the last penny, find more tax deductions, and save time and increase financial performance by. Templates for tracking rental income and expenses make setup faster and easier, plus you can customize the fields if needed. Accurately tracking property expenses is essential for a. Easily track income from tenants, manage expenses, and assess. We’re excited to offer you a free rent ledger template to simplify your property management tasks. Always keep track of your rental property's finances with our rental property income and expenses template. Stessa has a simple rental property analysis spreadsheet that you can download for free. A rental property spreadsheet offers a convenient way to keep track of monthly income and operating expenses. Follow the simple instructions outlined below to create and use a real estate expense spreadsheet to help keep your rental property finances in check. Streamline rental property finances with a balance sheet excel template, tracking income, expenses, and cash flow for optimal investment analysis and tax reporting, using key metrics. Download the rental income spreadsheet template to help you organize your rental income. Useful for showing changes in income or expenses over time. However, worksheets and spreadsheets don’t. $10,000 (including property management, taxes, insurance, and maintenance) holding period: Key components of the business expense tracker. Download the most recent irs schedule e form 1040 & instructions to report rental income. The rental property management template is a document in ms excel in different formats. Easily track income from tenants, manage expenses, and assess. To create a chart, simply. Essentially, the irs allows property owners to deduct an annual depreciation expense against their taxable income for each full year the property is rented out. A rental property spreadsheet offers a convenient way to keep track of monthly income and operating expenses. Ideal for comparing rent income across different properties. Instantly view your total expenses. Follow the simple instructions outlined below to create and use a real estate expense spreadsheet to help keep your rental property finances in check. Streamline rental property finances with a balance sheet excel template, tracking income, expenses, and cash flow for optimal investment analysis and tax reporting, using key metrics. A rental property expense spreadsheet is mainly used by real. However, worksheets and spreadsheets don’t. Easily track income from tenants, manage expenses, and assess. A rental property spreadsheet offers a convenient way to keep track of monthly income and operating expenses. In this article, we’ll explain how rental property owners can track every expense down to the last penny, find more tax deductions, and save time and increase financial performance. The rental property management template is a document in ms excel in different formats. Useful for showing changes in income or expenses over time. It keeps the records of your property and rent collection with various reports. Ideal for comparing rent income across different properties. Download the most recent irs schedule e form 1040 & instructions to report rental income. Download it for free today! Download the rental income spreadsheet template to help you organize your rental income. We’re excited to offer you a free rent ledger template to simplify your property management tasks. $10,000 (including property management, taxes, insurance, and maintenance) holding period: In this article, we’ll explain how rental property owners can track every expense down to the. To create a chart, simply. We’re excited to offer you a free rent ledger template to simplify your property management tasks. Ideal for comparing rent income across different properties. Essentially, the irs allows property owners to deduct an annual depreciation expense against their taxable income for each full year the property is rented out. The rental property management template is. However, worksheets and spreadsheets don’t. Easily track income from tenants, manage expenses, and assess. Always keep track of your rental property's finances with our rental property income and expenses template. A rental property spreadsheet offers a convenient way to keep track of monthly income and operating expenses. What is a rental property expenses spreadsheet? Ideal for comparing rent income across different properties. Essentially, the irs allows property owners to deduct an annual depreciation expense against their taxable income for each full year the property is rented out. In this article, we’ll explain how rental property owners can track every expense down to the last penny, find more tax deductions, and save time and increase. Proptino manager developed a free excel spreadsheet that you may use for your property portfolio to streamline the financial administration of your rental properties. Stessa has a simple rental property analysis spreadsheet that you can download for free. What is a rental property expenses spreadsheet? A rental property spreadsheet offers a convenient way to keep track of monthly income and. A rental property expense spreadsheet is mainly used by real estate investors as a tool to accurately record all of their. A rental property spreadsheet offers a convenient way to keep track of monthly income and operating expenses. We’re excited to offer you a free rent ledger template to simplify your property management tasks. Instantly view your total expenses by. To create a chart, simply. Accurately tracking property expenses is essential for a. A rental property spreadsheet offers a convenient way to keep track of monthly income and operating expenses. A rental property expense spreadsheet is mainly used by real estate investors as a tool to accurately record all of their. Proptino manager developed a free excel spreadsheet that you may use for your property portfolio to streamline the financial administration of your rental properties. Ideal for comparing rent income across different properties. Instantly view your total expenses by category and month. However, worksheets and spreadsheets don’t. Streamline rental property finances with a balance sheet excel template, tracking income, expenses, and cash flow for optimal investment analysis and tax reporting, using key metrics. Stessa has a simple rental property analysis spreadsheet that you can download for free. The rental property management template is a document in ms excel in different formats. Easily track income from tenants, manage expenses, and assess. Essentially, the irs allows property owners to deduct an annual depreciation expense against their taxable income for each full year the property is rented out. Always keep track of your rental property's finances with our rental property income and expenses template. In this article, we’ll explain how rental property owners can track every expense down to the last penny, find more tax deductions, and save time and increase financial performance by. $10,000 (including property management, taxes, insurance, and maintenance) holding period:Landlords Rental and Expenses Tracking Spreadsheet

Landlords Rental and Expenses Tracking Spreadsheet

Free Rental Expense Spreadsheet Google Spreadshee free rental

Rental Property & Expenses Spreadsheet

Rental And Expense Worksheet Excel

Rental Property and Expenses Excel Spreadsheet

Landlord Rent Ledger Spreadsheet, Rental Property and Expense

Rental And Expense Spreadsheet Template —

Free Rental Expense Spreadsheet Google Spreadshee free rental

Rental And Expense Spreadsheet Template 1 Printable Spreadshee

Download The Rental Income Spreadsheet Template To Help You Organize Your Rental Income.

It Keeps The Records Of Your Property And Rent Collection With Various Reports.

Download The Most Recent Irs Schedule E Form 1040 & Instructions To Report Rental Income.

Learn More About How To Use A Rental Property Analysis Spreadsheet.

Related Post: