Saas Startup Financial Model Template

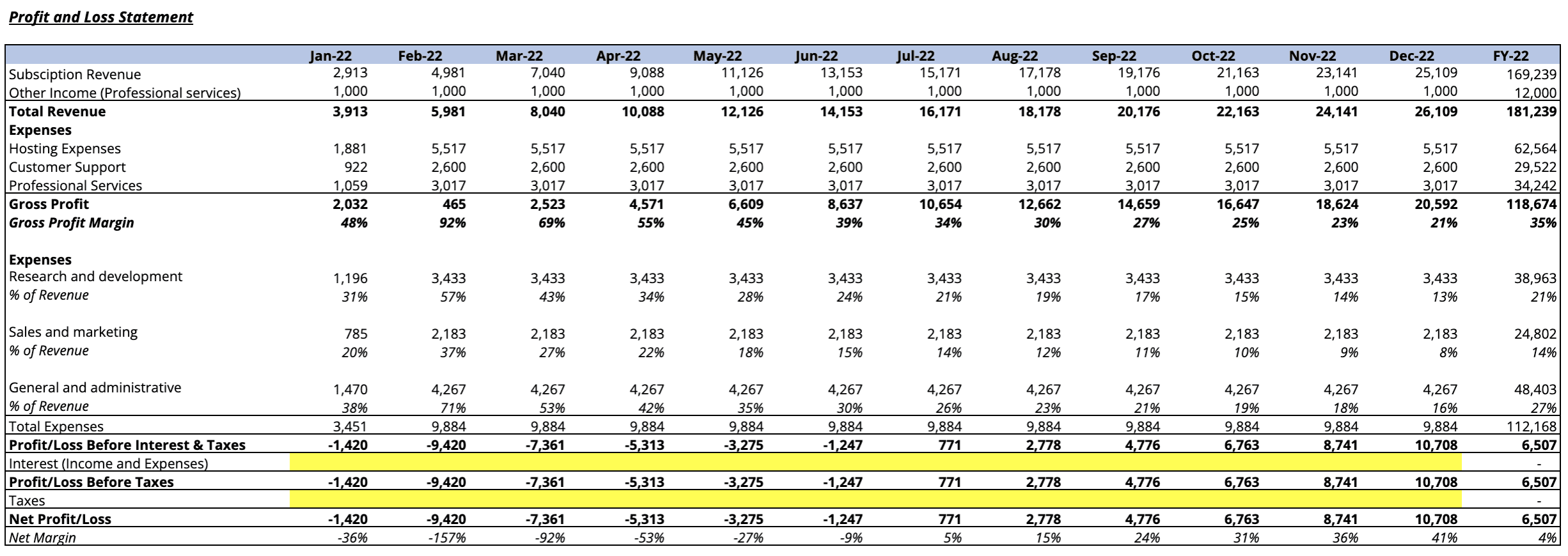

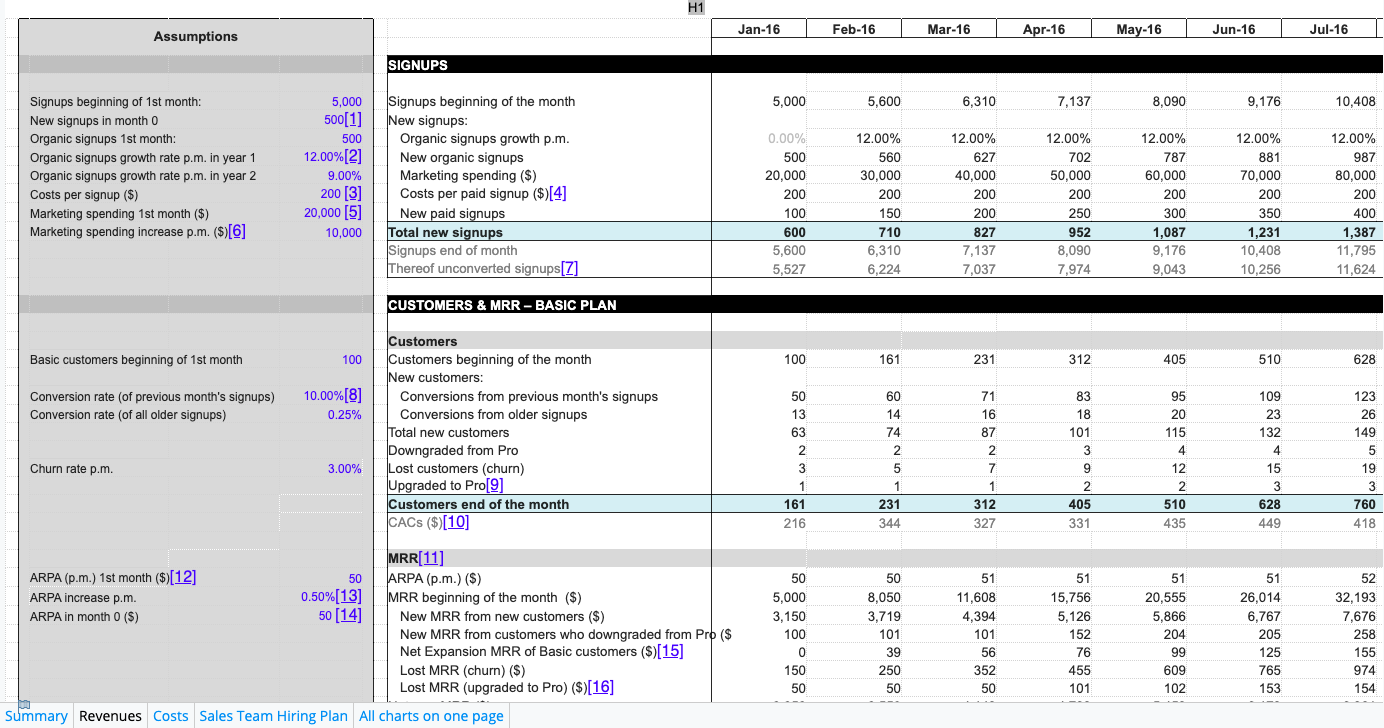

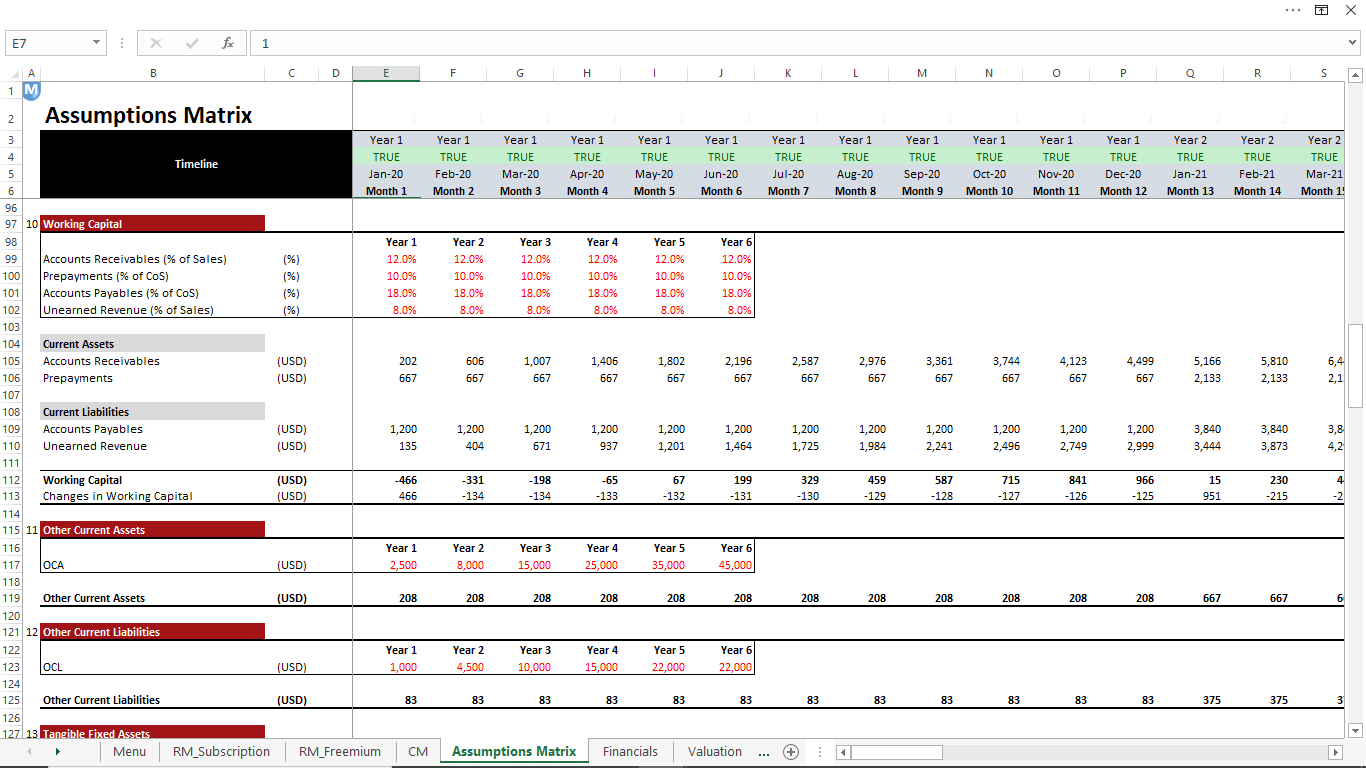

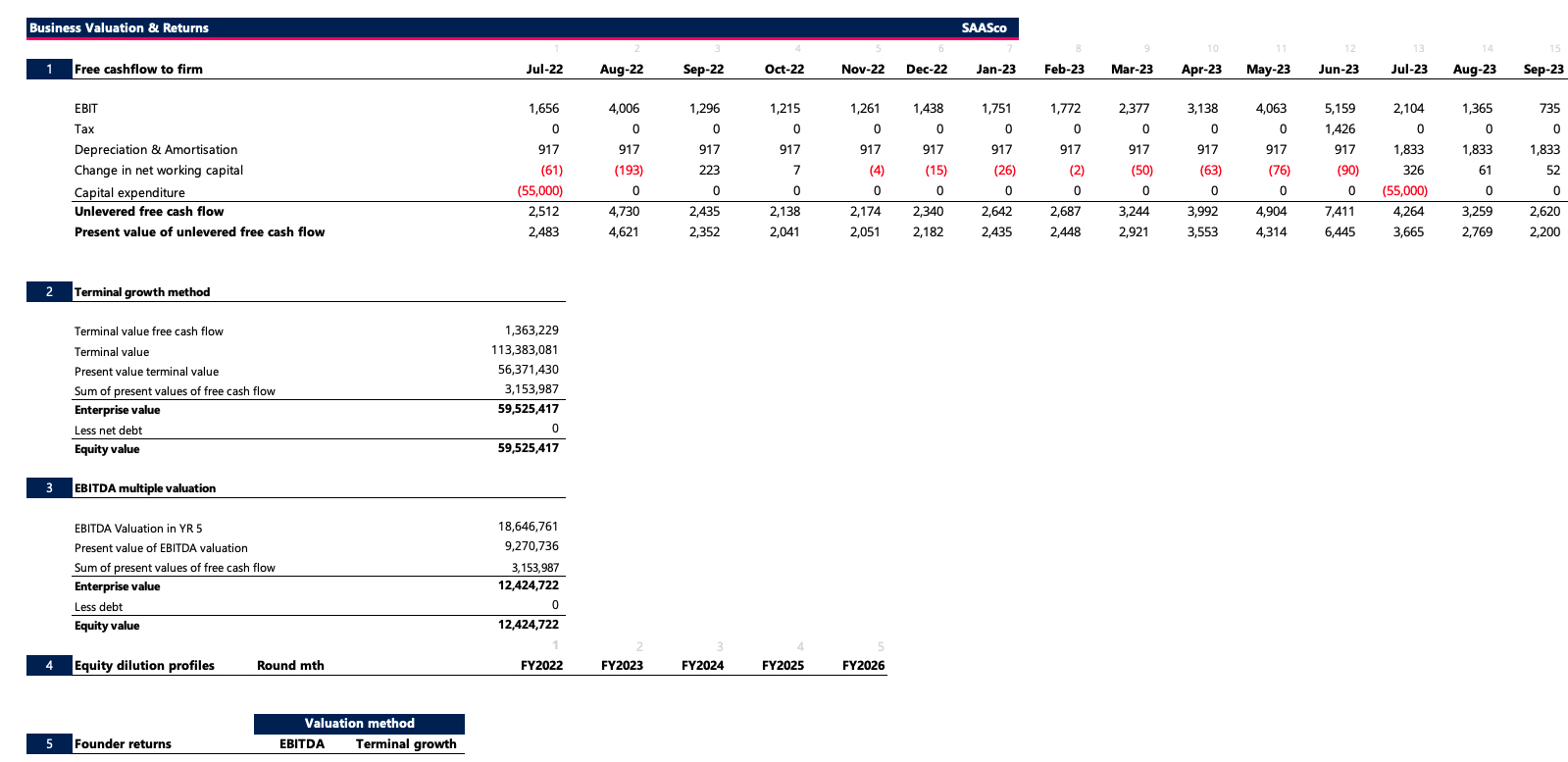

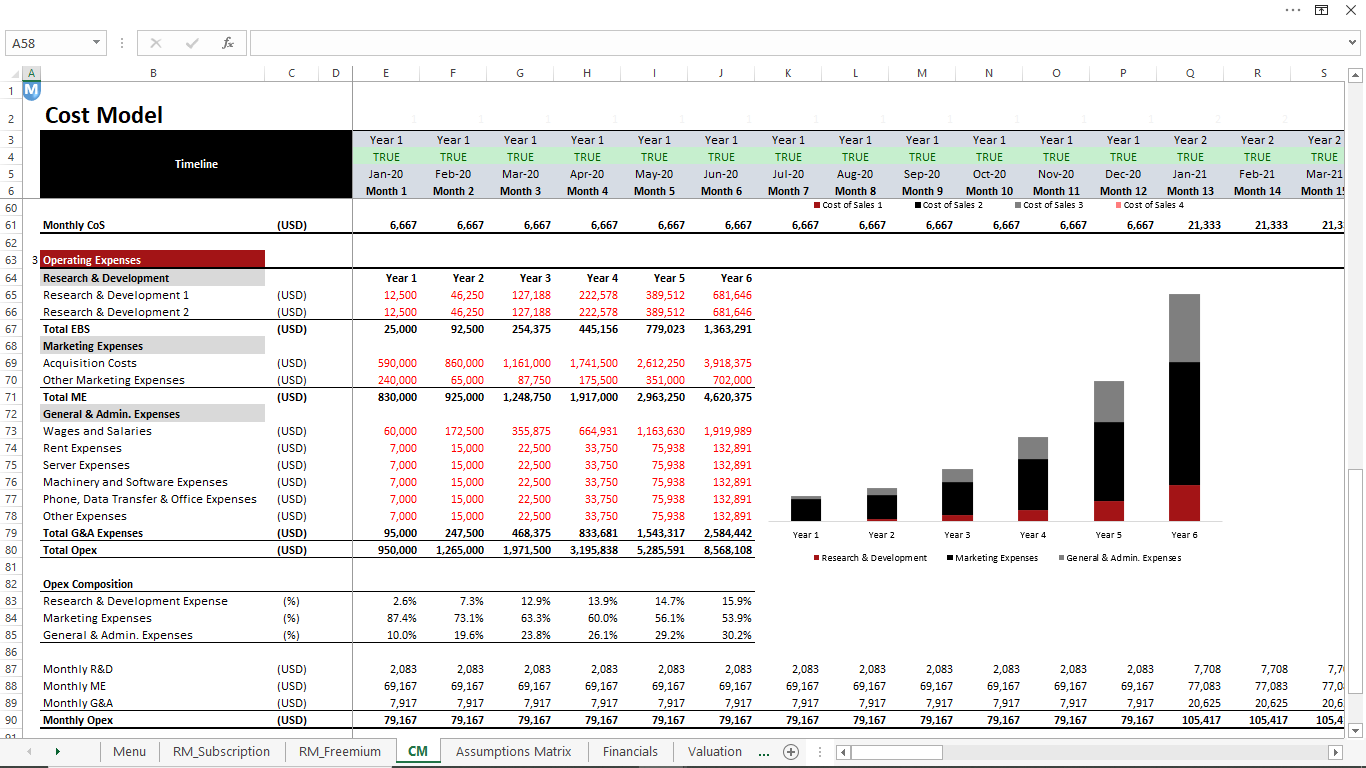

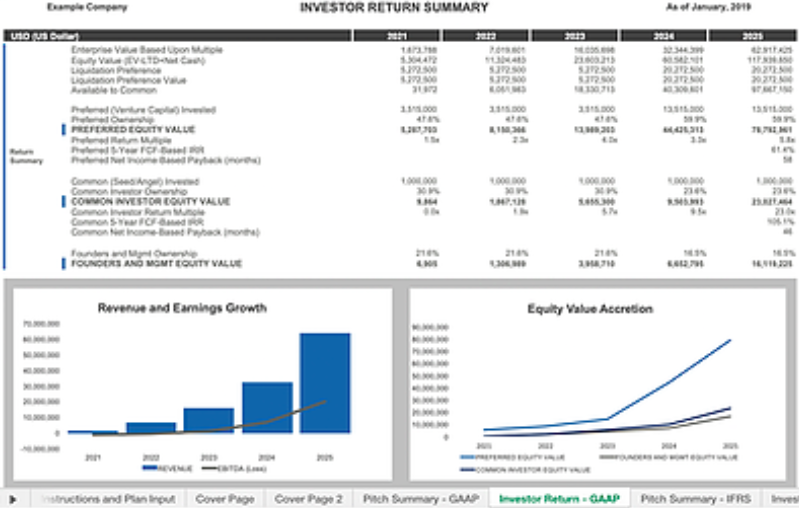

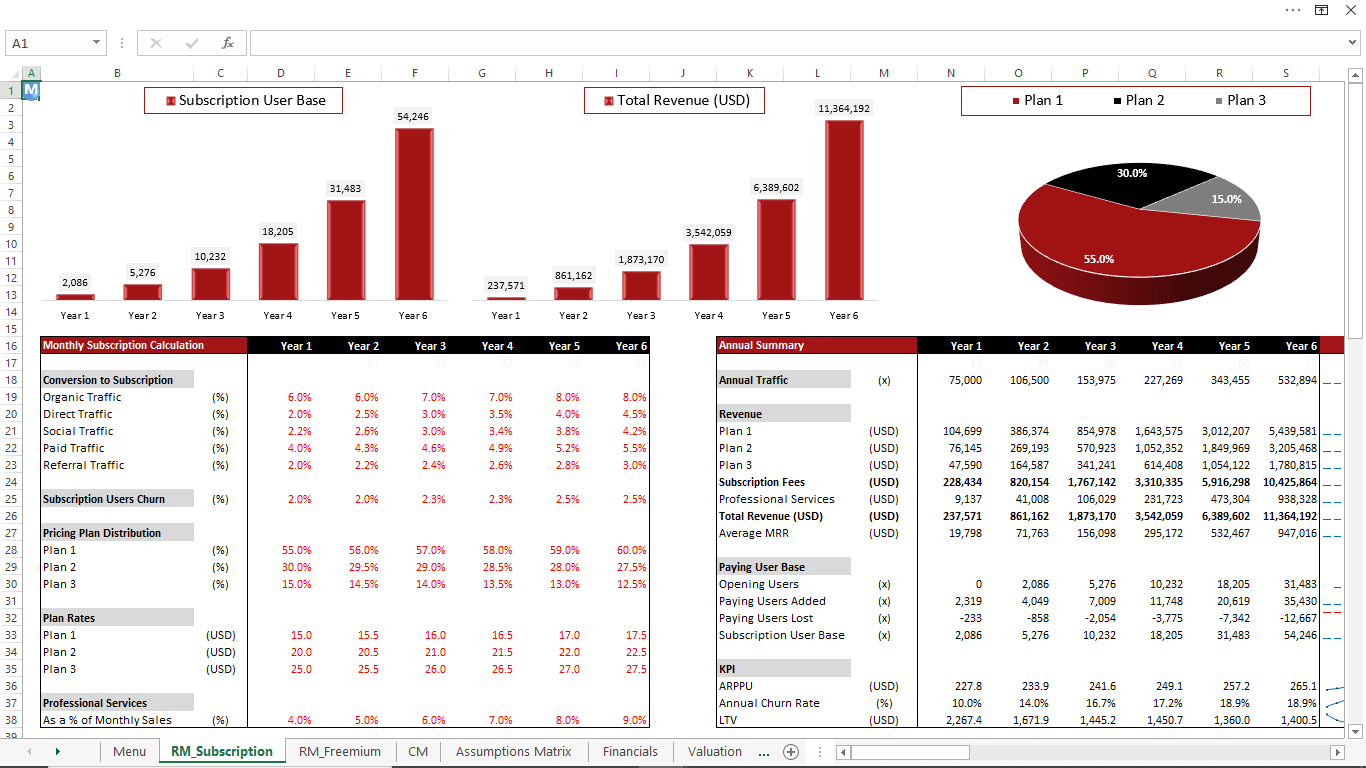

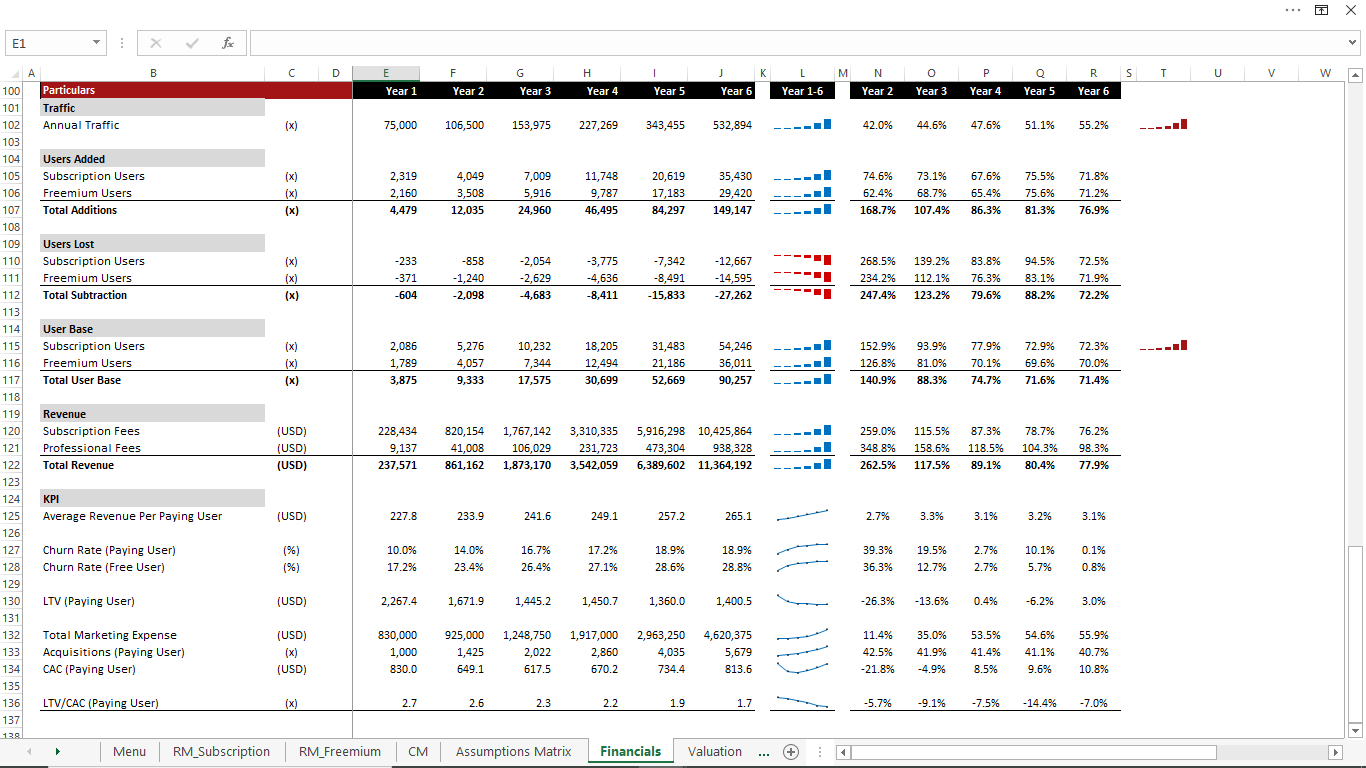

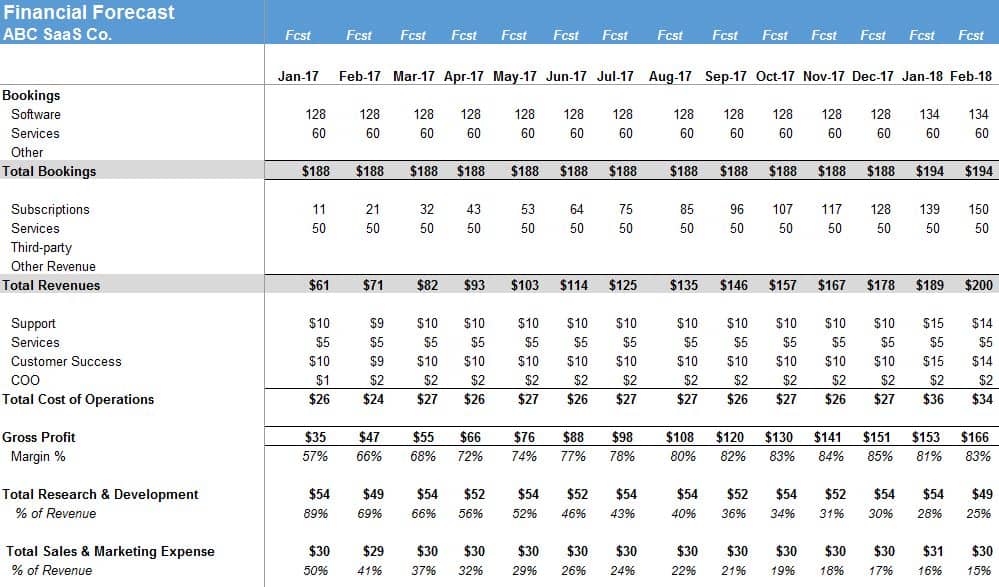

Saas Startup Financial Model Template - The operating expense financial model is designed to outline your saas company’s operating. (a) financial statements, (b) analysis capabilities, (c) revenue modeling, (d) cost modeling, (e) extra features. Download the ultimate saas financial model template today and turn your business aspirations into achievable financial goals! Forecast your saas startup's success with our free financial model template. A detailed analysis of each model is available below. If you’re looking to level up your financial model, then check out some of these financial model templates below: Here is the methodology i used to build this benchmark. Article by caya last update: Saas businesses often need upfront investment and founders raise capital to fund development. In each case, i tested the software/spreadsheet myself. (a) financial statements, (b) analysis capabilities, (c) revenue modeling, (d) cost modeling, (e) extra features. Saas businesses often need upfront investment and founders raise capital to fund development. Download the ultimate saas financial model template today and turn your business aspirations into achievable financial goals! The operating expense financial model is designed to outline your saas company’s operating. If you’re looking to level up your financial model, then check out some of these financial model templates below: Forecast your saas startup's success with our free financial model template. Forecast your saas startup's success with our free financial model template. The saas business itself can expect steady and recurring revenue from customers, which makes it easier to plan your budget, set performance targets and make. Streamlining recurring tasks like billing, invoicing, and revenue recognition frees up your team. I've found the most comprehensive financial startup model that comes up with p&l, balance sheet, cash flow models to help you make insightful decisions & hit your goals. Try our free financial model template for startups, saas, and ecommerce businesses. Forecast your saas startup's success with our free financial model template. Additionally, metrics such as mrr, arr, cltv,. The operating expense financial model is designed to outline your saas company’s operating. Start a financial model for your saas startup today! Start a financial model for your saas startup today! The operating expense financial model is designed to outline your saas company’s operating. Automation is key for efficient subscription management: Here is the methodology i used to build this benchmark. Article by caya last update: Collect all necessary business data. If you’re looking to level up your financial model, then check out some of these financial model templates below: In each case, i tested the software/spreadsheet myself. The operating expense financial model is designed to outline your saas company’s operating. Here is the methodology i used to build this benchmark. Here is the methodology i used to build this benchmark. I compared 40 points across 5 categories: Article by caya last update: In summary, here’s how to build a saas financial model from scratch in seven simple steps: The settings sheet allows you to. Saas businesses often need upfront investment and founders raise capital to fund development. Forecast your saas startup's success with our free financial model template. Article by caya last update: Start a financial model for your saas startup today! Forecast your saas startup's success with our free financial model template. Article by caya last update: In summary, here’s how to build a saas financial model from scratch in seven simple steps: Forecast your saas startup's success with our free financial model template. Streamlining recurring tasks like billing, invoicing, and revenue recognition frees up your team. Additionally, metrics such as mrr, arr, cltv,. Forecast your saas startup's success with our free financial model template. I compared 40 points across 5 categories: Article by caya last update: In each case, i tested the software/spreadsheet myself. I've found the most comprehensive financial startup model that comes up with p&l, balance sheet, cash flow models to help you make insightful decisions & hit your goals. Download the ultimate saas financial model template today and turn your business aspirations into achievable financial goals! A detailed analysis of each model is available below. Forecast your saas startup's success with our free financial model template. Here is the methodology i used to build this benchmark. I compared 40 points across 5 categories: The operating expense financial model is designed to outline your saas company’s operating. (a) financial statements, (b) analysis capabilities, (c) revenue modeling, (d) cost modeling, (e) extra features. Collect all necessary business data. Download the ultimate saas financial model template today and turn your business aspirations into achievable financial goals! The saas business itself can expect steady and recurring revenue. Try our free financial model template for startups, saas, and ecommerce businesses. Start a financial model for your saas startup today! If you’re looking to level up your financial model, then check out some of these financial model templates below: The operating expense financial model is designed to outline your saas company’s operating. In summary, here’s how to build a. Download the ultimate saas financial model template today and turn your business aspirations into achievable financial goals! The saas business itself can expect steady and recurring revenue from customers, which makes it easier to plan your budget, set performance targets and make. Additionally, metrics such as mrr, arr, cltv,. Automation is key for efficient subscription management: Forecast your saas startup's success with our free financial model template. If you’re looking to level up your financial model, then check out some of these financial model templates below: Collect all necessary business data. Find the details on the five different types of financial models and what each type tells you below. The operating expense financial model is designed to outline your saas company’s operating. I compared 40 points across 5 categories: Article by caya last update: Forecast your saas startup's success with our free financial model template. The settings sheet allows you to. Streamlining recurring tasks like billing, invoicing, and revenue recognition frees up your team. Here is the methodology i used to build this benchmark. (a) financial statements, (b) analysis capabilities, (c) revenue modeling, (d) cost modeling, (e) extra features.SaaS Financial Model For Startups & SMBs (FREE Template Included)

Startup financial models 12 templates compared for SaaS

SAAS Financial Model Template (FullyVetted and ReadytoUse) Eloquens

Saas Startup Financial Model Template

SAAS Financial Model Template (FullyVetted and ReadytoUse) Eloquens

Startup financial models 12 templates compared for SaaS

SAAS Financial Model Template (FullyVetted and ReadytoUse) Eloquens

SAAS Financial Model Template (FullyVetted and ReadytoUse) Eloquens

Software & SaaS Financial Model Template for Excel

SaaS Financial Model Your Financial Blueprint The SaaS CFO

In Summary, Here’s How To Build A Saas Financial Model From Scratch In Seven Simple Steps:

Saas Businesses Often Need Upfront Investment And Founders Raise Capital To Fund Development.

Try Our Free Financial Model Template For Startups, Saas, And Ecommerce Businesses.

In Each Case, I Tested The Software/Spreadsheet Myself.

Related Post: