Tax Invoice Template Australia

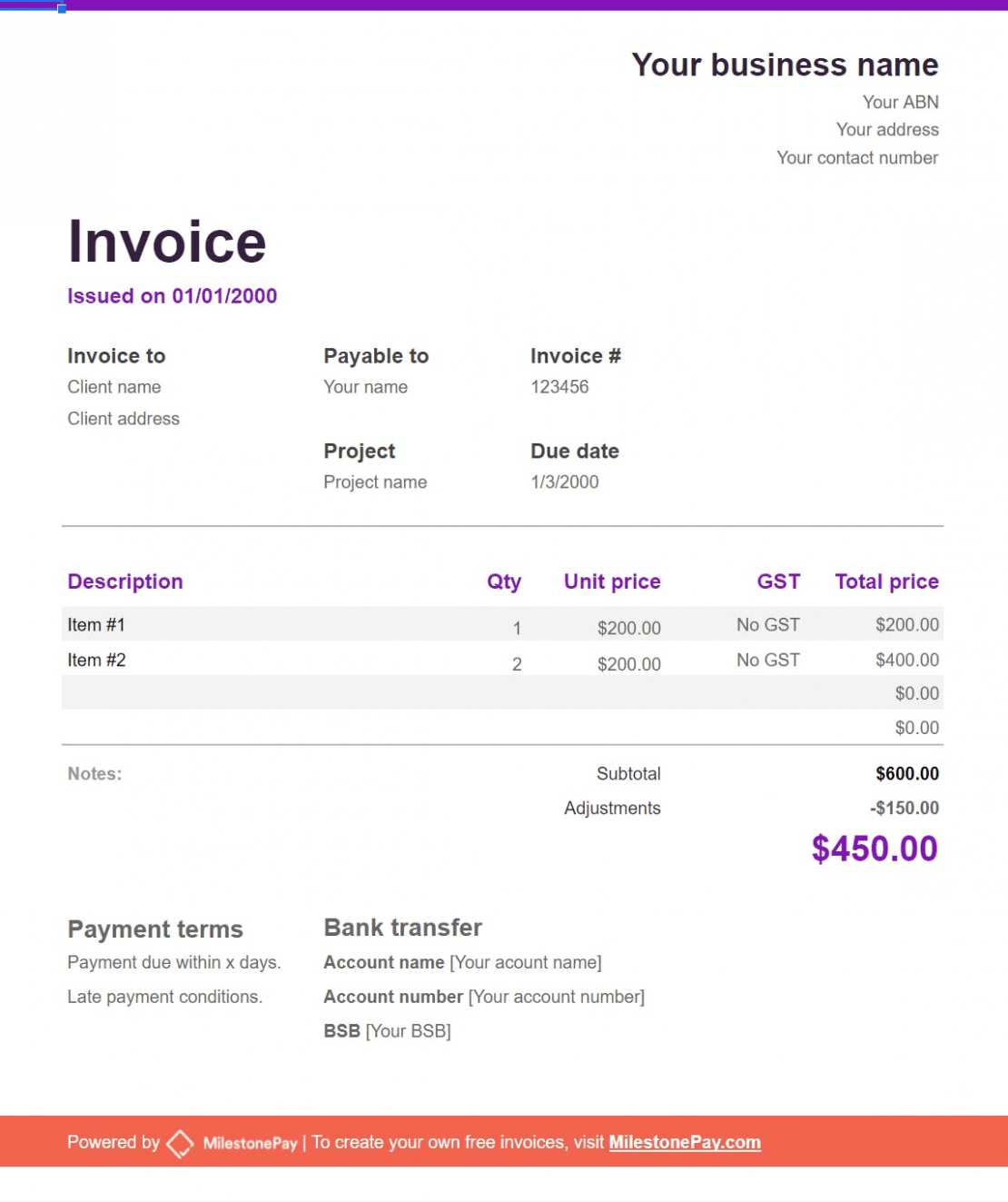

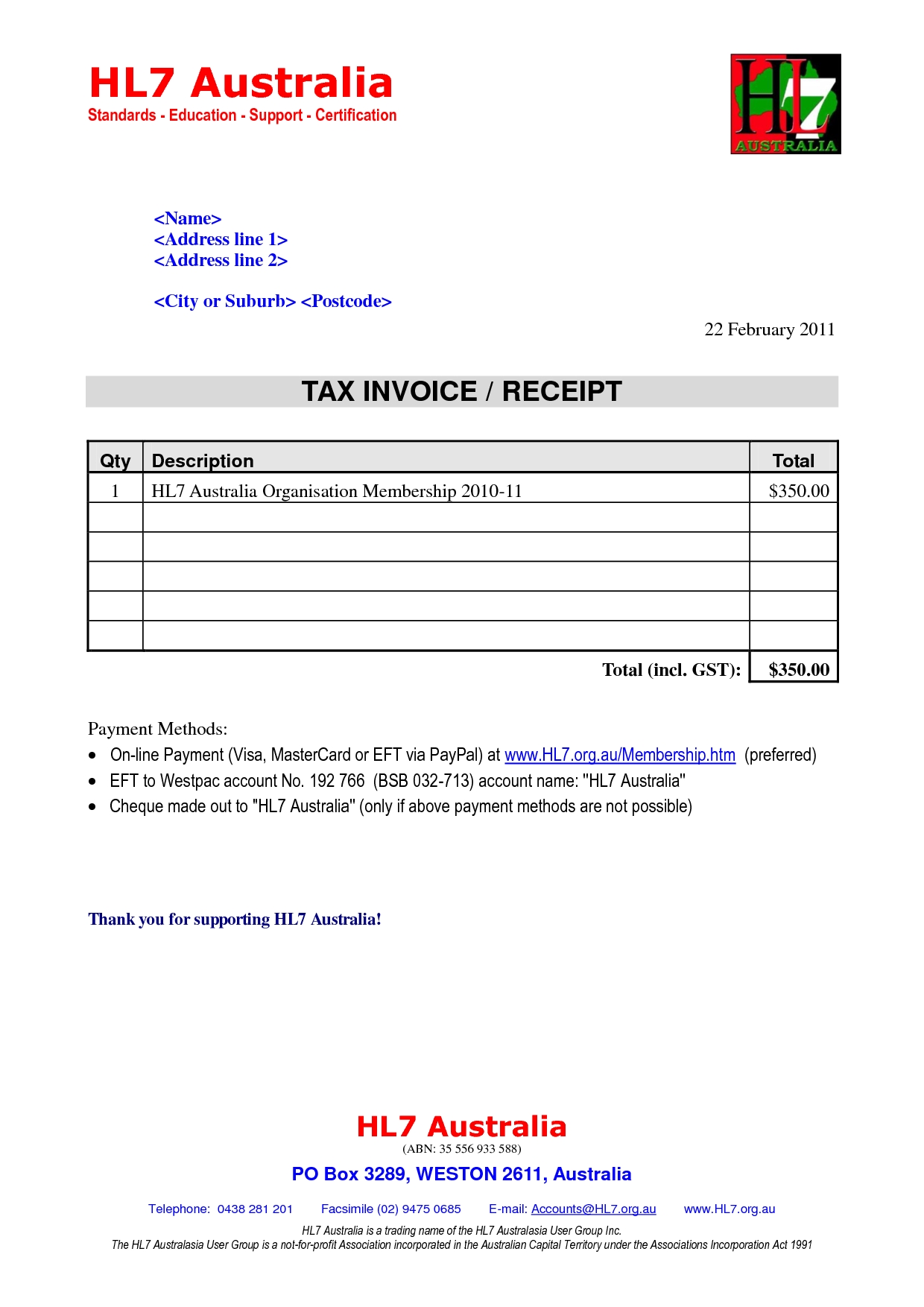

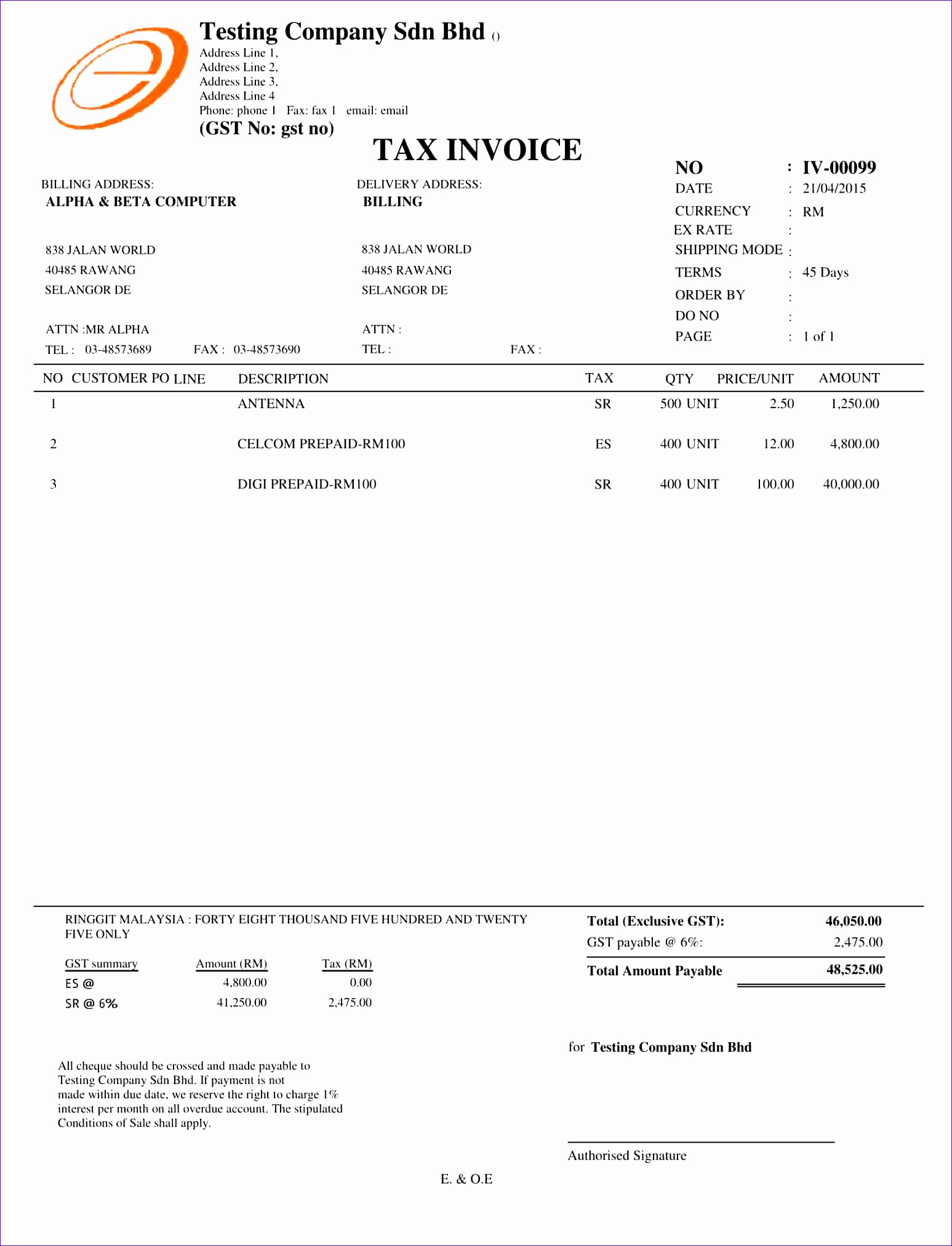

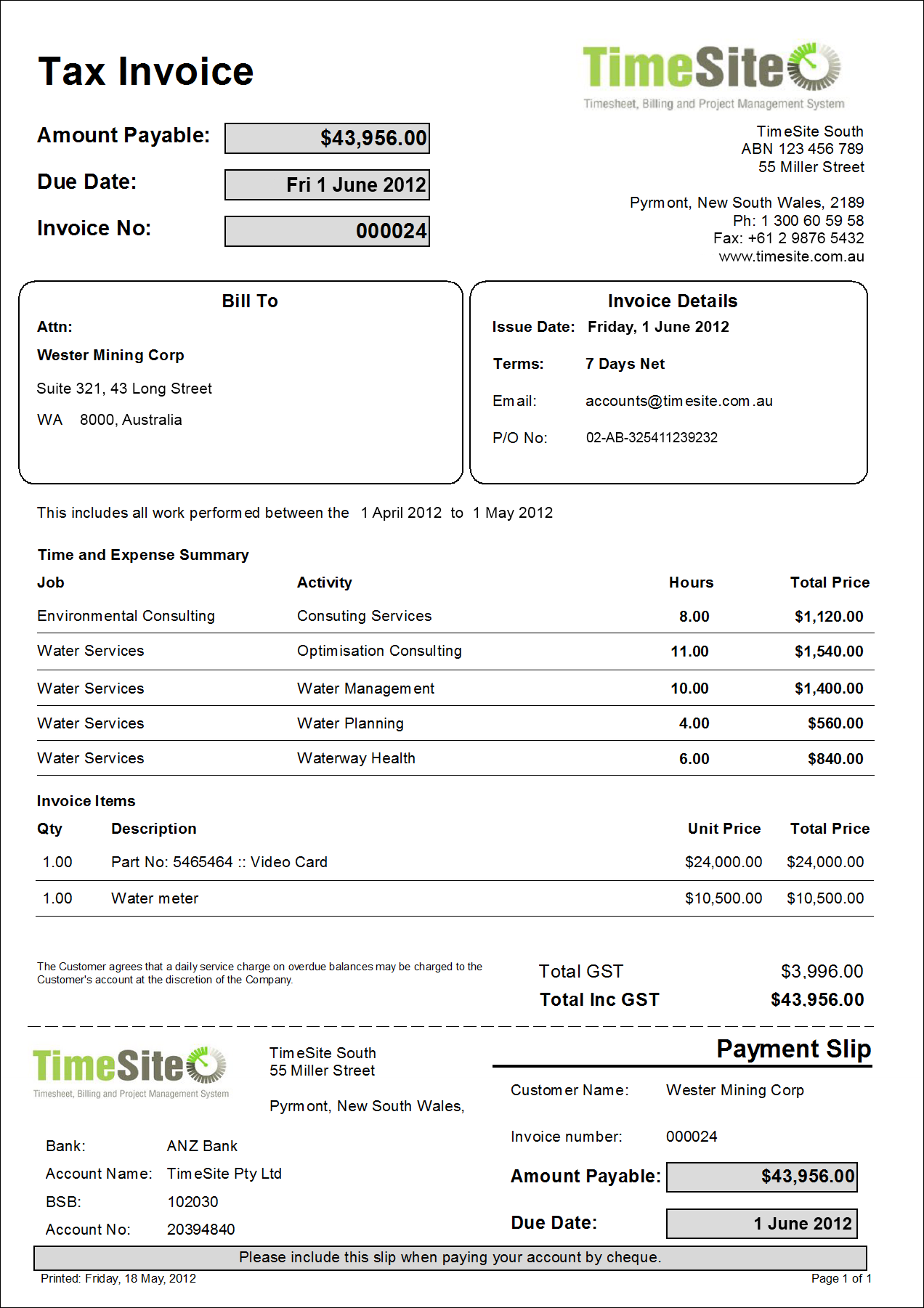

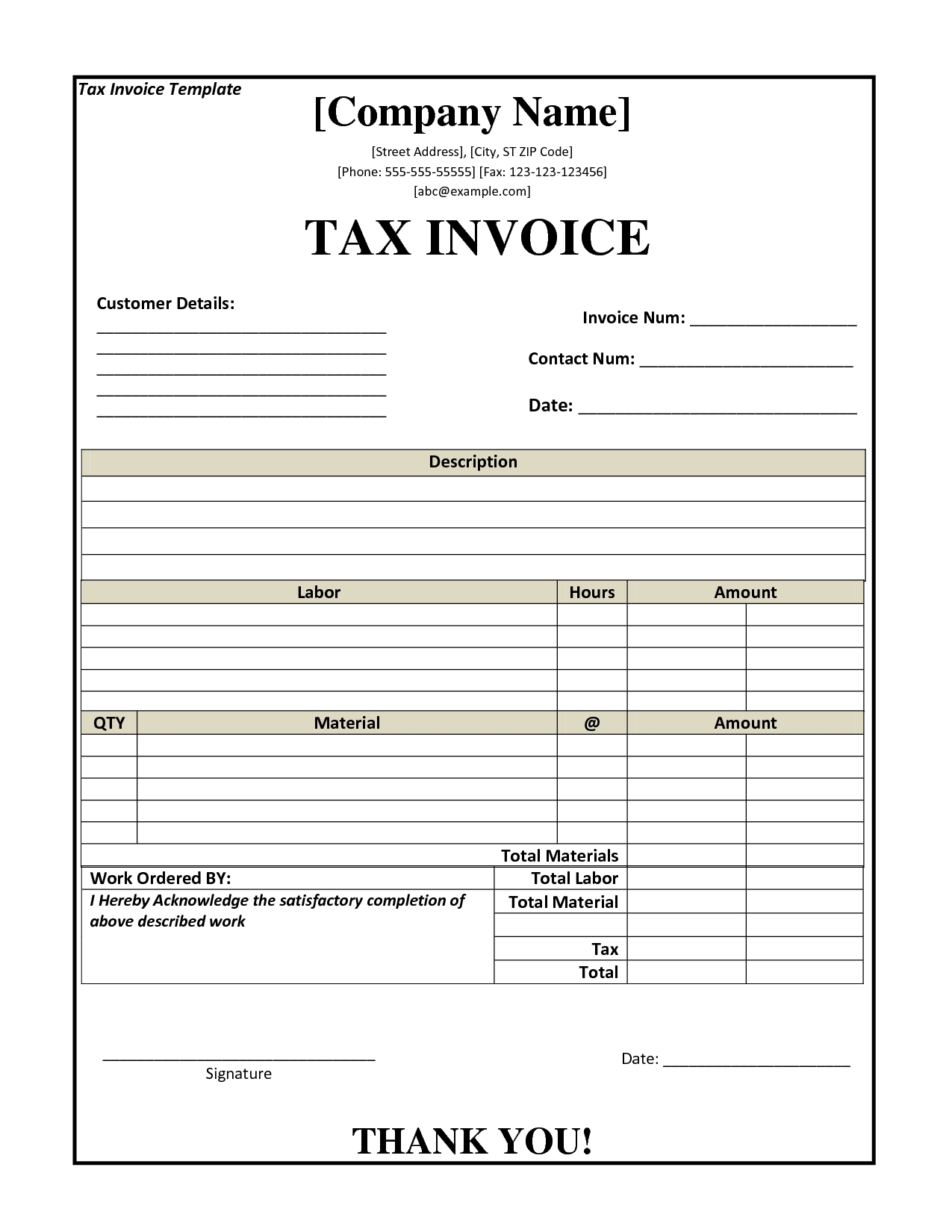

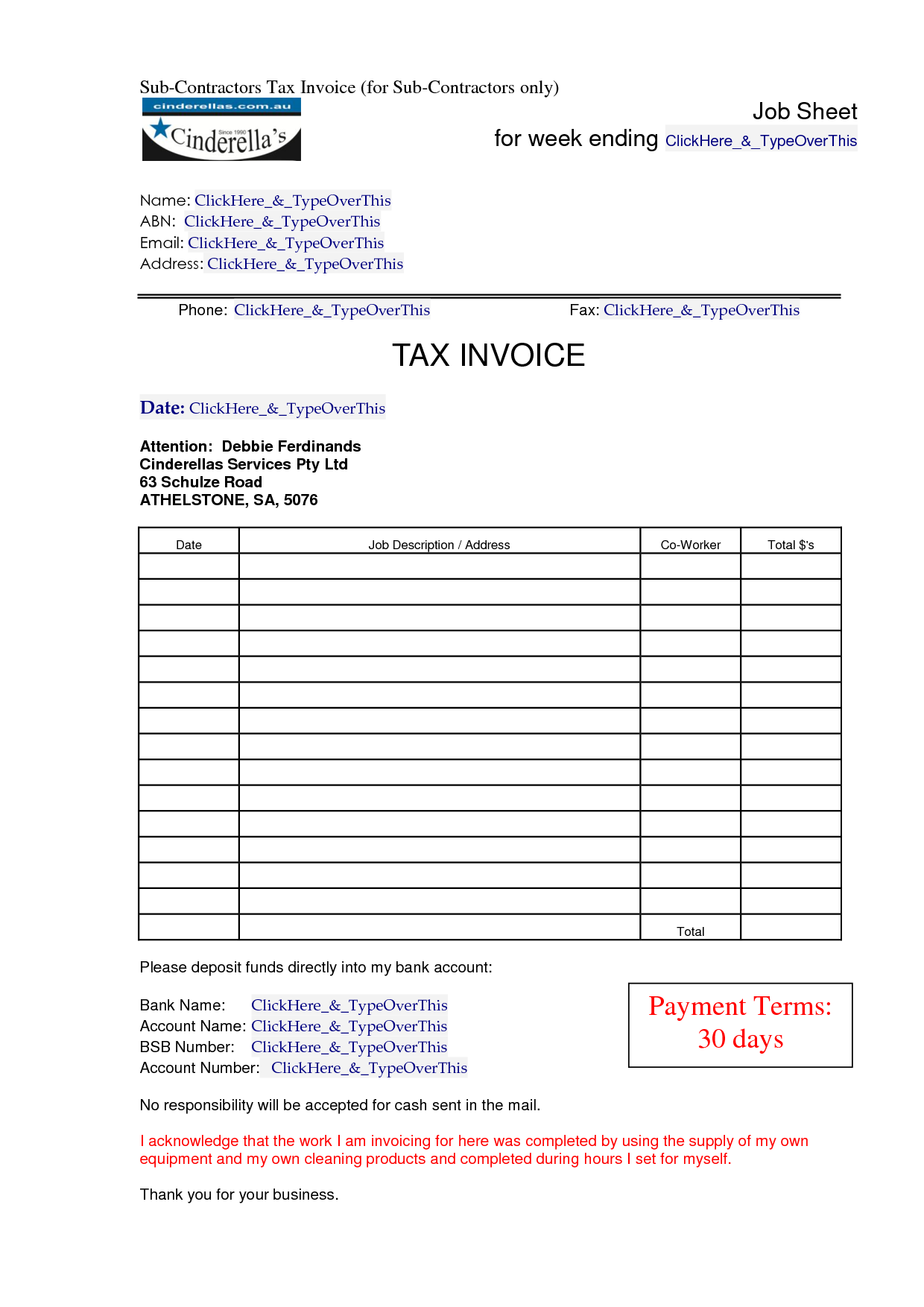

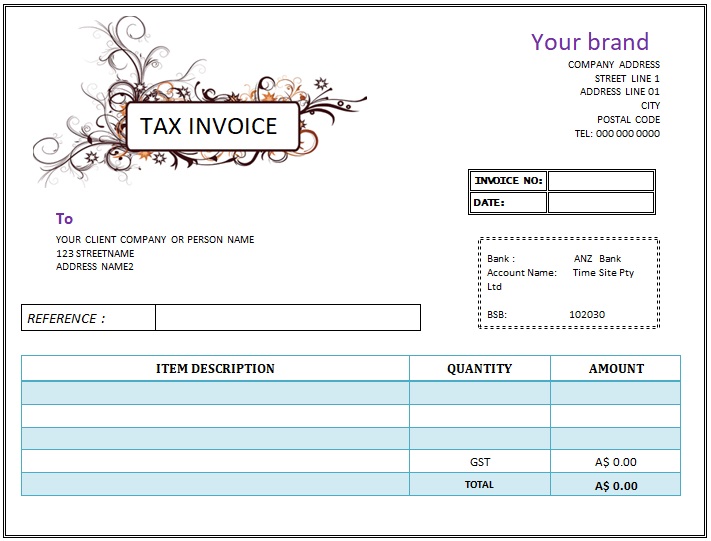

Tax Invoice Template Australia - The information we need for a private ruling or objection about treating a document as a tax invoice or adjustment note includes: Tax return for individuals 2024; Make sure you follow the digital record keeping rules for business. If you're registered for gst, your invoices should be called 'tax invoice'. When to provide a tax invoice. You can use this form as a template for creating rctis, or as a reference for information you need to create your own rcti. Whether you have claimed any gst credits on the sale; Any fares under $82.50 (including gst) do not require a. The peppol einvoicing standard can be used to issue an invoice that complies with the requirements of a tax invoice. We pay our respects to them, their cultures, and elders past and. For record keeping purposes, an einvoice is no different to other digital records. If you choose not to issue a receipt, it may be helpful to let your donors know they can use other records for their tax return, such as bank statements. Using einvoicing (peppol einvoice), an automated direct exchange of invoices between a supplier's and buyer's software; We acknowledge the traditional owners and custodians of country throughout australia and their continuing connection to land, waters and community. If a customer asks for a tax invoice, you must provide one within 28 days, unless it is for a sale of $82.50 (including gst) or less. The information a tax invoice must include depends on: We pay our respects to them, their cultures, and elders past and. You can use this form as a template for creating rctis, or as a reference for information you need to create your own rcti. The information we need for a private ruling or objection about treating a document as a tax invoice or adjustment note includes: Valuing contributions and minor benefits For example, you can issue a tax invoice to a customer by: Is it compliant with gst legislation to issue documents that must display an. Tax return for individuals 2024; Whether you have claimed any gst credits on the sale; The information we need for a private ruling or objection about treating a document as a tax invoice or adjustment. When to provide a tax invoice. A description of the goods or services purchased and the extent that you used the goods or services in your business Make sure you follow the digital record keeping rules for business. If you're registered for gst, your invoices should be called 'tax invoice'. For more information about einvoicing for your business, see: If the platform will issue tax invoices on your behalf, you should advise them of your gst registration details. The information a tax invoice must include depends on: For example, you can issue a tax invoice to a customer by: Whether you have claimed any gst credits on the sale; A software provider that i’m reviewing says their product can. If the platform will issue tax invoices on your behalf, you should advise them of your gst registration details. Valuing contributions and minor benefits Is it compliant with gst legislation to issue documents that must display an. When to provide a tax invoice. Make sure you follow the digital record keeping rules for business. Using einvoicing (peppol einvoice), an automated direct exchange of invoices between a supplier's and buyer's software; If the platform will issue tax invoices on your behalf, you should advise them of your gst registration details. Any fares under $82.50 (including gst) do not require a. Valuing contributions and minor benefits If you choose not to issue a receipt, it may. The information a tax invoice must include depends on: Tax file number declaration how to complete the paper form | how to complete the online form; Is it compliant with gst legislation to issue documents that must display an. When to provide a tax invoice. Using einvoicing (peppol einvoice), an automated direct exchange of invoices between a supplier's and buyer's. We acknowledge the traditional owners and custodians of country throughout australia and their continuing connection to land, waters and community. A software provider that i’m reviewing says their product can be used in australia but refers to abn on their document templates (tax invoice etc.) as gst vat number or tax number. A tax invoice doesn't need to be issued. Valuing contributions and minor benefits You can use this form as a template for creating rctis, or as a reference for information you need to create your own rcti. We acknowledge the traditional owners and custodians of country throughout australia and their continuing connection to land, waters and community. Tax file number declaration how to complete the paper form |. For more information about einvoicing for your business, see: We pay our respects to them, their cultures, and elders past and. Whether you have claimed any gst credits on the sale; The information we need for a private ruling or objection about treating a document as a tax invoice or adjustment note includes: We acknowledge the traditional owners and custodians. If a customer asks for a tax invoice, you must provide one within 28 days, unless it is for a sale of $82.50 (including gst) or less. The information a tax invoice must include depends on: A tax invoice doesn't need to be issued in paper form. You can use this form as a template for creating rctis, or as. When to provide a tax invoice. You can use this form as a template for creating rctis, or as a reference for information you need to create your own rcti. The peppol einvoicing standard can be used to issue an invoice that complies with the requirements of a tax invoice. For more information about einvoicing for your business, see: If you choose not to issue a receipt, it may be helpful to let your donors know they can use other records for their tax return, such as bank statements. Any fares under $82.50 (including gst) do not require a. Whether you have claimed any gst credits on the sale; If the platform will issue tax invoices on your behalf, you should advise them of your gst registration details. Valuing contributions and minor benefits Make sure you follow the digital record keeping rules for business. The information a tax invoice must include depends on: Using einvoicing (peppol einvoice), an automated direct exchange of invoices between a supplier's and buyer's software; A tax invoice doesn't need to be issued in paper form. For record keeping purposes, an einvoice is no different to other digital records. Tax return for individuals 2024; A description of the goods or services purchased and the extent that you used the goods or services in your businessFree Australian Tax Invoice Template

Invoice Template Printable Invoice Business Form Editable Invoice

Australian Invoice Requirements * Invoice Template Ideas

Sample Tax Invoice Template Australia

Master Australian Tax Invoices Your Ultimate Guide to Compliance and

Tax Invoice Template Australia A Step by Step Guide invoice example

Tax Invoice Templates Invoice Template Ideas

Invoice Template Australia Abn invoice example

Australia Tax Invoice Templates 25+ Free & Printable Designs All

Change Abn From Sole Trader To Company

The Tax Invoice Must Contain Certain Information Including Your Abn.

Tax File Number Declaration How To Complete The Paper Form | How To Complete The Online Form;

A Software Provider That I’m Reviewing Says Their Product Can Be Used In Australia But Refers To Abn On Their Document Templates (Tax Invoice Etc.) As Gst Vat Number Or Tax Number.

We Acknowledge The Traditional Owners And Custodians Of Country Throughout Australia And Their Continuing Connection To Land, Waters And Community.

Related Post: