Template Dispute Letter To Collection Agency

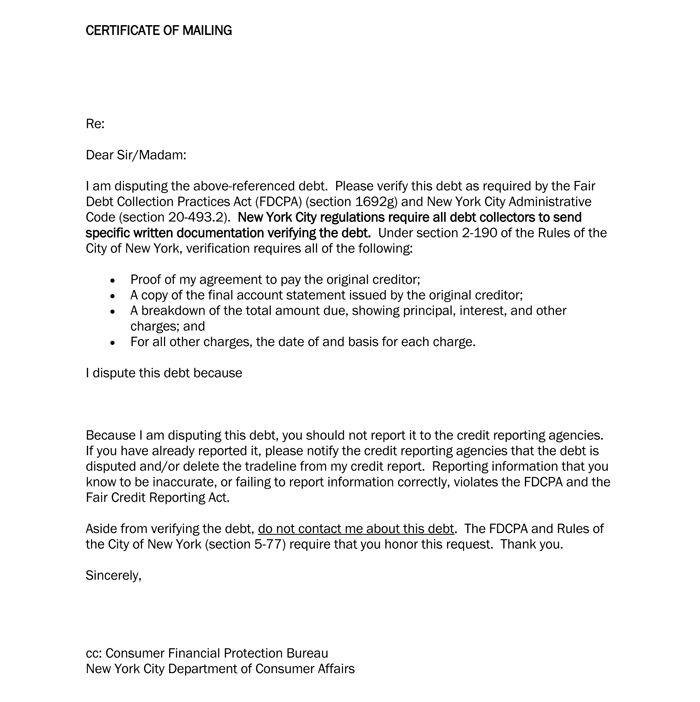

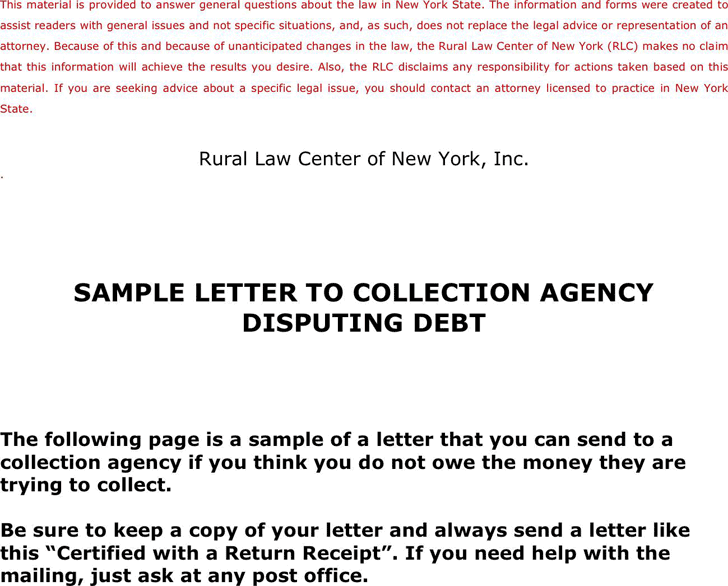

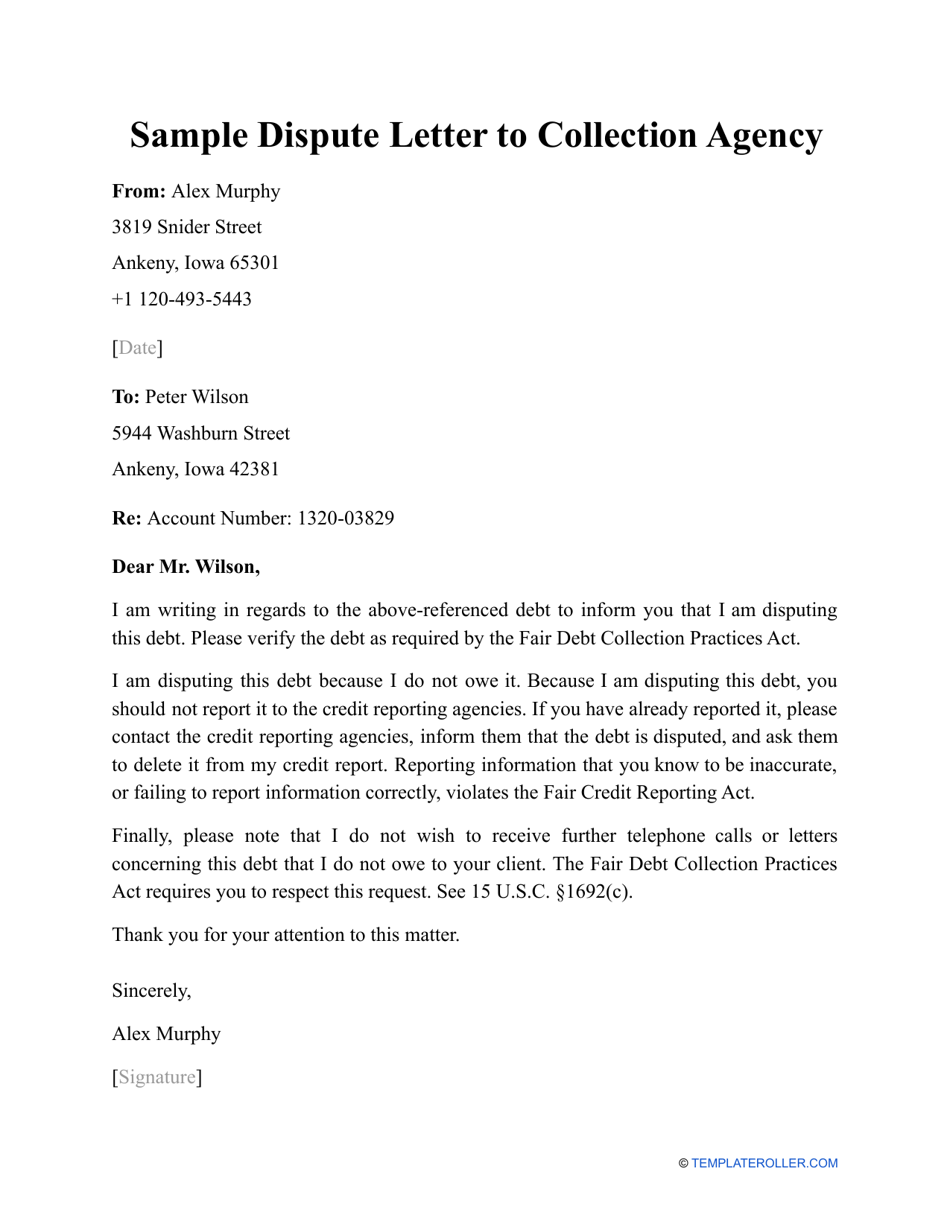

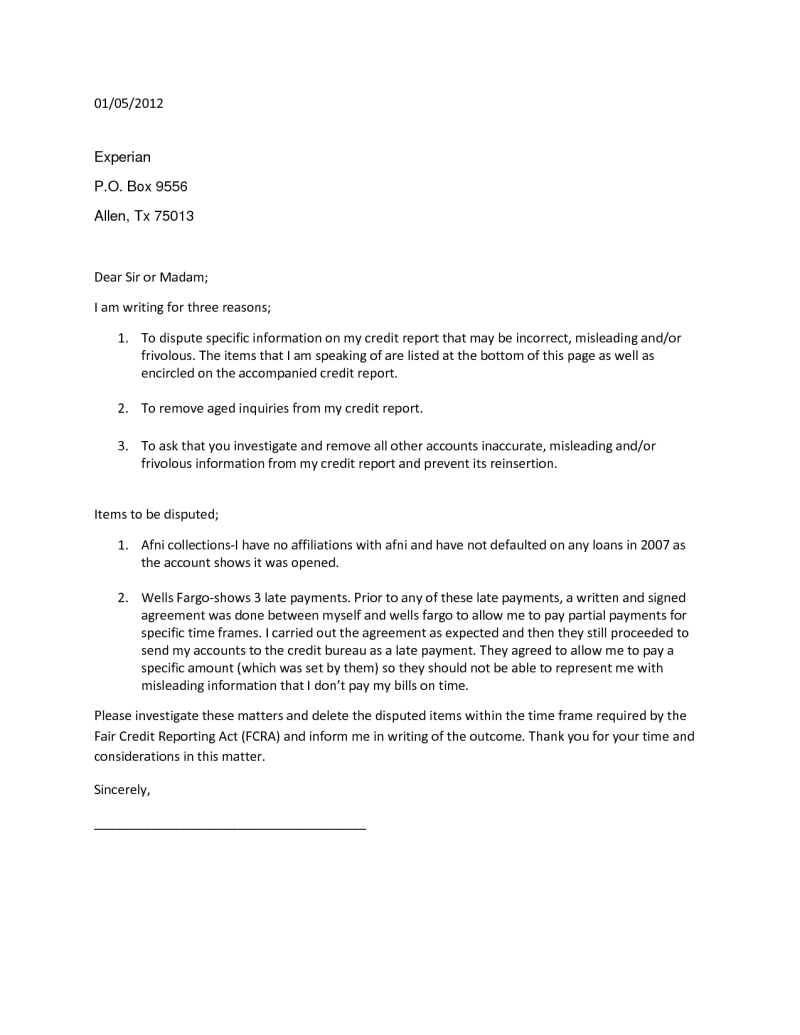

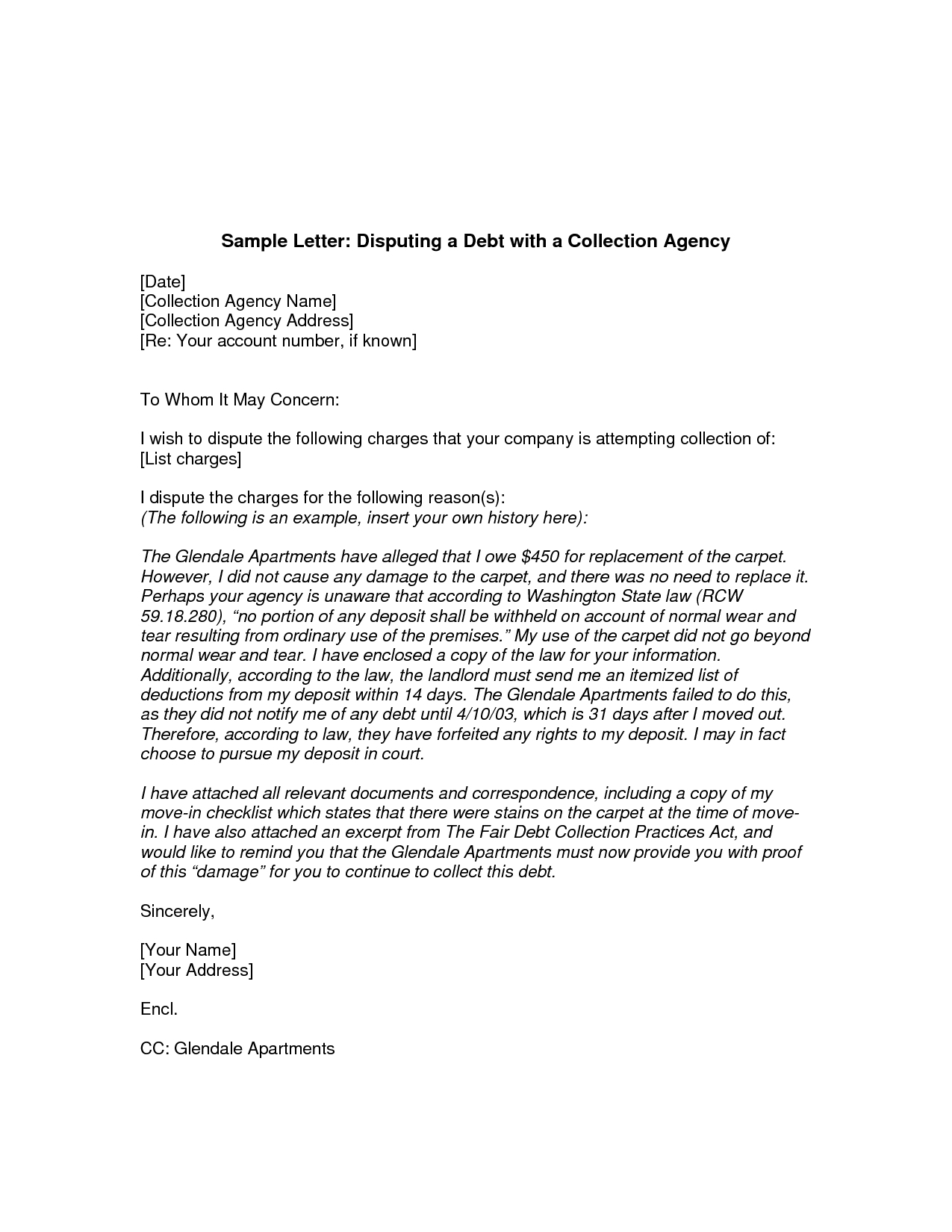

Template Dispute Letter To Collection Agency - Easily create a professional dispute letter to a collection agency with our free online template. By following the steps outlined in this guide. If you believe the debt is invalid or there are errors, write a dispute letter to the debt collector. In this article, we’ll show you how to write one. The following page is a sample of a letter that you can send to a collection agency if you think you do not owe the money they are trying to collect. Send a written dispute letter: Writing a powerful letter is crucial for fixing errors on your credit report, stopping collection calls, and resolving disputes fairly. Your account number, if known] to whom it may concern: Protect your rights and dispute errors on your credit report today. A demand letter is a formal written notice sent by a creditor or a collection agency to a debtor, requesting payment of an outstanding debt. Purpose of sending the letter: Use this letter to dispute a debt and to tell a collector to stop contacting you. I am aware of my rights under the fair debt collection. I am writing to dispute the validity of the debt associated with [account number], which i have been contacted about by your agency. If you send this letter within 30 days from the date you first receive a debt collection letter, the debt collector must. Be sure to keep a copy of your letter and. If a consumer does not think the debt is theirs, thinks that the amount is incorrect, or believes that there is some other type of error, the consumer can send the collector a dispute letter. When a debt is sold to a collection agency,. Start customizing without restrictions now! Collection verification letter to credit bureaus, round 1. Below are three unique and detailed templates for disputing a debt with a collection agency. Get the free collection agency debt dispute letter in a couple of clicks! This blank is 100% printable and editable. Dispute letter for collection agency template: Easily create a professional dispute letter to a collection agency with our free online template. These sample letters are meant to give you ideas on how to structure your own credit dispute letters. Use this letter to dispute a debt and to tell a collector to stop contacting you. With clear and concise language, it. I am aware of my rights under the fair debt collection. By following the steps outlined in this guide. Writing a powerful letter is crucial for fixing errors on your credit report, stopping collection calls, and resolving disputes fairly. The role of a demand letter in debt collection. This letter is sent to credit. Collection verification letter to credit bureaus, round 1. I am writing to dispute the validity of the debt associated with [account number], which i have. Your account number, if known] to whom it may concern: When a debt is sold to a collection agency,. Disputing a debt with a collection agency [date] [collection agency name] [collection agency address] [re: By following the steps outlined in this guide. With clear and concise language, it. If a consumer does not think the debt is theirs, thinks that the amount is incorrect, or believes that there is some other type of error, the consumer can send the collector a dispute letter. Each template includes a short introductory paragraph and is structured to. Send a written dispute letter: Writing a dispute letter to a collection agency can. In this article, we’ll show you how to write one. Each template includes a short introductory paragraph and is structured to. Get the free collection agency debt dispute letter in a couple of clicks! Use this letter to dispute a debt and to tell a collector to stop contacting you. When a debt is sold to a collection agency,. The role of a demand letter in debt collection. Purpose of sending the letter: If a consumer does not think the debt is theirs, thinks that the amount is incorrect, or believes that there is some other type of error, the consumer can send the collector a dispute letter. Learn how to write an effective collection dispute letter with our. Below are three unique and detailed templates for disputing a debt with a collection agency. A demand letter is a formal written notice sent by a creditor or a collection agency to a debtor, requesting payment of an outstanding debt. Easily create a professional dispute letter to a collection agency with our free online template. Protect your rights and dispute. If you send this letter within 30 days from the date you first receive a debt collection letter, the debt collector must. If you believe the debt is invalid or there are errors, write a dispute letter to the debt collector. Dispute letter for collection agency template: In this article, we’ll show you how to write one. Your account number,. Writing a dispute letter to a collection agency can be an effective way to address issues with your credit report or to contest a debt. With clear and concise language, it. Each template includes a short introductory paragraph and is structured to. If a consumer does not think the debt is theirs, thinks that the amount is incorrect, or believes. Easily create a professional dispute letter to a collection agency with our free online template. When a debt is sold to a collection agency,. The role of a demand letter in debt collection. Each template includes a short introductory paragraph and is structured to. Collection verification letter to credit bureaus, round 1. If you believe the debt is invalid or there are errors, write a dispute letter to the debt collector. This document is intended to be used by the debtor (the business or individual owing money) who will send the letter to the collection agency that originally contacted them to. These sample letters are meant to give you ideas on how to structure your own credit dispute letters. I am aware of my rights under the fair debt collection. With clear and concise language, it. By following the steps outlined in this guide. Purpose of sending the letter: The following page is a sample of a letter that you can send to a collection agency if you think you do not owe the money they are trying to collect. This blank is 100% printable and editable. Below are three unique and detailed templates for disputing a debt with a collection agency. Protect your rights and dispute errors on your credit report today.Dispute Collection Letter Template

Debt Collection Dispute Letter Template prntbl

Debt Dispute Letter Template Collection Letter Template Collection

Cra Dispute Letter 1 Collection Agency Credit Bureau

Sample Dispute Collection Letter

Dispute Letter To Collection Agency For Your Needs Letter Template

How to Write a Collection Dispute Letter? [With Template]

Sample Letter For Disputing A Debt Collection Notice For Your Needs

Free Sample Letter To Collection Agency Disputing Debt PDF 16KB 3

Sample Dispute Letter to Collection Agency Fill Out, Sign Online and

Disputing A Debt With A Collection Agency [Date] [Collection Agency Name] [Collection Agency Address] [Re:

I Am Writing To Dispute The Validity Of The Debt Associated With [Account Number], Which I Have Been Contacted About By Your Agency.

Learn How To Write An Effective Collection Dispute Letter With Our Guide And Templates.

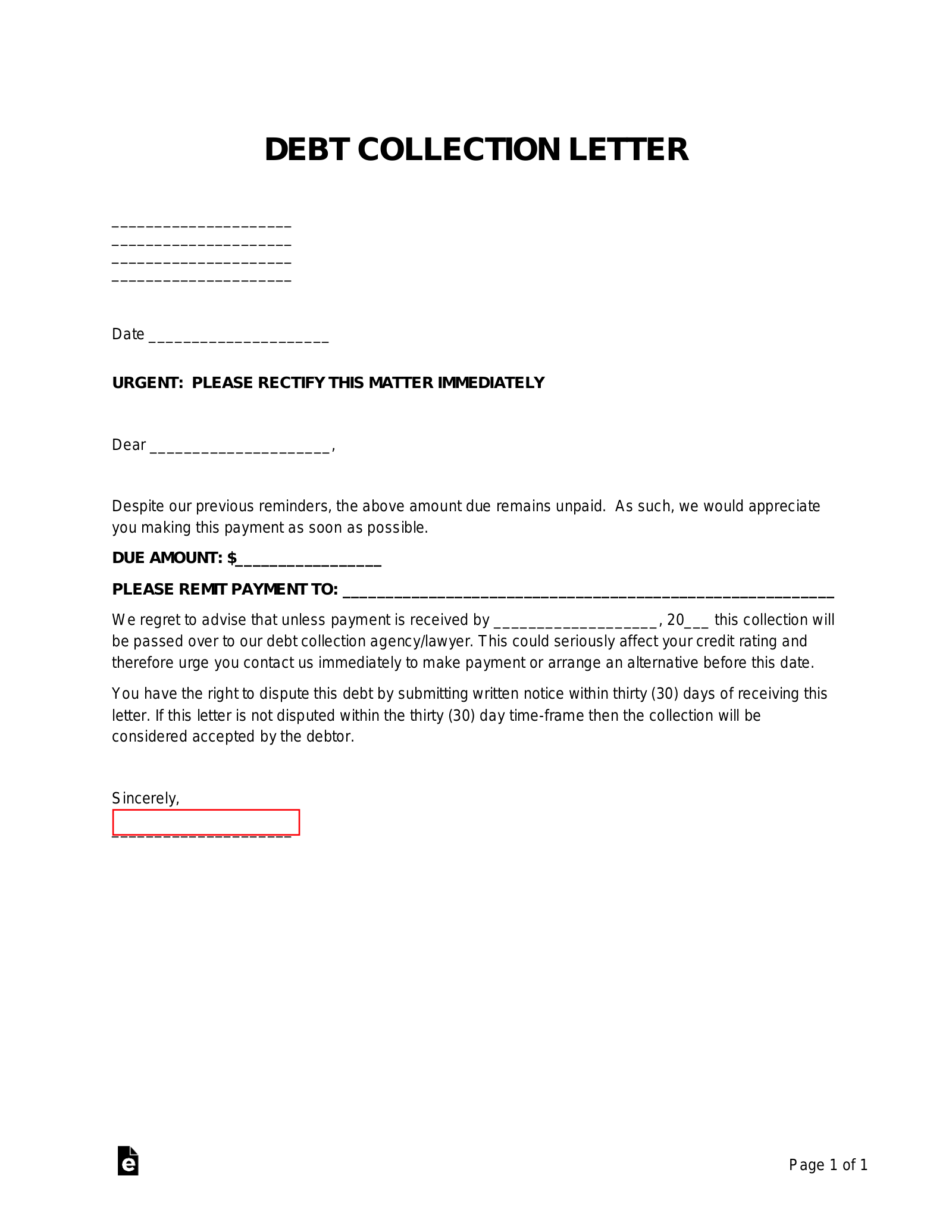

A Demand Letter Is A Formal Written Notice Sent By A Creditor Or A Collection Agency To A Debtor, Requesting Payment Of An Outstanding Debt.

Related Post:

![How to Write a Collection Dispute Letter? [With Template]](https://cdn-resources.highradius.com/resources/wp-content/uploads/2022/06/Sample-Letter-for-Debt-Collection-Dispute.png)