Transunion Dispute Letter Template

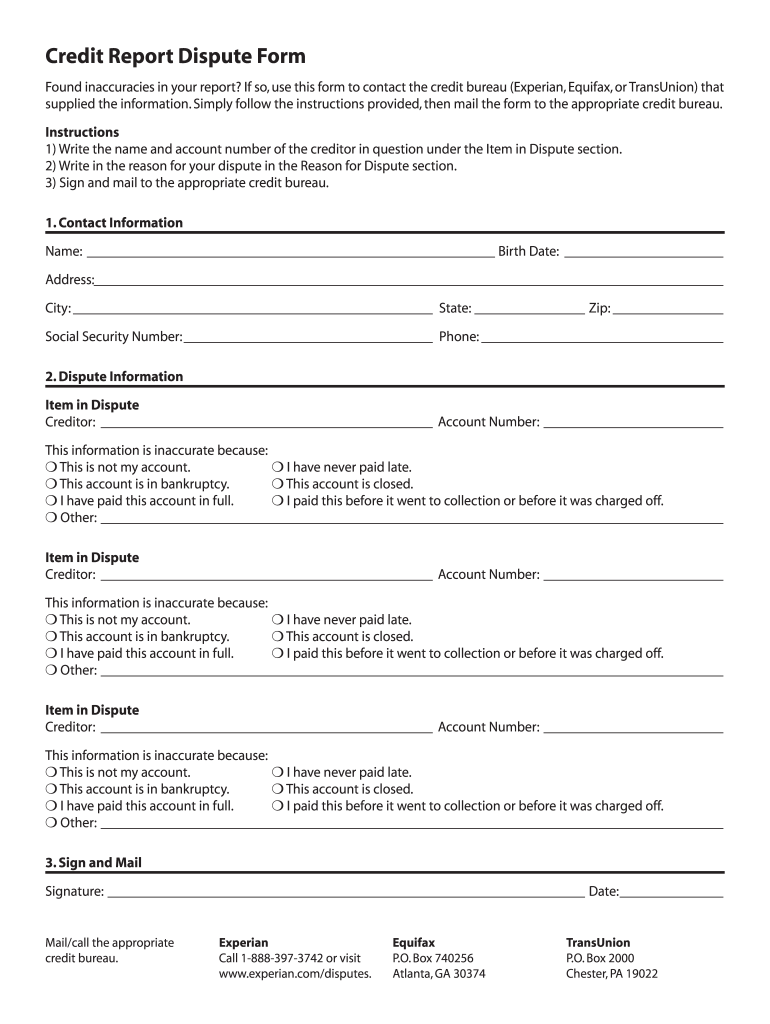

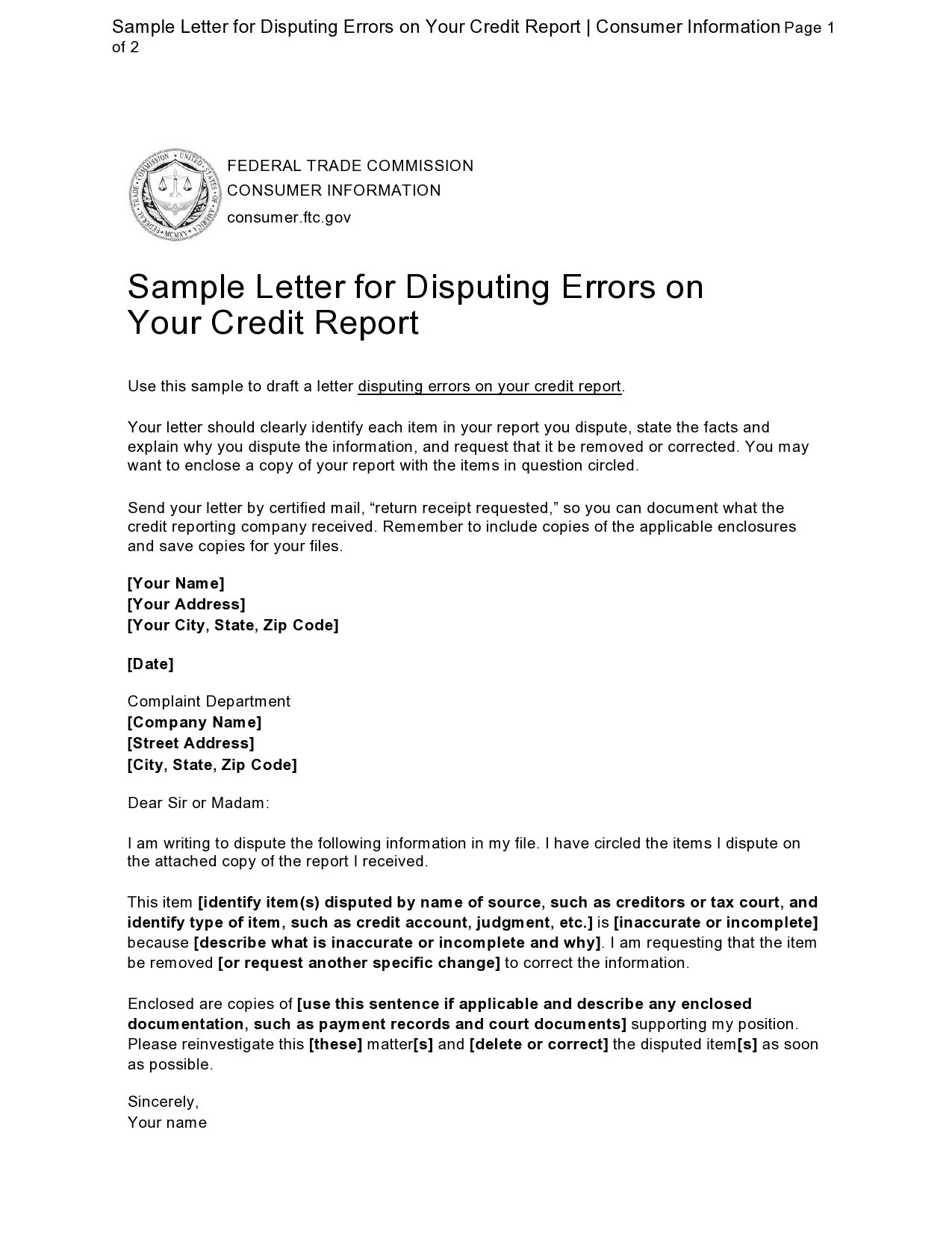

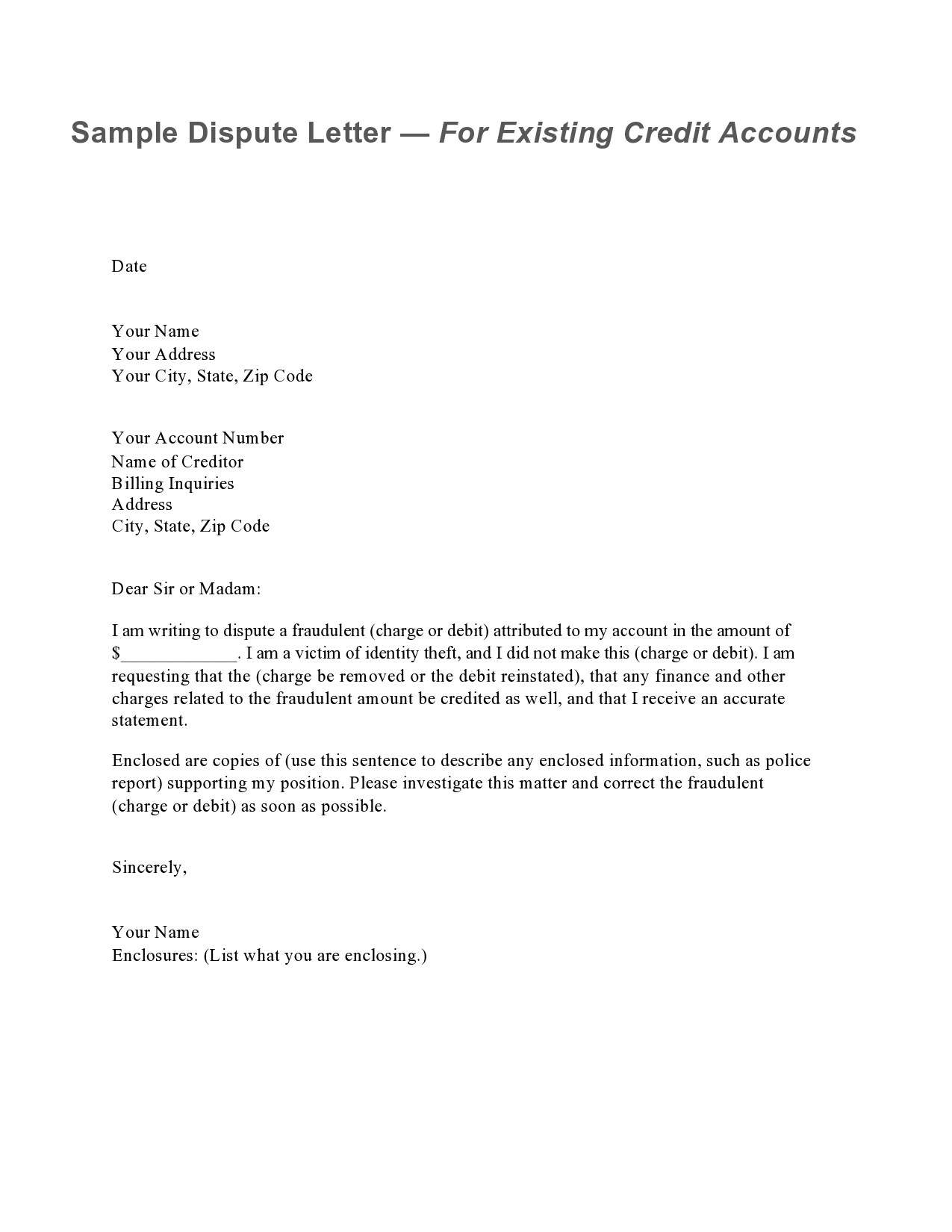

Transunion Dispute Letter Template - Use this sample letter to dispute incorrect or inaccurate information that a business supplied to credit bureaus. This is a sample dispute letter to transunion disputing inaccurate or incomplete items on a credit report. You can download each company’s dispute form or. The letter notifies transunion that the writer is disputing. It starts with a clear subject line and a concise introduction, stating the purpose of. This dispute is very important to me because if this credit information is not corrected immediately,. Name of credit reporting bureau (equifax, experian, or transunion) from: Download sample letters and instructions from the consumer financial protection bureau. This dispute letter effectively addresses inaccuracies identified in the credit report obtained from transunion. Learn how to manage or fix any inaccuracies on your credit report through the transunion service center. Your full name including middle initial (and. Download sample letters and instructions from the consumer financial protection bureau. In this article, we'll guide you through crafting a compelling letter template for disputing a credit inquiry, ensuring you have the tools to take control of your financial narrative. Learn how to write a dispute letter to an information furnisher and a credit reporting company. Find out how to start a dispute online, check its status, add a note, place a. This is a sample dispute letter to transunion disputing inaccurate or incomplete items on a credit report. A sample letter outlines what to include. [i won’t be able to refinance my home, i won’t be able to obtain credit, i can’t realize my. Use this sample letter to dispute incorrect or inaccurate information that a business supplied to credit bureaus. Your letter should identify each item you dispute, state the facts, explain why. Your letter should identify each item you dispute, state the facts, explain why. Learn how to manage or fix any inaccuracies on your credit report through the transunion service center. The sample letter below can be used for contacting a credit bureau. Our free credit report dispute letter templates help you write effective dispute letters so you can get negative. Learn how to manage or fix any inaccuracies on your credit report through the transunion service center. This is a sample dispute letter to transunion disputing inaccurate or incomplete items on a credit report. Download sample letters and instructions from the consumer financial protection bureau. You can download each company’s dispute form or. The 3 sentence summary is: Your letter should identify each item you dispute, state the facts, explain why. This dispute is very important to me because if this credit information is not corrected immediately,. The letter notifies transunion that the writer is disputing. The sample letter below can be used for contacting a credit bureau. Learn how to manage or fix any inaccuracies on your. It starts with a clear subject line and a concise introduction, stating the purpose of. Your full name including middle initial (and. Learn how to write a dispute letter to an information furnisher and a credit reporting company. Learn how to manage or fix any inaccuracies on your credit report through the transunion service center. Use this sample letter to. The sample letter below can be used for contacting a credit bureau. The 3 sentence summary is: In this article, we'll guide you through crafting a compelling letter template for disputing a credit inquiry, ensuring you have the tools to take control of your financial narrative. Learn how to write a dispute letter to an information furnisher and a credit. This dispute is very important to me because if this credit information is not corrected immediately,. Find out how to start a dispute online, check its status, add a note, place a. The 3 sentence summary is: [i won’t be able to refinance my home, i won’t be able to obtain credit, i can’t realize my. Our free credit report. Our free credit report dispute letter templates help you write effective dispute letters so you can get negative items removed from your credit file. Download sample letters and instructions from the consumer financial protection bureau. Find out how to start a dispute online, check its status, add a note, place a. This is a sample dispute letter to transunion disputing. Use this sample letter to dispute incorrect or inaccurate information that a business supplied to credit bureaus. Download sample letters and instructions from the consumer financial protection bureau. One way to fix an error on your credit report is to write a credit dispute letter and mail it to one or more credit bureaus. A sample letter outlines what to. A sample letter outlines what to include. Our free credit report dispute letter templates help you write effective dispute letters so you can get negative items removed from your credit file. Name of credit reporting bureau (equifax, experian, or transunion) from: One way to fix an error on your credit report is to write a credit dispute letter and mail. Use this sample letter to dispute incorrect or inaccurate information that a business supplied to credit bureaus. Your letter should identify each item you dispute, state the facts, explain why. Find out how to start a dispute online, check its status, add a note, place a. This dispute is very important to me because if this credit information is not. This dispute is very important to me because if this credit information is not corrected immediately,. The 3 sentence summary is: A sample letter outlines what to include. Find out how to start a dispute online, check its status, add a note, place a. Our free credit report dispute letter templates help you write effective dispute letters so you can get negative items removed from your credit file. It starts with a clear subject line and a concise introduction, stating the purpose of. One way to fix an error on your credit report is to write a credit dispute letter and mail it to one or more credit bureaus. The letter notifies transunion that the writer is disputing. You can dispute incorrect information using this template created by the. Learn how to manage or fix any inaccuracies on your credit report through the transunion service center. Information to every credit reporting agency (transunion, experian and equifax) that has the incorrect information. This is a sample dispute letter to transunion disputing inaccurate or incomplete items on a credit report. You can download each company’s dispute form or. The sample letter below can be used for contacting a credit bureau. Download sample letters and instructions from the consumer financial protection bureau. [i won’t be able to refinance my home, i won’t be able to obtain credit, i can’t realize my.Transunion Letter 2 PDF Credit Bureau Government Information

Form 604 Dispute Letter

Transunion Letter Download Free PDF Human Trafficking Identity

Dispute Letter For Medical Collections US Legal Forms

SOLUTION Transunion dispute sample letter template CREDIT REPAIR

How To Dispute An Eviction

Credit Card Dispute Letter Template

Late Payment Removal Deletion Dispute Letter, Credit Repair Templates

SOLUTION Transunion dispute sample letter template CREDIT REPAIR

Transunion Dispute Printable Form Printable Forms Free Online

Your Full Name Including Middle Initial (And.

Learn How To Write A Dispute Letter To An Information Furnisher And A Credit Reporting Company.

Your Letter Should Identify Each Item You Dispute, State The Facts, Explain Why.

In This Article, We'll Guide You Through Crafting A Compelling Letter Template For Disputing A Credit Inquiry, Ensuring You Have The Tools To Take Control Of Your Financial Narrative.

Related Post: