Trust Templates

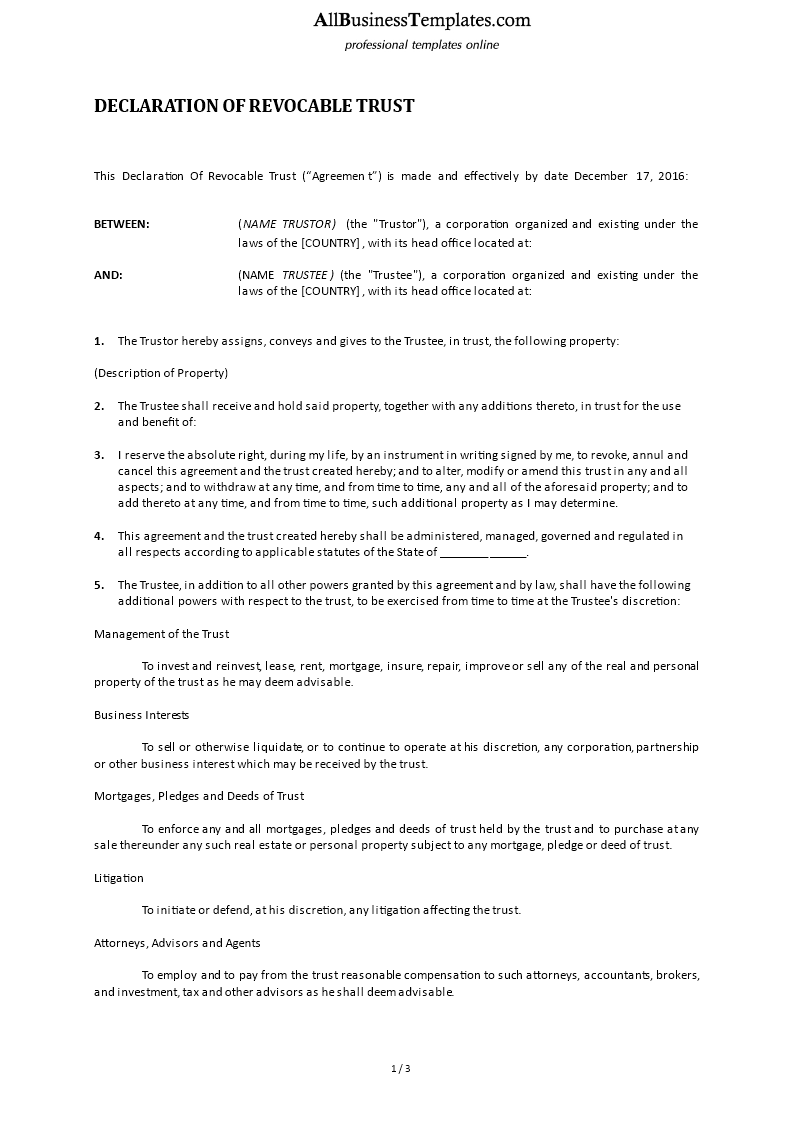

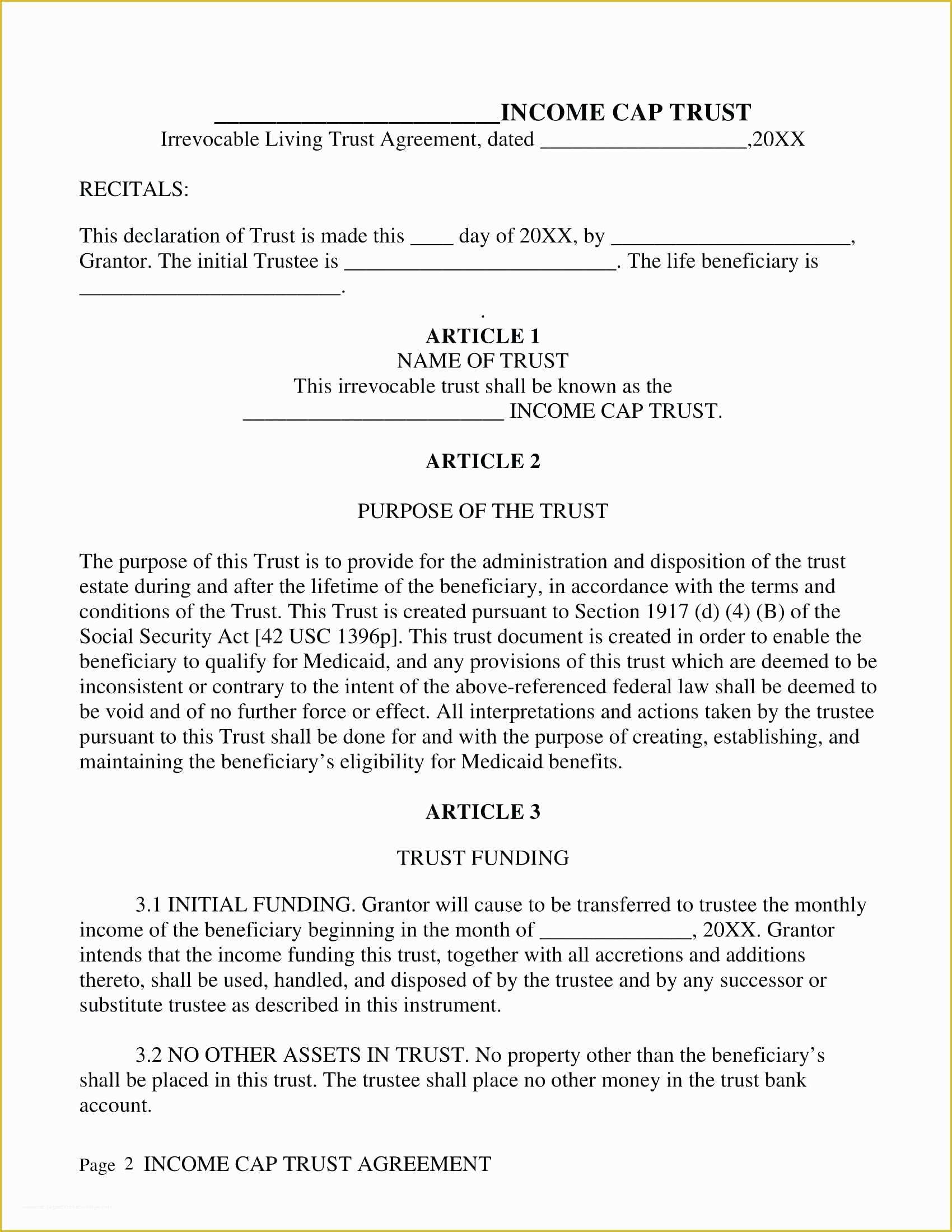

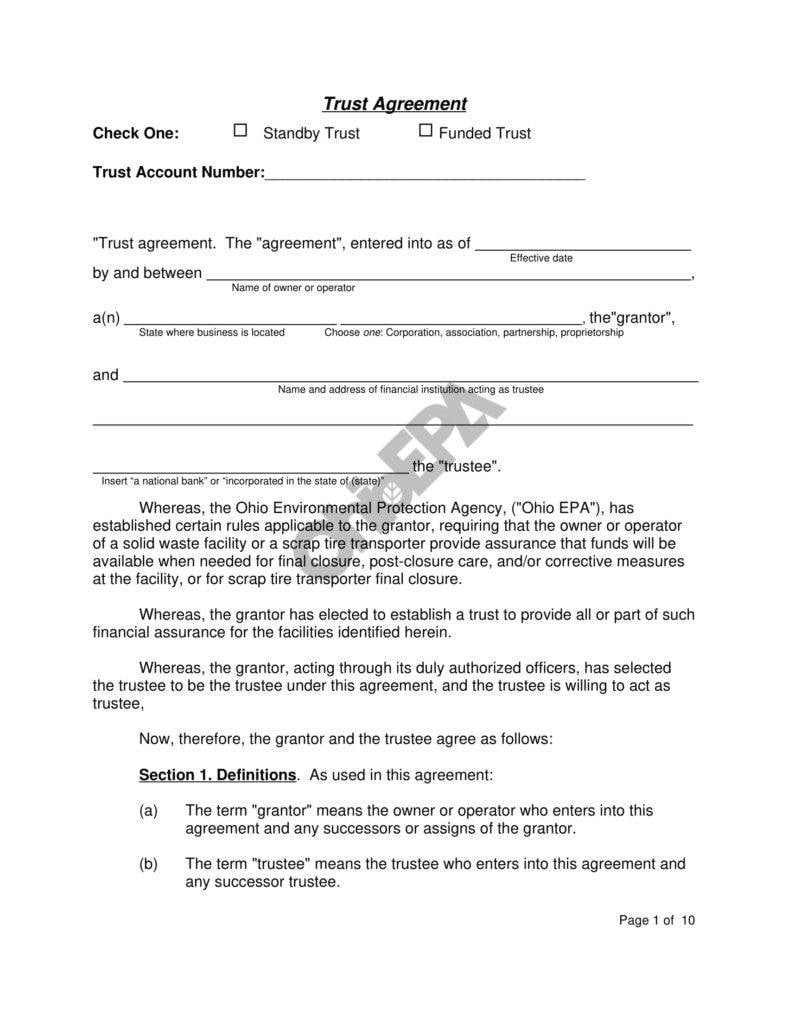

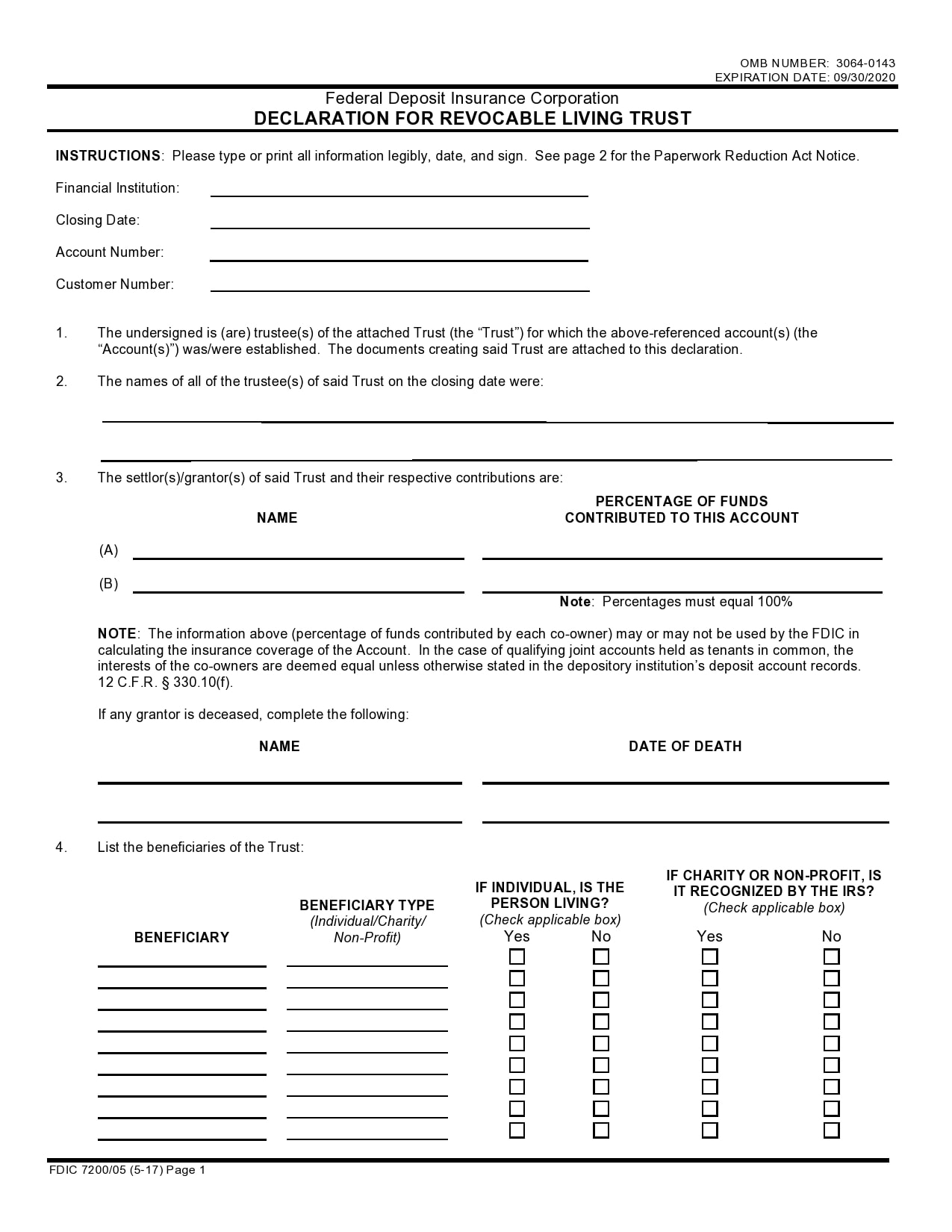

Trust Templates - These trust agreements are 100% free and will save you a ton of time! You have assets you want to be distributed quickly upon your death or incapacitation. Find the forms tailored to your specific situation down below. Creating a professional living trust agreement is not easy, but it's possible. A revocable living trust is an essential legal document that allows individuals to place their assets in a trust while still alive for their beneficiaries to inherit after their death. Setting up a revocable trust involves careful contemplation of your assets and how you wish them to be handled both during your lifetime and upon your passing. Trust and distribute trust property to the persons entitled to it. In regards to this, there are two types of forms: Still, there are other documents that you can use with living trust forms: A living trust, also known as a revocable trust, is an agreement created by a person, known as the grantor, to hold some portion of their assets during their lifetime. Creating a professional living trust agreement is not easy, but it's possible. These trust agreements are 100% free and will save you a ton of time! Trust forms are documents that serve as a drafting resource for a range of estate planning scenarios. Protect assets, expedite distribution to beneficiaries, and safeguard. Establish your revocable living trust seamlessly. However, a revocable trust does not offer the tax benefits and asset protection benefits that an irrevocable trust does, though it does still allow for the avoidance of probate. Create your document with ease and avoid going to court. There are also free printable living trust forms available. A living trust, also known as a revocable trust, is an agreement created by a person, known as the grantor, to hold some portion of their assets during their lifetime. Find the forms tailored to your specific situation down below. You have assets you want to be distributed quickly upon your death or incapacitation. Who will place assets or property into this living trust? All of our trust forms are available in microsoft word and pdf. There are many cases where you can establish a trust with just a living trust template. Trust forms are documents that serve as a. You have assets you want to be distributed quickly upon your death or incapacitation. All of our trust forms are available in microsoft word and pdf. Living trusts come in different types, usually dependent on their capacity to be changed once initiated. The agreement should state that the grantor is making a trust for the sake of the beneficiaries. Trust. Find the forms tailored to your specific situation down below. Setting up a revocable trust involves careful contemplation of your assets and how you wish them to be handled both during your lifetime and upon your passing. Living trusts come in different types, usually dependent on their capacity to be changed once initiated. There are also free printable living trust. Templates for revocation and amendment agreement, land trust agreement, property release, beneficiary agreement, amended and restated property, revocable living trust agreement,. These trust agreements are 100% free and will save you a ton of time! However, a revocable trust does not offer the tax benefits and asset protection benefits that an irrevocable trust does, though it does still allow for. Trust forms are documents that serve as a drafting resource for a range of estate planning scenarios. It should include all the assets and. A revocable living trust is an essential legal document that allows individuals to place their assets in a trust while still alive for their beneficiaries to inherit after their death. Who will place assets or property. Setting up a revocable trust involves careful contemplation of your assets and how you wish them to be handled both during your lifetime and upon your passing. Protect assets, expedite distribution to beneficiaries, and safeguard. Trust and distribute trust property to the persons entitled to it. Living trusts come in different types, usually dependent on their capacity to be changed. A living trust, also known as a revocable trust, is an agreement created by a person, known as the grantor, to hold some portion of their assets during their lifetime. Create your document with ease and avoid going to court. Living trusts come in different types, usually dependent on their capacity to be changed once initiated. Find the forms tailored. Given below are the steps to set up a revocable living trust: A living trust (or inter vivos trust) is a legal document allowing an individual (grantor) to place assets under the management of a trustee, who can be the grantor or. Who will place assets or property into this living trust? Setting up a revocable trust involves careful contemplation. These trust agreements are 100% free and will save you a ton of time! Setting up a revocable trust involves careful contemplation of your assets and how you wish them to be handled both during your lifetime and upon your passing. Still, there are other documents that you can use with living trust forms: A revocable living trust is an. Create your document with ease and avoid going to court. A living trust, also known as a revocable trust, is an agreement created by a person, known as the grantor, to hold some portion of their assets during their lifetime. All of our trust forms are available in microsoft word and pdf. It helps shopify merchants set customer expectations, reduce. You have assets you want dispersed privately. Trust forms are documents that serve as a drafting resource for a range of estate planning scenarios. Living trusts come in different types, usually dependent on their capacity to be changed once initiated. Find the forms tailored to your specific situation down below. There are many cases where you can establish a trust with just a living trust template. Protect assets, expedite distribution to beneficiaries, and safeguard. Establish your revocable living trust seamlessly. Who will place assets or property into this living trust? The agreement should state that the grantor is making a trust for the sake of the beneficiaries. In regards to this, there are two types of forms: Why use 360 legal forms for your revocable living trust? Trust and distribute trust property to the persons entitled to it. It should include all the assets and. Create your document with ease and avoid going to court. A living trust (or inter vivos trust) is a legal document allowing an individual (grantor) to place assets under the management of a trustee, who can be the grantor or. However, a revocable trust does not offer the tax benefits and asset protection benefits that an irrevocable trust does, though it does still allow for the avoidance of probate.Declaration Of Revocable Trust Templates at

Free Printable Revocable Trust Form (GENERIC)

Revocable Trust Template Free

18+ Trust Agreement Templates PDF, Word Free & Premium Templates

FREE 10+ Sample Living Trust Form Templates in PDF Word

50 Professional Trust Agreement Templates [& Forms] ᐅ TemplateLab

FREE 10+ Sample Living Trust Form Templates in PDF Word

Printable Revocable Living Trust Form Printable Forms Free Online

34 Free Living Trust Forms ( & Documents) ᐅ TemplateLab

Free Printable Living Trust Templates [PDF] Irrevocable

Delegate Duties And Powers, Including Hiring And/Or Employing Accounts, Lawyers, And Other Experts.

Find A Suitable Living Trust Template For Your Needs Among Our Comprehensive Collection Of 34 Revocable Living Trust Forms.

You Have Assets You Want To Be Distributed Quickly Upon Your Death Or Incapacitation.

It Helps Shopify Merchants Set Customer Expectations, Reduce Support Inquiries, And Build Trust By Clearly Communicating Important Shipping And Return Details.

Related Post:

![50 Professional Trust Agreement Templates [& Forms] ᐅ TemplateLab](http://templatelab.com/wp-content/uploads/2019/03/trust-agreement-15.jpg?w=395)

![Free Printable Living Trust Templates [PDF] Irrevocable](https://www.typecalendar.com/wp-content/uploads/2023/06/Download-Free-Living-Trust-Word-Document.jpg)