Wisp Template For Tax Professionals

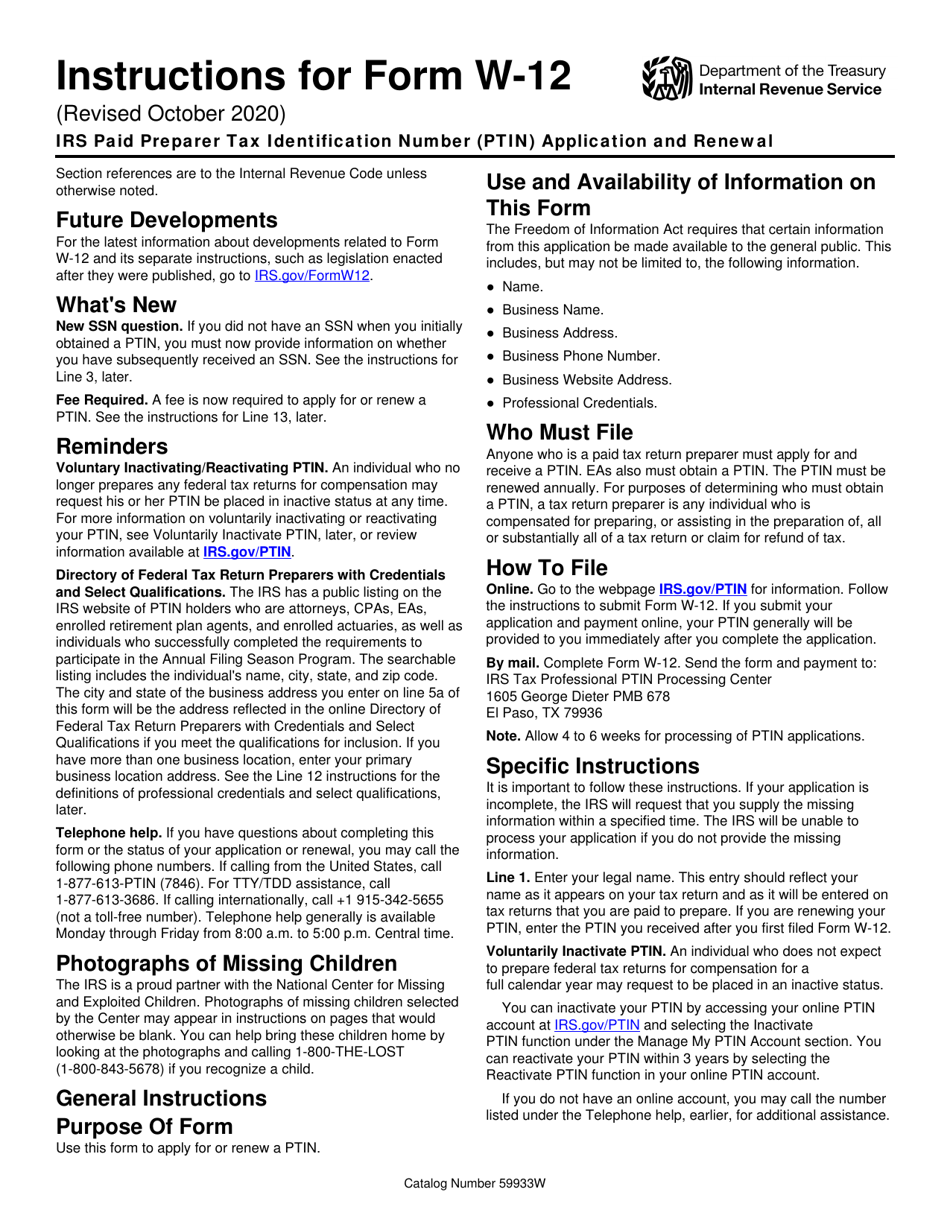

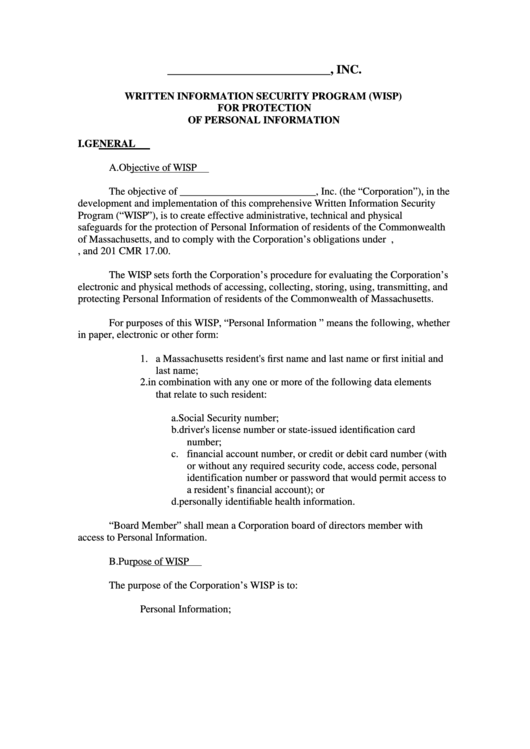

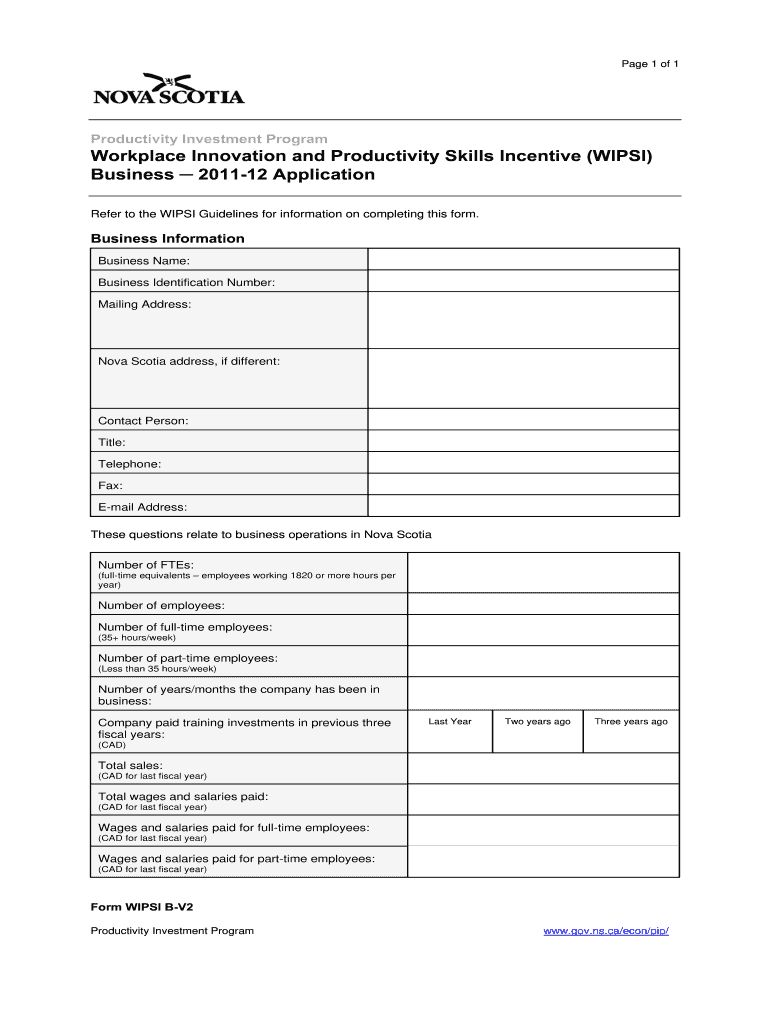

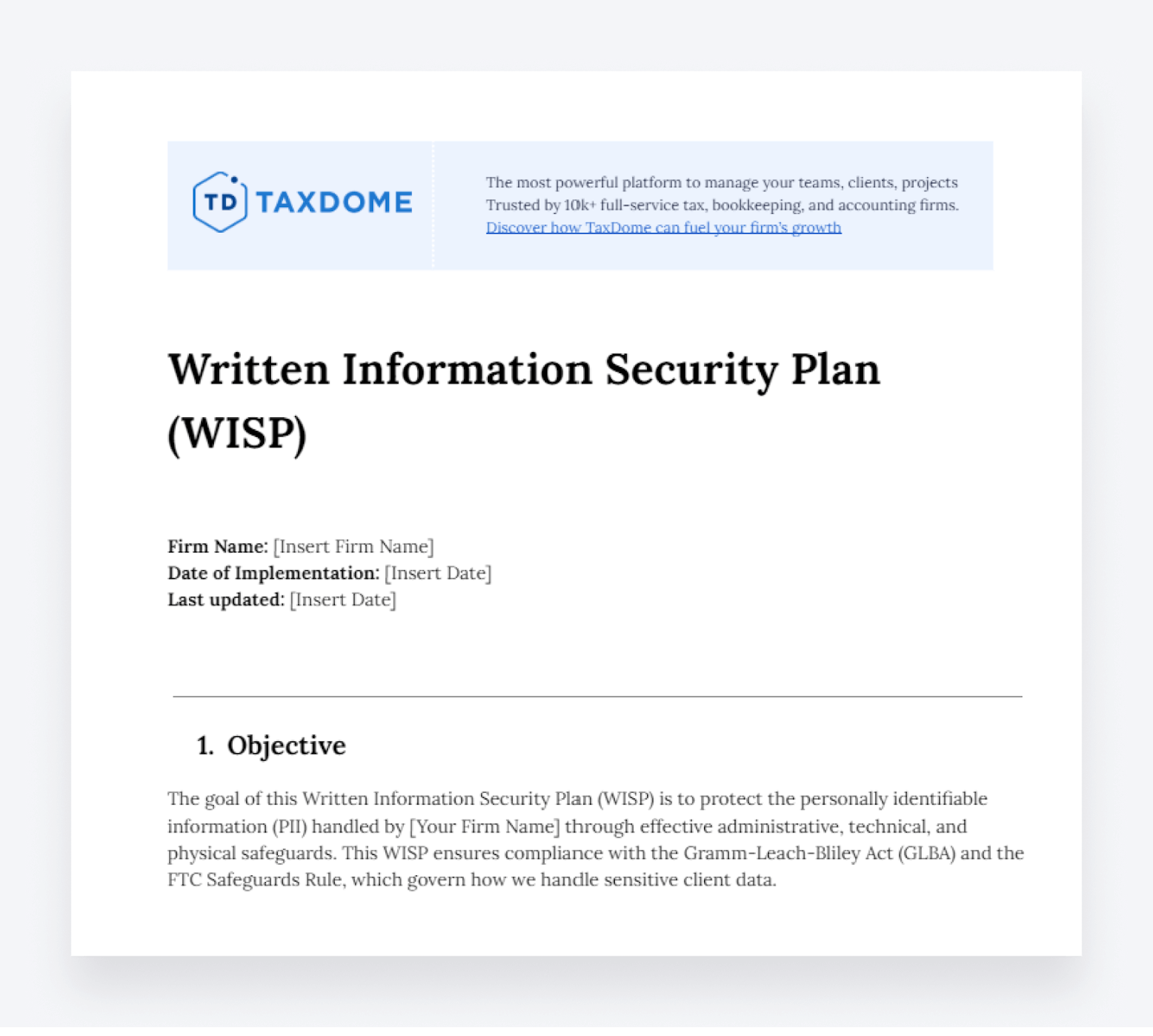

Wisp Template For Tax Professionals - Not only is a wisp essential for your business and a good business practice, the. This file provides comprehensive instructions and guidelines for creating a written information security plan (wisp) tailored for tax and accounting practices. Ease the compliance burden and protect your clients and your firm with a free, customizable wisp template from tech 4 accountants. The wisp template is required for tax professionals by the irs and helps to ensure that important records are accurate and available, allowing the person filing their taxes the best knowledge. Ongoing support and updates to keep your wisp current; The wisp template includes a range of features that can help tax professionals work more efficiently. That's why we've created a simple and easy tool that helps you build a wisp tailored. Wisp builder starts with an editable security summit template that contains essential elements, all ready to create your firm’s irs wisp! At protection plus, we want to ensure that tax and accounting professionals are protected from all angles. Tax pros need a written information security plan (wisp) for irs compliance and data protection. Federal mandates require that every. We’ve developed a comprehensive wisp template for tax professionals that you can customize for your practice. Federal law requires all professional tax preparers and accounting firms to: Ease the compliance burden and protect your clients and your firm with a free, customizable wisp template from tech 4 accountants. Tax pros need a written information security plan (wisp) for irs compliance and data protection. Not only is a wisp essential for your business and a good business practice, the. That's why we've created a simple and easy tool that helps you build a wisp tailored. The wisp template includes a range of features that can help tax professionals work more efficiently. At protection plus, we want to ensure that tax and accounting professionals are protected from all angles. Ongoing support and updates to keep your wisp current; Creating a written information security plan or wisp is an often overlooked but critical component. The wisp template is required for tax professionals by the irs and helps to ensure that important records are accurate and available, allowing the person filing their taxes the best knowledge. Federal law, enforced by the federal trade commission, requires professional tax preparers to create. Ongoing support and updates to keep your wisp current; At protection plus, we want to ensure that tax and accounting professionals are protected from all angles. Discover a comprehensive guide on data security. Get a free template at erowisp.com. Creating a written information security plan or wisp is an often overlooked but critical component. We’ve developed a comprehensive wisp template for tax professionals that you can customize for your practice. Federal mandates require that every. Some of the key features include: Having a wisp protects businesses and. Not only is a wisp essential for your business and a good business practice, the. Ongoing support and updates to keep your wisp current; Or, rather than spend billable hours creating a wisp, our security experts can create one for you. The wisp template is required for tax professionals by the irs and helps to ensure that important records are accurate and available, allowing the person filing their taxes the best knowledge. Discover a 2025. Tax pros need a written information security plan (wisp) for irs compliance and data protection. We’ve developed a comprehensive wisp template for tax professionals that you can customize for your practice. Create a written information security plan or irs wisp monitor, test and maintain the irs wisp plan That's why we've created a simple and easy tool that helps you. Federal law requires all professional tax preparers and accounting firms to: Having a wisp protects businesses and. If you’re ready to get started, download the free wisp template to create your plan. Federal mandates require that every. This file provides comprehensive instructions and guidelines for creating a written information security plan (wisp) tailored for tax and accounting practices. Create a written information security plan or irs wisp monitor, test and maintain the irs wisp plan Creating a written information security plan or wisp is an often overlooked but critical component. Having a wisp protects businesses and. Or, rather than spend billable hours creating a wisp, our security experts can create one for you. Discover a 2025 complete written. Federal law requires all professional tax preparers and accounting firms to: Creating a written information security plan or wisp is an often overlooked but critical component. If you’re ready to get started, download the free wisp template to create your plan. Some of the key features include: Or, rather than spend billable hours creating a wisp, our security experts can. The security summit partners recently unveiled a special new sample security plan designed to help tax professionals, especially those with smaller practices, protect their data. Discover a 2025 complete written information security plan (wisp) template tailored for sole practitioners and ptin holders. If you’re ready to get started, download the free wisp template to create your plan. Expert guidance from. The wisp template is required for tax professionals by the irs and helps to ensure that important records are accurate and available, allowing the person filing their taxes the best knowledge. Not only is a wisp essential for your business and a good business practice, the. Having a wisp protects businesses and. Discover a 2025 complete written information security plan. Federal law, enforced by the federal trade commission, requires professional tax preparers to create and maintain a written data security plan. Federal law requires all professional tax preparers and accounting firms to: Discover a 2025 complete written information security plan (wisp) template tailored for sole practitioners and ptin holders. Or, rather than spend billable hours creating a wisp, our security experts can create one for you. Having a wisp protects businesses and. Create a written information security plan or irs wisp monitor, test and maintain the irs wisp plan Not only is a wisp essential for your business and a good business practice, the. Creating a written information security plan or wisp is an often overlooked but critical component. This file provides comprehensive instructions and guidelines for creating a written information security plan (wisp) tailored for tax and accounting practices. Get a free template at erowisp.com. The wisp template includes a range of features that can help tax professionals work more efficiently. Tax pros need a written information security plan (wisp) for irs compliance and data protection. Expert guidance from information security professionals; Want to ensure your wisp meets all necessary requirements? At protection plus, we want to ensure that tax and accounting professionals are protected from all angles. The wisp template is required for tax professionals by the irs and helps to ensure that important records are accurate and available, allowing the person filing their taxes the best knowledge.Wisp Template Irs

Wisp Template For Tax Professionals

Free Irs Wisp Template

Wisp Template Free

Wisp Template

WISP for Tax Preparers 2024 Etsy

Wisp Policy Template

Free WISP template safeguard your tax practice today Blog

Wisp Template For Tax Professionals

Template Blank WISP Tech4Accountants PDF Information Security

Ongoing Support And Updates To Keep Your Wisp Current;

Discover A Comprehensive Guide On Data Security.

Federal Mandates Require That Every.

That's Why We've Created A Simple And Easy Tool That Helps You Build A Wisp Tailored.

Related Post: